How to submit your crypto taxes to Skatteverket using Divly

This guide will walk you through how to use your Divly tax report to submit your crypto taxes to Skatteverket. This guide will assume that you have already imported all your transactions, resolved any warnings, and purchased your Divly crypto tax report. If you have not yet completed these steps, then please see the Getting Started FAQ for more information.

The Divly tax report is country specific

All users in Divly will always receive a localized version of the Divly Tax Report suited for their country (this can be changed in your Settings). The Swedish tax report is tailored for Swedish citizens declaring their taxes to Skatteverket. It cannot be used by residents paying taxes in other countries. If you are paying taxes in a different country, please go to the guide suitable for your country.

The tax report includes the information needed to submit your crypto taxes to Skatteverket. The tax report does not explicitly state how much in taxes you will need to pay. This depends on many other factors (other assets, salary, etc) and can only be seen in Skatteverket’s portal.

What is included in the Divly Tax Report (Sweden)

When you navigate to the Tax Report page in Divly and click the button Get Tax Report. There are a few options:

Swedish Tax Report & K4 (recommended)

This report includes the core information needed to declare your crypto taxes.

-

Capital Gains Tax (Kapitalvinstskatt): This section contains your crypto K4 report required to submit your capital gains taxes. This is the most common form of taxes when dealing with crypto.

-

Income Tax (Inkomstskatt): This section contains labels such as Mining, Rewards, and Income. These may require submitting a T2 form.

-

Interest Income Tax (Ränteinkomst): This section contains Staking Rewards and Interest Received that are submitted in section 7.2 in Skatteverkets Inkomstdeklaration.

-

Övriga Upplysningar: This section contains information to be added to Övriga Upplysningar in Skatteverket. Feel free to add more information if you want to disclose more information to Skatteverket. This is called making an Öppet Yrkande and is often recommended.

Swedish K4 PDF Report (självrättelse)

This file includes the K4 report if you want to declare by old-fashioned post. It is also required if you are submitting a självrättelse (declaring crypto taxes for prior years). See our guide for how to declare cryptocurrency taxes for previous years in Sweden.

Swedish K4 SRU (Digital inlämning)

The SRU file is an optional way to hand in your K4 form. SRU is a file format created by Skatteverket that is used for importing financial information into Skatteverkets web portal. Among other things it can be used by Swedish declarants to automatically import K4 crypto declaration information right into Skatteverkets web portal. You can find instructions on how to use the SRU file further down in this guide.

Övriga Upplysningar

This is a TXT file of what is already provided in the Swedish Tax Report & K4 (recommended) for those that want it in this format.

How to submit your crypto taxes to Skatteverket

Start by opening the PDF that you downloaded from Divly, then follow the instructions below.

Submitting Capital Gains Tax

To declare your capital gains taxes, you need to fill in section D of the K4 form.

-

Log in to Skatteverkets online portal with BankID.

-

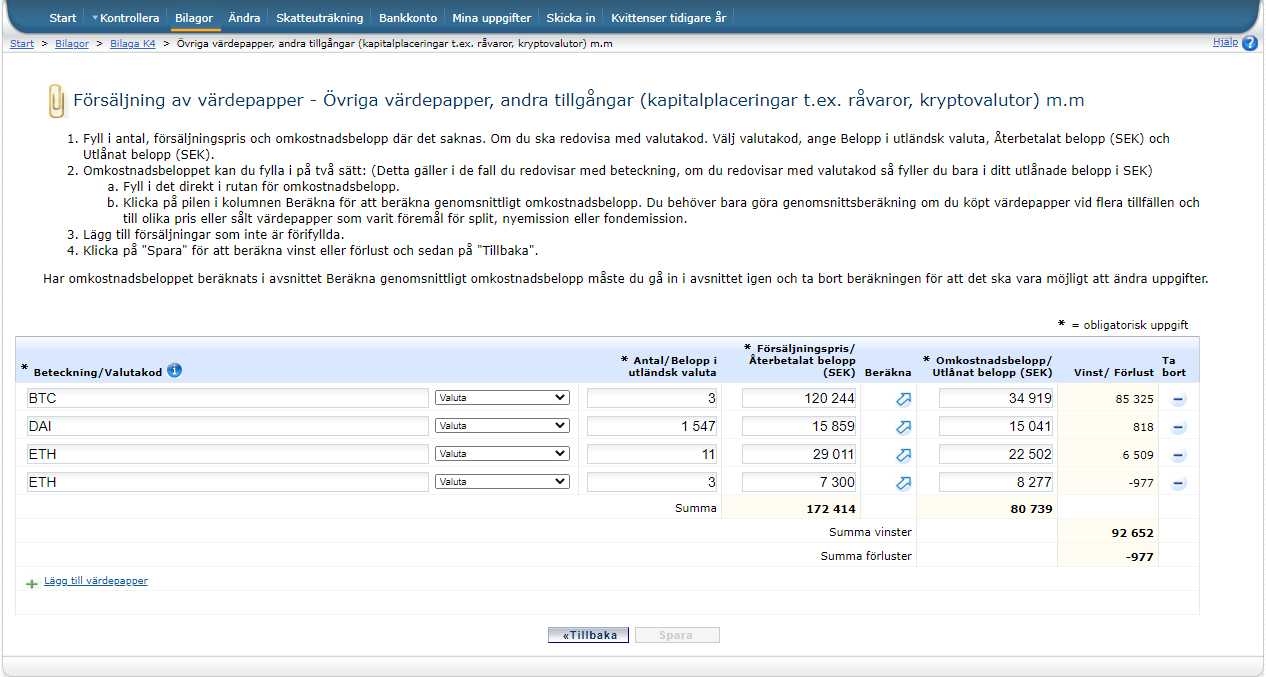

Navigate to Bilagor > Skapa en bilaga Försäljning av värdepapper > Försäljning av värdepapper m.m. (K4) > Övriga värdepapper, andra tillgångar (kapitalplaceringar t.ex, råvaror, kryptovalutor) m.m.

-

Copy paste the values from the PDF file into the K4 form in Skatteverket. Do this for every cryptocurrency listed in your PDF file. You can only use whole numbers when filling in Antal/Belopp i utländsk valuta. Profits and losses on separate lines for the same crypto since losses are only deductible by 70%.

-

Click Spara at the bottom once done.

-

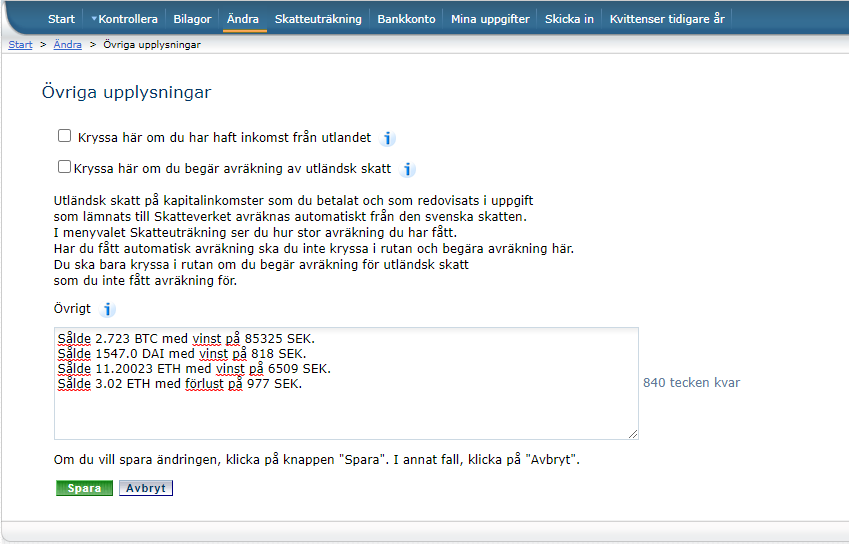

Finally you need to provide the exact amount of crypto sold in decimals. To do this, navigate to Ändra in the top menu. On the page in the dropdown choose 17. Övriga upplysningar. Provide the exact amount of each crypto you sold in the text box. You can copy and paste the text in the TXT file provided by Divly to save time.

Submitting Income Tax

How to submit your income tax depends on the type of income you received (salary, mining etc).

Mining: (Divly label: Mining) If you have received a surplus income from mining, then you need to fill out a T2 form. You can find this form in the online portal by navigating to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2). Make sure you only declare mining if you made a profit after the expenses of your mining hardware etc have been deducted! The expenses can be used to deduct mining income for several years. For a more complete guide on how to submit the T2 form please read our mining tax guide.

Salary and other benefits: (Divly label: Income) If you have received an income as a salary, then this should already be declared by your employer. If your employer has failed to report your salary, then navigate to Ändra and choose the appropriate field in the dropdown (typically 1.1). Update the value in the chosen section so it includes the income you received in crypto. This amount needs to be converted to SEK. You will then need to go to Övriga Upplysningar and provide information regarding the amount you have received in crypto and from whom.

Rewards: (Divly label: Reward) If you have received an income from rewards (like Coinbase Earn), then you need to fill out a T2 form. You can find this form in the online portal by navigating to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2). This is assuming that the Rewards are not categorized as a form of employment or done as a business. If you are unsure about how your specific engagement with a reward system should be treated, please contact Skatteverket and ask them.

Submitting Interest Income Tax

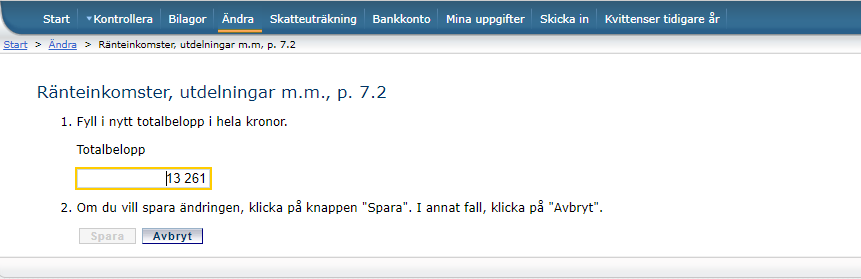

To declare your interest income, you need to add the total sum to section 7.2. You will need to do this if you have received crypto from loan interest or staking rewards (Divly label: Staking Rewards, Interest Received).

-

Navigate to Ändra and in the dropdown select 7.2 Ränteinkomster, utdelningar m.m.

-

Fill in the new total sum of interest to include the crypto interest income.

-

Click on Spara.

-

Go back to the previous page Ändra.

-

This time choose 17. Övriga upplysningar and describe the nature of the interest (staking reward, loan interest etc).

To declare your interest expenses (Divly label: Interest Paid) then follow the same steps above but in step 1 navigate to 8.1 Ränteutgifter m.m.

I can't fit the text into Övriga Upplysningar!

If you have traded many different types of cryptocurrencies, there may not be enough room in Övriga Upplysningar (even though Divly has shortened the text as much as possible). This is because Skatteverket caps the total amount text allowed to 999 characters.

Since this was becoming a recurring issue, we contacted Skatteverket for an alternative solution. They suggested that the tax payer should contact them via this form, attach the TXT file, and provide their social security number (personnummer) so that they can link it to the correct person. You can then mention in your Övriga Upplysningar that you have sent them a complete TXT file with your cryptocurrency details through the kontakt form.

How to declare your taxes with the SRU file (Optional)

What is a SRU file?

SRU is a file format created by Skatteverket that is used for importing financial information into Skatteverkets web portal. Among other things it can be used by Swedish declarants to automatically import K4 crypto declaration information right into Skatteverkets web portal. If you are declaring capital gains taxes for Sweden with Divly, using the SRU file export is the most seamless way to enter your K4 information into Skatteverket.

What does the SRU file contain?

The SRU file, when used for the Swedish K4 capital gains declaration, contains your sale price, cost basis for each crypto currency you’ve made losses or profits for during the year structured in a way that Skatteverket can read and import it.

How do I generate an SRU file in Divly?

Once logged into Divly and when you’re ready to declare your taxes:

- Go to Tax Report

- Select the year you are reporting for in the top left corner.

- Press “Generate Tax Report 20xx”

- Select Swedish K4 SRU (Digital inlämning)

- A field will appear asking you to enter your Swedish personnummer. You can either enter it here or leave it blank and edit yourself (see more information below under “Do I need to enter my personnummer?”

- Click Generate

- Once generated, the file will appear in the table under Your files.

- Press the file in the table to download it.

Do I need to enter my personnummer?

For the file to work with Skatteverket, a Swedish personnummer must be entered into the file somehow. It’s important that this personnummer is the actual personnummer for the person logged in to Skatteverket for it to work. You can either pass your personnummer in the format yyyymmddnnnn into Divly when generating your file and Divly will populate the file in the appropriate places (See above). Divly does not store your personnummer in any other place other than in the SRU file that you generate.

If you are not comfortable entering your person number into Divly you can just leave the field blank. However, for the file to work with Skatteverket you still have to enter the personnummer yourself. Here’s a short explanation on how you can achieve that:

- Download the file from Divly without entering the personnummer.

- Open the downloaded SRU file in any text editor.

- In one or several places there will be a placeholder called PERSONNUMMER.

- Replace all placeholders in the sru file with your actual personnummer in the format YYYYMMDDNNNN.

- Once all placeholders are replaced, save the file and close it.

How do I import the SRU file into Skatteverket?

Assuming you now have a SRU file containing your personnummer you can go ahead and import it into Skatteverket:

- Login to Skatteverkets web portal

- Click on Bilagor.

- Next to Försäljning av värdepapper m.m (K4) there is a link that says Importera. Click Importera.

- Follow the instructions in the web portal to upload the SRU file you have generated and click then click Importera.

- Assuming the import was successful you now see a screen with a link to your imported K4 form.

- Click on Övriga värdepapper, andra tillgångar (kapitalplaceringar t.ex. råvaror, kryptovalutor) m.m

- You will now see a summary of profits and losses in different currencies that have been imported. Review carefully that the reported numbers are what you expect them to be.

- Done!

Övriga upplysningar

Skatteverkets also wants you to enter more exact crypto amounts sold in each currency rather than the rounded number that the K4 form allows. See the part about Övriga upplysningar above in this guide to learn what you should enter.

EN

EN