Update! Starting January 1, 2026, all cryptocurrency brokers must report customer information to tax authorities within the EU under the new EU directive, DAC8. Make sure to file your crypto taxes before it's too late.

As crypto continues to mature so does the associated tax system and tax enforcement procedures. Tax authorities across the globe are realizing that a lot of tax money is being withheld by individuals not declaring their crypto gains.

For the 2024 tax year, Skatteverket reported that only around 9000 people declared tax on their crypto trading. For the 2020 income year, 3000 people filed such declarations; for 2021, the figure was 8000, while for the 2022 and 2023 tax years only 6000 did so. It is likely that many more people have in fact traded cryptocurrencies, and for this reason it is also likely that Skatteverket will begin devoting more resources to reducing tax evasion. The EU directive DAC8 will simplify this process for Skatteverket.

In some countries such as Australia and the US, tax authorities have already started enforcing crypto taxes much harder for several years. With most blockchains acting as publicly visible ledgers, and tracking tools becoming more sophisticated, the chance of being discovered is increasing.

It is not uncommon for us at Divly to talk to people who have either forgotten or misunderstood how to pay taxes on crypto correctly for prior years. Often they come to us because they want to do the right thing! If you are in a similar situation and want to rectify your crypto taxes, then this guide will be able to help you.

A common misconception is when you assume you don’t need to pay taxes unless you sell crypto for fiat (swedish crowns) and/or send it to a Swedish bank.

This is not correct! A crypto to crypto trade is considered a taxable event and must be included in your taxes. For more information about crypto taxes in Sweden, feel free to read our extensive guide.

What is a Självrättelse?

Fortunately, there is a way to rectify past errors by submitting a Självrättelse to Skatteverket. As long as you proactively notify of past errors, then according to the law, no additional tax surcharge will be applied.

From Skatteverkets website: Lagen säger att skattetillägg inte får tas ut när en person på eget initiativ har rättat en oriktig uppgift (49 kap. 10 § 2 p. SFL).

However, a självrättelse only works if you point out the errors before Skatteverket finds them or has started an investigation. Typically you can submit a självrättelse 6 years back, with the exception of extreme cases where 10 years applies.

How do I submit a Självrättelse?

There are four main steps to consider when submitting a självrättelse.

-

Assemble the necessary documents needed for each tax year to correctly declare your crypto gains (e.g. K4).

-

Summarize the different types of income and expenses for each year by filling in this document.

-

Either write a letter that meets specific criteria we will describe below, or fill out form SKV 6891 with the necessary information.

-

Print everything out and mail it to your closest Skatteverket office or the address on the form SKV 6891.

You can submit a självrättelse for multiple years simultaneously to save time. However, Skatteverket will provide an individual verdict for each year.

Step 1: Assemble the necessary documents

Calculating your gains and assembling the necessary documents is typically the tricky part of the process. This is especially true if you have many crypto to crypto trades.

The documents required will depend on the classification of the cryptocurrency transactions you have had. For the majority of people who have only bought and sold crypto, one will need to provide a K4 for each relevant year.

However, if you have received crypto in the form of an income or loan interest, then you may need to provide other forms of supporting documentation. If you have been mining as a hobby it’s best to include a T2 form.

As we understand it, for the purpose of submitting the självrättelse, providing a K4 should be sufficient for capital gains tax activities (selling, trading crypto etc). However, it is always good to have proof of purchase / receipts / transaction history available if Skatteverket were to ask for them.

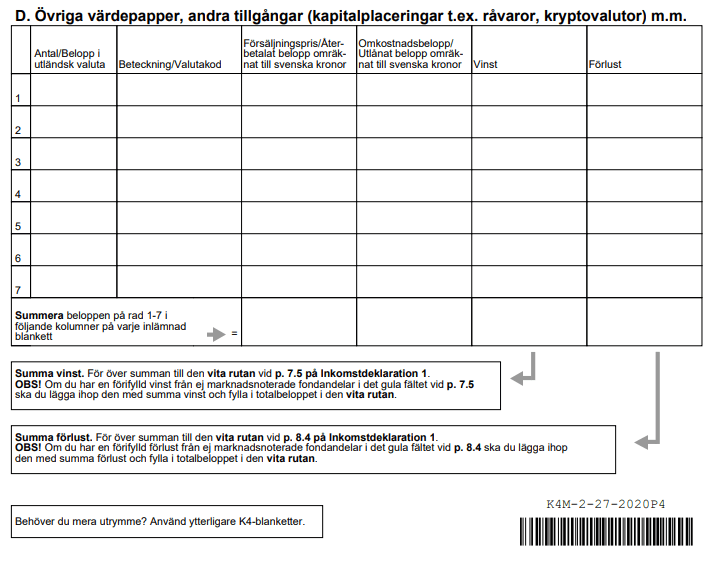

Since you will be sending the självrättelse via physical mail, you will need to download, print, and fill in the K4. When reporting crypto you want to fill out section D. Övriga värdeppaper, andra tillgångar (kapitalplaceringar t.ex. råvaror, kryptovalutor) m.m. You can download the K4 from Skatteverket’s website.

With Divly you can download a K4-form for all previous years. This simplifies the process greatly!

Step 2: Summarize your income

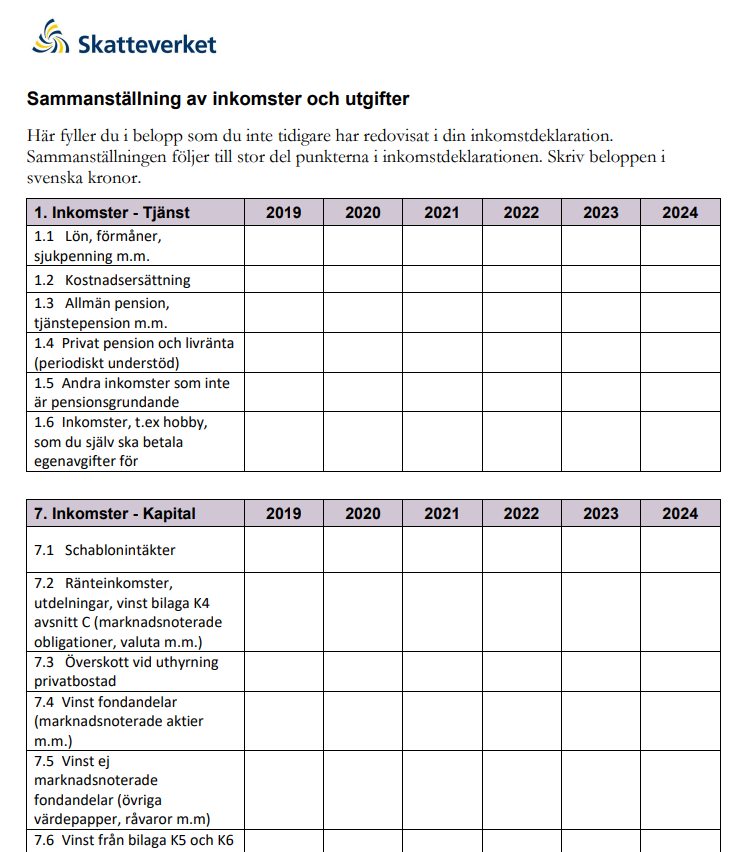

The second step is a lot easier and requires you to sum up the totals for each category for the relevant years. To make life easier, download and fill in this form.

The form only requires you to sum up the totals for the amounts you are amending. You do not need to “redo” the entire declaration. Make sure to provide the totals in SEK. Here are few sections that may need amending depending on your scenario:

Section 1.1: If you got paid a salary or wage in crypto.

Section 1.6: If you have been mining crypto as a hobby (T2).

Section: 7.2: If you have received crypto as loan interest or staking rewards.

Section: 7.5: If you have incurred capital gains on crypto from activities such as selling or trading crypto (K4).

Section: 8.4: If you have incurred capital losses on crypto from activities such as selling or trading crypto (K4).

Step 3: Write a letter regarding your submission

There are two methods you can use to finalize this step. The first is by writing a letter, the second is by filling out form SKV 6891. Which one you do is up to you but you will need to provide the information below:

-

That you request a reconsideration (begär omprövning).

-

That you correct previous errors and now report any undeclared income or adjust incorrect deductions.

-

Which tax years the correction applies to (up to six years back).

-

Which exchanges/wallets you have traded on.

Finally, make sure to sign the letter or the form before sending it!

Step 4: Send in your submission to Skatteverket

This step is the easiest! Print everything out and mail it to your closest Skatteverket office or the address on the form SKV 6891. You have now set the wheels in motion to rectify past tax errors.

What happens after?

Once Skatteverket receives your självrättelse they will eventually begin the process of using the information you provided to provide a new verdict for the respective years. How long this process will take can vary from case to case. Skatteverket may also contact you and ask for more specific information such as your crypto transaction history. It is good to have this information available if they do require it.

Eventually you will be given a verdict for each year you submitted. You will either need to pay tax or receive a tax refund depending on the scenario. It’s good to know that there is interest applied to your tax account with Skatteverket.

Congratulations! You have now cleaned up your crypto tax history. Hopefully you will be able to worry less and sleep better once everything is declared and paid for. Feel free to share the article to friends if you found it useful.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN