Crypto taxes on Safello: You’re in the right place

Filing cryptocurrency taxes can feel overwhelming. The rules are not always clear, and official guidance often misses important details.

At the same time, tax authorities are gaining more access to data from crypto platforms, including exchanges like Safello. More and more exchanges are required to share information about your transactions.

That’s exactly why Divly exists. We built a tool that guides you step-by-step to file your taxes in line with local rules, without stress or confusion. In this guide, we’ll show you exactly how to report your transactions made on Safello.

Safello and Divly are also official partners, read more about that below.

Do I need to pay taxes after using Safello?

When engaging in cryptocurrency trading through Safello, it's important to remember that you may need to report your transactions to your local tax authority. Most users typically buy or sell crypto in SEK (Swedish Krona). Selling crypto is a taxable event in Sweden and needs to be declared. Don't worry, managing your taxes for Safello transactions can be efficiently handled!

It's crucial to understand that reporting your financial gains or losses to your local tax authority falls under your responsibility. While you can opt to manually calculate your taxes yourself, you can also lighten the load by using specialized tax software or by contacting a tax lawyer to do it for you. Regardless of the method you choose, you should find our comprehensive cryptocurrency tax guide specifically tailored for Swedish citizens as a useful start!

How to export your Safello transaction history

Before getting started calculating your taxes, you first need to get access to your transaction history from Safello. You can either download files from Safello that include these transactions, or by using crypto tax software like Divly you can import transactions automatically by using BankID.

Automatic import

Safello and Divly have together worked on an integration that automatically imports your transaction history into Divly. This method utilizes BankID and takes less than a minute to complete. Divly does not store any personal information beyond your transaction data.

- In Divly, click the button Import from Safello.

- You will be redirected to Safello. Use BankID to authorize Divly to access your transaction history from Safello.

- Divly will import your transactions from Safello and calculate your taxes.

File import

You can import transactions from Safello into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

- Sign in to Safello.

- Click on Wallet in the sidebar and then Transactions.

- Click on the button Export. A CSV file will download.

- Drag and drop the CSV file into Divly. Divly will import the transactions and calculate your taxes.

Transaction types to consider when calculating your Safello taxes

There are four types of transaction types that you should consider when using Safello. All of these should be considered when declaring your taxes with Skatteverket.

Buy Crypto with Fiat

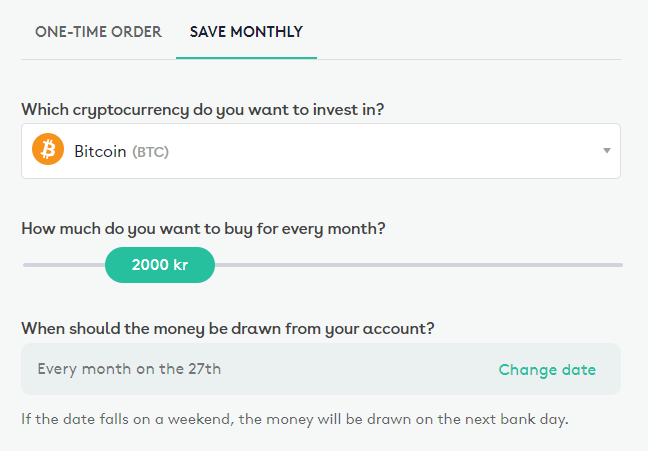

In Safello, you can purchase crypto using Swish, Klarna, Bankgiro, and SEPA with Swedish Crowns. You can even automate your purchases on a monthly schedule which is a handy feature.

Any purchase you make on Safello will be added to your cost basis (in Swedish, this is called “omkostnadsbelopp”). You should keep track of all your purchases and ensure that you calculate the cost basis correctly using the Average Cost Basis methodology (in Swedish, this is called “genomsnittsmetoden”). For more information see our Swedish Tax Guide. If you have used Divly, then the cost basis calculations will be automated for you.

Trading fees are included in the purchase price when using Safello and should be used to reduce your taxable gains. So if you swished 20,000 SEK for 1 Ethereum, then the cost basis will be 20,000 SEK.

Sell Crypto for Fiat

In Safello you can connect your bank account to be able to sell cryptocurrency for Swedish Crowns.

Selling crypto is a taxable event and should be declared to Skatteverket. This is done by taking the difference of the sale price and the cost basis of the respective cryptocurrency. Profits and losses for each cryptocurrency are summarized and recorded separately in the K4 report. If you have used Divly, then both the calculations and K4 report will be automated for you.

Similar to purchases, trading fees are included in the sale price and should be used to deduct your taxable gains. If you sold 1 Ethereum and received 25,000 SEK, then your sale price is 25,000 SEK.

Withdraw crypto from Safello

When you purchase crypto in Safello, it will automatically be stored in your Safello wallet. If you do not send your crypto to another wallet, then you don’t need to worry about Withdrawals.

If you have withdrawn crypto from Safello to another wallet or exchange, then make sure that the transfer is matched when doing your taxes. Apart from the transfer fee, a transfer is not a taxable event.

Deposit crypto from Safello

If you have transferred crypto into Safello, then similar to above, this is not a taxable event (apart from the transfer fee).

Withdrawals and Deposits in Safello prior to the Safello Wallet

Before the introduction of the Safello Wallet (2021-09-27), crypto was not stored in Safello. Instead, users of Safello had crypto sent to a Wallet of their choosing. If this includes you, and you have used other exchanges to trade crypto, then it is important to add deposits / withdrawals manually in Divly to ensure that these transfers are matched.

If you need help or have questions regarding this, feel free to reach out to our trained support staff who can help guide you through the process.

Will Skatteverket find out if I don't declare my crypto?

It is very likely that Skatteverket will find out if you have traded crypto within the next few years. The EU has agreed to adopt a proposal known as DAC8 that will require all exchanges and dealers to share information about their clients to tax authorities within the EU starting 1 January 2026. In Sweden Skatteverket can look back 6-10 tax years an require unpaid taxes to be settled.

Therefore, if you have traded crypto using Safello stay compliant and declare your taxes for this and previous years proactively. If you have forgotten to declare crypto taxes for previous years you can always ammend this in Sweden without being fined by submitting a Självrättelse. Divly can help you declare for all years including the ones you missed.

Doing your Safello taxes with Divly

As Safello and Divly are official partners, we have built an effective solution to import your transactions into Divly. If you are looking for a process to simplify and automate your taxes, then Divly can help assemble a finished K4 report to be used when declaring your taxes to Skatteverket.

You can import your Safello transactions into Divly by either using the Automated Import or the File Import method. As a bonus a 30% discount is available in Divly for anyone with a Safello wallet (more about this at the end of this guide).

Once you have purchased a plan, you will be able to download the Divly Tax Report that includes all the information required to declare your crypto taxes. For more information on how to use the tax reports to declare to Skatteverket, please see our Skatteverket guide for crypto.

If you have used other Wallets or Exchanges, then make sure to import these into Divly too before submitting your taxes to Skatteverket. You can import as many wallets as you want into Divly and still enjoy the discount as a Safello user.

Why is Divly the best choice for Safello taxes?

Why is Divly the best choice for Safello taxes?

Divly is built specifically for each country with a focus on accuracy. Unlike generic tools, we automatically generate the compliant, localized tax report you need for your country. We handle all the complex local rules of your local tax legislation so you don't have to.

-

Fast Import: Fast import of Safello transactions that combines with your other wallets/accounts.

-

Accurate Calculations: Accurate calculation of your taxes with gains/loss and the right cost method (e.g. FIFO).

-

Local Tax Report: Simple download of local tax report with guide on how to declare in your country.

Frequently asked questions (FAQ?)

Yes, in most countries you are required to pay taxes on crypto. For more details see your country-specific crypto tax guide.

Crypto typically incurs a capital gains tax in the majority of jurisdictions. This means you need to pay taxes on the difference between what you bought crypto for and what you sold it for (minus fees).

If you received crypto through other methods (e.g. salary), methods like income tax will apply.

Yes, you can use Divly to declare crypto taxes for previous years that you missed. In many countries you can self-report mistakes and not get penalized for it.

Divly provides localized guides on how to fix previous years for many of our supported countries.

It is a criminal offense to not pay your taxes. It is also difficult to avoid since crypto transactions are recorded publicly on the blockchain and exchanges have been forced to hand over information to local tax authorities.

Yes, you need to file a tax report even if you lost money. The good news is that by filing your losses you may be able to reduce your taxes.

Divly is a premium service to help people calculate and submit their crypto taxes. We use industry standard practices to secure your data.

- We do not sell your information to third parties such as other companies or government agencies.

- We do not perform any KYC. Divly only requires an email address and your pseudonymous crypto transactions to generate your taxes.

Feel free to use a temporary email / protonmail. You can also delete all your transactions and synched wallets at any time.

Yes. You can safely ask your accountant to create and manage a new Divly account for you, or invite them to see and/or edit your existing Divly account. Divly provides accountants with a special feature to manage multiple clients with crypto.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN