Doing your crypto taxes can be difficult. You may even miss out on tax refunds you are eligible for. In this article, we're going to teach you how to do your crypto taxes and how Divly can be used to automate it. We’ll be covering the following topics:

- When should you declare your crypto?

- How cryptocurrencies are taxed

- Tax treatment of different cryptocurrency transaction types

- How to submit your tax report to Skatteverket

- Other helpful information

This guide is updated and maintained on a regular basis to account for changes made by the local tax authority (Skatteverket) and for new types of transactions. In the event that you find any errors or outdated information, it is greatly appreciated if you let us know by sending an email to [email protected].

When should you declare your crypto?

If you are declaring for transactions you made during the calendar year 2025, the deadline to file your taxes is the 4th May 2026.

-

17 March 2026 - Online tax portal opens and you can start declaring your taxes.

-

4 May 2026 - Last day to submit your taxes

If you need more time to declare your crypto taxes, you can digitally apply for a tax extension via Skatteverket's online portal.

What if you missed declaring crypto taxes for previous years?

If you've missed declaring crypto taxes for previous years, you can correct it by submitting a Självrättelse to Skatteverket. By voluntarily submitting a självrättelse, you avoid paying additional tax surcharges.

It’s important to note that a Självrättelse is only valid if you submit it before Skatteverket identifies the errors or begins an investigation. Generally, you can correct your tax return up to six years ago, with some exceptions allowing for changes up to ten years back in time.

This is becoming an increasingly important topic since on the 1st January 2026, a new directive from the EU called DAC8 will be enforced. In short, all crypto exchanges with clients in the EU will be required to share customer information with EU tax authorities, including Skatteverket.

How is crypto taxed in Sweden?

In Sweden, you have to pay a 30% capital gains tax on cryptocurrency trading profits. You can deduct 70% of losses from your gains. Furthermore, you’ll have to pay 30% interest income tax over your staking rewards and pay your regular income tax rate over cryptocurrency mining rewards.

Therefore your cryptocurrency activity may be subject to three different types of taxes: Capital Gains Tax, Income tax, and Interest Income Tax. We will explain how they work and when they are relevant to you.

Capital Gains Tax

Cryptocurrencies are treated in accordance with the provisions on “Other Assets” in Chapter 52 of the Income Tax Act (Inkomstskattelagan). This means that any form of sale of Bitcoin or other cryptocurrencies must be reported as a capital gain. We will walk through a long list of detailed scenarios that involve capital gains tax, but in essence, expect to declare and pay capital gains taxes on your cryptocurrencies if you have:

-

sold cryptocurrency

-

exchanged a cryptocurrency for another cryptocurrency

-

exchanged a cryptocurrency for a fiat currency

-

Paid with cryptocurrency when buying a product or service

-

Lended out cryptocurrency

How to calculate capital gains tax

Capital gains tax on crypto is calculated using the Average Cost Basis method (In Swedish: Genomsnittsmetoden). To correctly calculate gains, you need to figure out your cost basis (In Swedish: Omkostnadsbelopp). You pay 30% taxes on the profits you make. If you made a loss, then 70% of the loss can be deducted.

The sale price represents the value of the transaction in Swedish krona. The average price you purchased the crypto in Swedish krona will be your cost basis. If you have mined crypto or received crypto as income, the cost basis will be the value of the coins on the day you receive them in Swedish krona.

Skatteverket provides several examples of different cases on their website. It is important to calculate this correctly, so if in doubt it is better to use an automation tool like Divly.

How to declare crypto gains and losses

You submit capital gains tax on crypto using the K4 form in section D. You can read more about how to submit capital gains taxes at the end of this guide.

Income Tax

If you have earned crypto for some form of work or effort then you need to pay standard income tax, just as you would have been taxed on a normal salary.

If you decide to keep the cryptocurrency that you received, then you will need to pay capital gains taxes on any profits or losses that are incurred when you sell them. The cost basis in this case would be equivalent to the amount you declared in your income tax return.

How to calculate income tax for crypto

Income tax on crypto can occur through various types of transactions, such as salary, mining, and rewards. To calculate the correct cost basis, make sure to sum up the value in Swedish krona of the transactions subject to income tax. Use the price in Swedish krona on the day you gained access to the cryptocurrency.

Bosse is paid 0.1 ETH as part of his salary. It is worth 10 000 SEK on the day he received his ETH. Bosse then decides to sell 0.1 ETH a month later for 15 000 SEK.

In this case, Bosse must report 10 000 SEK as income from employment. This is added to his other salary income, where he pays municipal tax and also state tax if his income exceeds a certain threshold.

Bosse must also declare a capital gain of 15 000 - 10 000 = 5 000 SEK. Bosse pays 30% capital tax on the gain, which equals 1 500 SEK.

How to declare crypto income tax

How to submit income taxes depends on the type of income tax. If its a salary, then you will declare it under Inkomst av Tjänst. If it refers to mining, you need to fill out a T2 form.

Interest Income Tax

If you have received crypto in the form of loan interest or staking rewards, then you will be subject to interest income tax (In Swedish: Ränteinkomst). Similar to capital gains tax, it is taxed at a rate of 30%. The difference is that losses from interest payments you have made are fully deductible.

How to calculate interest income tax for crypto

Simply sum up the income from the different transaction types that contribute to interest income tax. Make sure to price it in SEK based on its value on the day you received it.

Sam Brokeman has received three staking rewards during the tax year.

1 January: 0.03 ETH = 2 000 SEK

1 February: 0.03 ETH = 2 600 SEK

1 March: 0.03 ETH = 1 900 SEK

In total, Sam has earned 2 000 + 2 600 + 1 900 = 6 500 SEK in staking rewards. He declares this total sum and is required to pay 30% in interest income taxes, which equals 1 950 SEK.

How to declare crypto income tax

You declare the total value of interest income in SEK on section 7.2 of your declaration. This includes transaction types such as staking rewards and interest.

Tax treatment of different cryptocurrency transaction types

Certain transactions trigger the three different types of taxation listed above. Below is a master list for your reference, we will go through each in detail in this guide. Each transaction has an associated tax event and the corresponding label in Divly for those using our service to automate their tax reporting.

| Transaction Type | Tax Event | Divly Label |

|---|---|---|

| Buy Crypto | None | Buy |

| Sell Crypto | Capital Gains Tax | Sell |

| Trade Crypto For Crypto | Capital Gains Tax | Traded crypto |

| Initial Coin Offering (ICO) | Capital Gains Tax | Traded Crypto |

| Purchase Goods & Services | Capital Gains Tax | Goods/Services |

| Pay Trading Fee with Crypto | Capital Gains Tax | *Fee Included in Trade |

| Pay Transfer Fee with Crypto | Capital Gains Tax | *Fee Included in Transfer |

| Transfer Crypto Between Your Wallets | None | Transfer |

| Lost or Stolen Crypto | None | Lost/Stolen |

| Give Crypto as a Gift | None | Gifted Away |

| Receive Crypto as a Gift | None | Received Gift |

| Donate Crypto | None | Donation |

| Airdrop | None | Airdrop |

| Fork | None | Fork |

| Mining | Income Tax | Mining |

| Reward (e.g. referral) | Income Tax | Reward |

| Cashback | None | Cashback |

| Income (e.g. freelancing, salary) | Income Tax | Income |

| Lending Crypto | Capital Gains Tax | Traded Crypto (Fordran) |

| Interest Received | Interest Income Tax | Interest Received |

| Interest Paid | Interest Income Tax (deductible) | Interest Paid |

| Staking Reward | Interest Income Tax | Staking Reward |

| Margin Trading | Capital Gains Tax | Realized Profit / Realized Loss |

| Futures / Derivatives Trading | Capital Gains Tax | Realized Profit / Realized Loss |

| Trade NFT | Capital Gains Tax | Trade |

| Create & Sell NFT | Income Tax | Income |

| Liquidity Pools | Capital Gains Tax | Not yet available |

*Take note that certain transaction types are complex and may have multiple forms of tax events depending on the specifics of the transaction. The above table summarizes our opinion of what is the most common type of Tax Event for each type of transaction.

Buy Crypto / Buy Crypto with Fiat

There are no taxes involved when buying crypto. However, you need to ensure that you keep track of the price you paid for it to be added to your average cost basis (in Swedish this is called “omkostnadsbelopp”). If you purchased the crypto in a foreign currency (e.g. USD or EUR) make sure to convert it to the value in local currency on that day.

When buying crypto you can add the trading fee to the cost basis (44 kap. 14 § IL). This will help reduce your taxes. For example, you purchase 1 ETH for 10 000 SEK and pay a trading fee of 100 SEK. Your cost basis for 1 ETH is 10 000 + 100 = 10 100 SEK.

Sell Crypto / Sell Crypto for Fiat

Selling cryptocurrency will always require you to declare capital gains tax whether it's at a profit or loss. Once again, it's important to calculate the selling price in local currency at the time of sale.

When selling crypto you can subtract the trading fee from the sale price (44 kap. 13 § IL). This will help reduce your taxes again. Let's continue with the previous example from above where we now sell 1 ETH for 20 000 SEK and pay a trading fee of 300 SEK. The profit for 1 ETH is 20 000 - 10 100 - 300 = 9 600 SEK. If you are using Divly, all the fees are automated in the calculations.

Trade Crypto for Crypto

In Sweden trading crypto for crypto is a capital gains tax event. You must pay capital gains on the cryptocurrency you sold. The value is based on the cryptocurrency that you sold it for, in your local currency. For example, if you sold 1 Bitcoin for 10 Ethereum, then the selling price is the value of 10 ETH in Swedish crowns.

Finally, you need to account for the cost basis of your Ethereum that you purchased. This is the same as the value above, 10 ETH in Swedish crowns on the day of the trade.

Initial Coin Offering (ICO)

An ICO is when you invest your crypto (usually Ethereum) in a new project that in turn provides you a token that represents that project. In a taxation point of view, it functions the same as a crypto to crypto trade. Essentially, you send cryptocurrency in exchange for a token from a new project. You follow the same principle where you sell your crypto for the value of the ICO token in local currency. Capital gains tax is applied to the crypto you sent, and a cost basis is added to the new token at the same price.

Purchase Goods & Services with Crypto

When you purchase a good (e.g. new computer, amazon gift card) or pay for a service online (e.g. VPN service), then you must pay capital gains tax on the crypto you spent. This works the same as selling crypto for fiat, the selling price is what the same good or service costs in your local currency.

Pay Trading Fees in Crypto

On some exchanges, typically when you trade crypto for crypto, the trading fee will be paid in crypto. In these cases you need to convert the crypto you used to pay for the trading fee into your local currency and then pay capital gains on it. This can become quite tedious if you have many trades.

Pay Transfer Fees in Crypto

If you transfer crypto between two wallets you own, then the transfer fee is seen as paying for a service. In this case, the cryptocurrency used to pay the transfer fee is taxed as capital gains. Similarly, if you transfer crypto as a gift then the transfer fee is seen as a service and should be taxed. Take note that we are only referring to the transfer fee! Not the actual coins transferred.

If you transfer crypto to a wallet you do not own (in exchange for something else), then you can use the transfer fee to offset the sale price. This is similar to how a trading fee works and can reduce your tax payable.

The same logic as above applies if you send crypto from an exchange and the exchange charges you a withdrawal fee.

Transfer Crypto Between Your Own Wallets

Transfering crypto between your own wallets is not a taxable event (this includes sending crypto to your account on an exchange). Only the transfer fee is taxed as described in the section above. It is important that you track these transfers properly so you don't pay unnecessary taxes!

Lost or Stolen Crypto

You do not need to pay taxes on lost or stolen crypto. However, take note that you can’t offset lost or stolen crypto against your profits. You simply remove the relevant cost basis from your calculations.

Give Crypto as a Gift / Receive Crypto as a Gift

Gifting or inheriting in Sweden is tax free. You are free to give away crypto without needing to pay any taxes. Similar to lost or stolen crypto, you can't deduct gifted crypto from your profits.

If you received crypto as a gift you don’t need to pay taxes on it until you sell it. If possible, ask for the purchase receipt from the one who gifted you the crypto. You can inherit the price they paid as your cost basis, this means you pay less taxes when you finally sell it.

Donate Crypto

Donating crypto is the same as giving a gift and is tax free in Sweden. In some countries donating crypto is tax deductible, in Sweden it is not. To be tax deductible in Sweden the gift must be given in the form of a currency to an accepted charity. Skatteverket does not consider crypto to be a currency.

Airdrop

An airdrop is typically considered as a gift from the token holder or blockchain. You only pay taxes when you sell it. The cost basis in this case should be set to zero.

If the airdrop was obtained as compensation for performing a service (e.g. referring people) then it can be classified as Income Tax. In this case you should label the transaction as a Reward in Divly.

Hard Fork

A hard fork is typically considered as a gift from the new blockchain fork. You only pay taxes when you sell it. The cost basis in this case should be set to zero.

Skatteverket has not provided a generalized statement regarding forks. However, when Bitcoin Cash was forked from Bitcoin in 2017 Skatteverket made the call that the 'dividend' Bitcoin Cash would not create a capital gains event. The cost basis should therefore be 0 SEK.

Mining

If you are mining as an individual then the proceeds are classified as income from a hobby (In Swedish: Inkomst av Tjanst (hobby)). Hence, you are required to declare and pay Income Tax on mining proceeds. This is calculated as the value of the proceeds in local currency on the day you mined them. The cost basis of the newly minted coins are equal to the amount you declared in income. Once you sell the crypto in the future, you need to pay regular capital gains taxes.

A more in depth guide regarding mining and declaring can be found in our mining tax guide.

Lending Crypto and Loan Interest

When receiving loan interest payments, they are subject to Interest Income Taxes. If the interest is paid in cryptocurrency, ensure to record the cost basis to avoid paying excessive capital gains tax in the future.

If you have taken a crypto loan and paid interest, this can be deducted by 100% from the interest profits you have made.

Lending cryptocurrency in Sweden is considered to enact a capital gains tax event. These tax rules make lending of cryptocurrency quite complex to account for in Sweden. Every time you lend your crypto you can think of it as selling your crypto. In return you get a claim (fordran) which has the cost basis of the value of the crypto lent out. Once you are repaid the principal amount, you effectively sell the claim and repurchase the crypto. If the claim has appreciated in value, then you need to pay capital gains taxes on it just like a regular crypto. Skatteverket has an in-depth description of different scenarios.

If you have deposited crypto to centralized interest bearing platforms such as BlockFi, Celsius or Nexo then this could potentially be seen as lending out crypto. After having spoken to Skatteverket and tax lawyers we have reason to believe that this is probably the case. It will likely depend on the Terms & Conditions of each platform. Since you can trade on these platforms, calculating what your claim is worth (e.g. FordranBlockFi) can be very time consuming and tricky. You will need to calculate your total holdings in SEK on the respective platform whenever you make a withdrawal. In this case, you should create a trade every time you lend out your crypto and get it back. Use a different currency for each loan or platform you use, for example: FordranA, FordranB, FordranBlockFi, FordranCelsius, FordranETH. Divly will then calculate the capital gains on these different claims and include them in your tax report.

How is staking taxed in Sweden?

Skatteverket has made a statement regarding staking on Ethereum 2.0. The act of locking up your coins to stake them should not incur a taxable event in most scenarios. This means you would only need to pay taxes on the staking rewards.

However, this can depend on the specifics of the staking mechanism If you have received a new form of currency that represents your stake, this will likely be seen as a trade of two cryptocurrencies. This can occur in certain staking pools and crypto exchanges. As we have understood it, it is not seen as a disposal or taxable event assuming you have not transferred the rights for someone else to use your crypto in the process of staking. Take note that if you have transferred your voting rights to another party, then this may be seen as a disposal. In that case you should follow the same tax logic as when lending out crypto.

Staking rewards are subject to Interest Income Taxes. Staking rewards are typically paid in the cryptocurrency associated with the blockchain you are staking towards. The cryptocurrency you receive will have a cost basis equal to the amount in local currency on the day you obtain access to the staking rewards. If you keep the crypto and sell it at a later date, normal capital gains taxes apply.

You must declare the value of your staking rewards in section 7.2 of the declaration.

Rewards (e.g. referral)

Airdrops and other rewards are not subject to Income Tax unless you have performed some form of work to receive the benefits. If in any case you have received a reward from referring a friend, sharing a post, or any other required action such as receiving crypto from Coinbase Earn, then you need to declare the reward as Income Tax. The cost basis of the cryptocurrency is the same amount as you declared in your Income Tax.

Cashback

In most cases when earning crypto as cashback you only pay taxes on it when you sell it. The cost basis should be set to zero.

Income From Other Activities (e.g. freelancing, salary)

If you have been paid in cryptocurrency for your work or a favor you completed, then that needs to be declared as Income Tax. The cost basis of the crypto you received is the same value you declared as income.

The employer should report the crypto payment in what is called 'arbetsgivaredeklarationen'. Skatteverket sees compensation in crypto from the employer to the employee as a benefit (similar to how a security is seen as a benefit). For more information regarding this topic feel free to read the Swedish version of this guide.

Margin Trading

Margin trading involves borrowing to take leveraged positions on crypto. Often the outcome of the trades are provided as realized profit or loss after margin fees are accounted for. In these cases the realized profit or loss is applied as capital gains tax once the position is closed. If you realized a profit, the cost basis of the profit is applied after you have paid the capital gains taxes. If you realized a loss, it works the same as if you sold the coins for 0 SEK, the loss is equal to the average cost basis of the coins.

In Divly, any funding fees (positive or negative) will be labeled either Realized Profit or Realized Loss. This is true for example for Futures trading on Binance.

NFT

How NFT’s are taxed depends on the scenario. If you have purely bought and sold a NFT for speculation, then it is handled in the same way as any other cryptocurrency if the underlying asset linked to the NFT is classified as "Other Asset". This means you pay capital gains tax and declare each one in the K4 form. For detailed information on trading NFTs please read this article.

If you have created NFTs for the purpose of selling them to make an income, then you may be liable to pay income tax. In that case you should figure out whether it would be considered as a hobby or as a business. The classification will dictate how you need to report your NFT taxes. It is best to either call Skatteverket or consult a tax lawyer (skattejurist) if you are unsure what category you fall in.

Regardless if you have traded, created, or sold NFT’s its good practice to submit a statement in Övriga Upplysningar explaining how you handled the NFT taxes. In Swedish this is called Öppet Yrkande. This can help minimize the risk of having to pay a tax surcharge if you submit it incorrectly.

How are liquidity pools taxed?

Skatteverket has provided information in that depositing crypto into a Liquidity Pool should be seen as a sale. In return you receive the LP token which has its own cost basis. Once you exchange the LP token for your share of the crypto in the liquidity pool, you pay capital gains taxes on the profit you made of the LP token.

The crypto you received will inherit the same cost basis as the sale price. If you want more information and specific examples, then feel free to read what has been published by Skatteverket.

More transaction types and examples

Skatteverket has a page on cryptocurrencies that explains in detail more complex transaction types that may be of interest to you. We thought we'd share it in case the transaction types affect you.

How to submit your tax report to Skatteverket

Once all the tax calculations are done and Skatteverkets tax portal is open, its time to declare your taxes before the deadline in May. You can submit your taxes online or by mail. We will primarily focus on the online portal in this guide.

Submitting Capital Gains Tax

To declare your capital gains taxes, you need to fill in section D of the K4 form. There are three ways you can do this:

-

Manually fill in the K4 form on Skatteverkets online portal.

-

Upload SRU files to the online portal to fill in the K4 form automatically.

-

Fill in the K4 PDF version, print it out and mail it to Skatteverket.

If you have used Divly to calculate your taxes, you will be able to download both a PDF file with all the information needed to submit your crypto taxes and a SRU file. This PDF file contains the information needed to fill in the online K4 form. Divly even provides a text file with information you can add to övriga upplysningar. These are the steps you need to take on the online portal if you are using the first method:

-

Log in to Skatteverkets online portal with BankID.

-

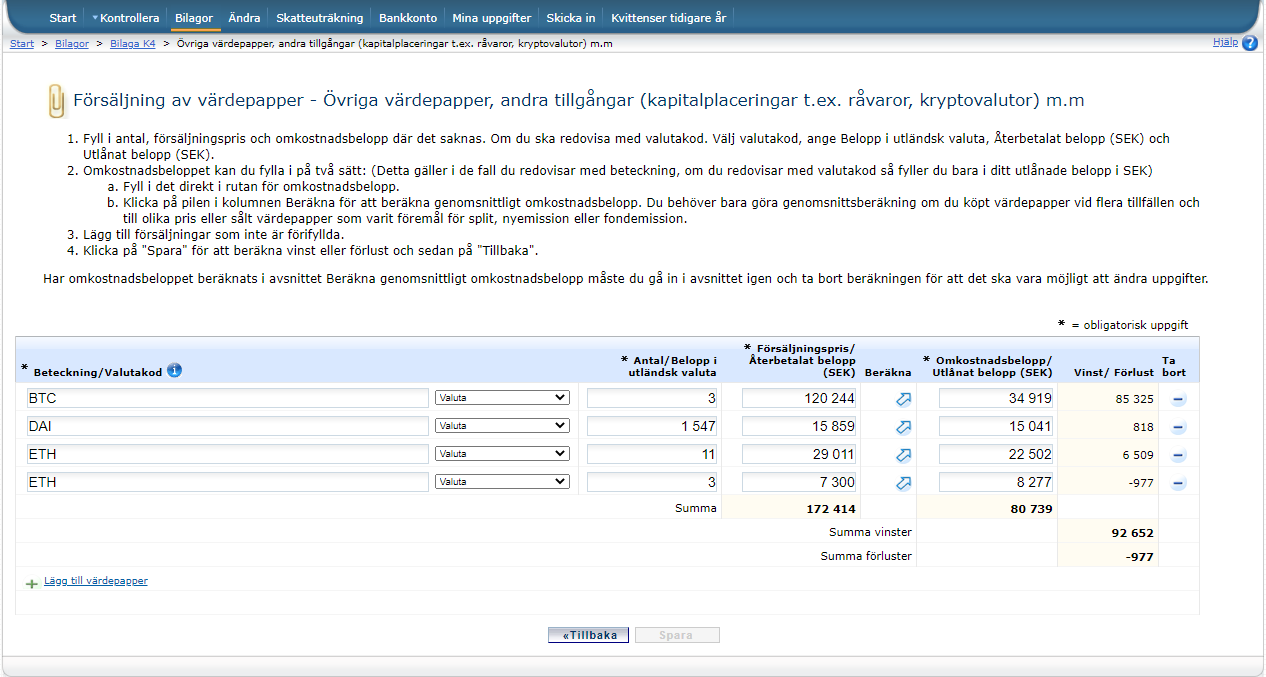

Navigate to Bilagor > Skapa en bilaga Försäljning av värdepapper > Försäljning av värdepapper m.m. (K4) > Övriga värdepapper, andra tillgångar (kaptialplaceringar t.ex, råvaror, kryptovalutor) m.m.

-

Fill in the values for each currency (if you used Divly it will be provided in the downloadable CSV). Make sure to report profits and losses on seperate lines for the same crypto since losses are only 70% deductible. Tip: In Divly you can download the SRU file that you simply upload to Skatteverket to avoid having to fill in everything manually.

-

Click Spara at the bottom once done.

-

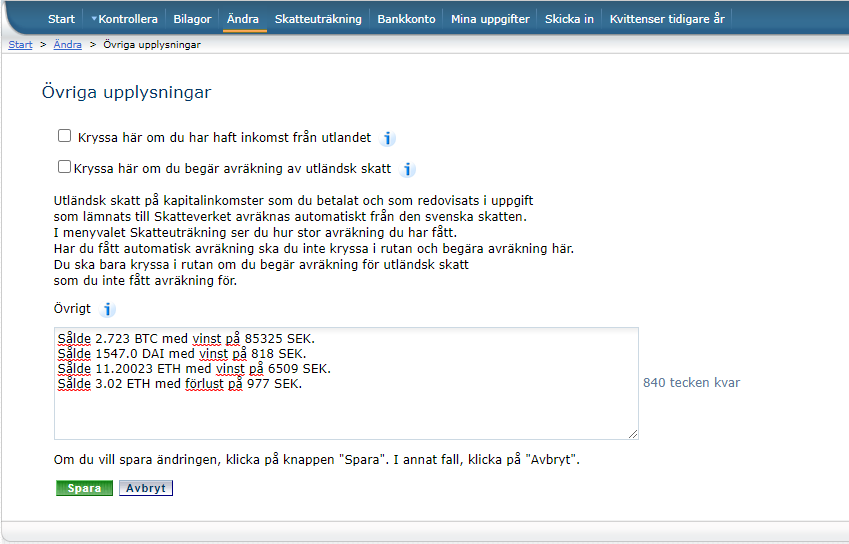

Finally you need to provide the exact amount of crypto sold in decimals. To do this, navigate to Ändra in the top menu. On the page in the dropdown choose 18. Övriga upplysningar. Provide the exact amount of each crypto you sold in the text box.

You are done! Skatteverket will calculate the taxes based on the information you provided.

Submitting Income Tax

How to submit your income tax depends on the type of income you received (salary, mining etc).

Mining Rewards

If you have received a surplus income from mining, then you need to fill out a T2 form. You can find this form in the online portal by navigating to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2). Make sure you only declare mining if you made a profit after the expenses of your mining hardware etc have been deducted! The expenses can be used to deduct mining income for several years. For a more complete guide on how to submit the T2 form please read our mining tax guide.

Salary and benefits

If you have received an income as a salary, then this should already be declared by your employer. If your employer has failed to report your salary, then navigate to Ändra and choose the appropriate field in the dropdown (typically 1.1). Update the value in the chosen section so it includes the income you received in crypto. This amount needs to be converted to SEK. You will then need to go to Övriga Upplysningar and provide information regarding the amount you have received in crypto and from whom.

Rewards

If you have received an income from rewards like Coinbase Earn, then you need to fill out a T2 form. You can find this form in the online portal by navigating to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2). This is assuming that the Rewards are not categorized as a form of employment or done as a business. If you are unsure about how your specific engagement with a reward system should be treated, please contact Skatteverket and ask them.

Submitting Interest Income Tax (Ränteinkomst)

To declare your interest income, you need to add the total sum to section 7.2. You will need to do this if you have received crypto from loan interest or staking rewards (Divly label: Loan Interest).

-

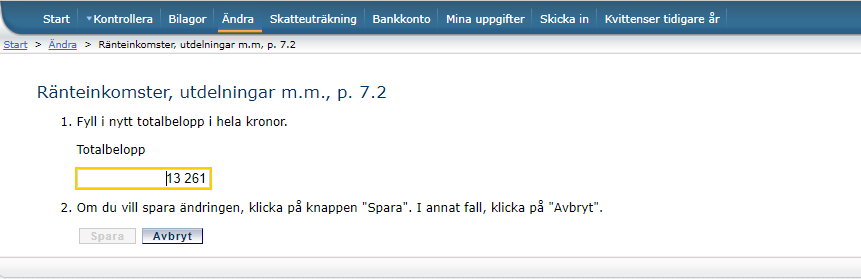

Navigate to Ändra and in the dropdown select 7.2 Ränteinkomster, utdelningar m.m.

-

Fill in the new total sum of interest to include the crypto interest income.

-

Click on Spara.

-

Go back to the previous page Ändra.

-

This time choose 17. Övriga upplysningar and describe the nature of the interest (staking reward, loan interest etc).

To declare your interest expenses then follow the same steps above but in step 1 navigate to 8.1 Ränteutgifter m.m.

What to do if you are uncertain about your taxes

If you are worried about having declared specific transactions incorrectly then you can always submit an explanation in the form of an Öppet Yrkande. This reduces the chance that you would need to pay a tax surcharge if you made a mistake. To do this navigate to 17. Övriga Upplysningar and write an explanation of the methods you used to calculate your taxes.

Other helpful information

What if I lost my crypto transaction history?

Some people have been unfortunate to have traded on an exchange that has shut down. Others may have lost their login details or forgot to store old crypto addresses. It is never a pleasant experience calculating your crypto taxes with missing holes in your transaction history.

In Divly we try to solve this problem by applying a cost basis of 0 to any crypto being sold or withdrawn where there is no purchase record. We also provide a warning called Missing Crypto Purchase History to notify the user when this happens. This means that the capital gains taxes may be higher than what it could have been.

If you can’t prove to Skatteverket the true price you paid for the crypto, then it’s best to be safe and assume you purchased it for nothing.

How do you avoid crypto taxes in Sweden?

You can't legally avoid paying crypto taxes in Sweden but you can reduce them. 70% of your losses can be used to offset your gains.

You can use this rule to lower your crypto taxes at the end of the year. For example, assume you have already realized a profit of 700 SEK in the current tax year. You have one altcoin that has done poorly and if you were to sell it you would make a loss of 1000 SEK. If you sell it before the end of the year you can realize that loss which means your capital gains would be 700 - (1000 * 70%) = 0 SEK.

Many people who calculate taxes manually also forget that you can use trading fees to reduce the taxes you pay. If you use a tax automation software like Divly then this will be handled automatically. For more information on how you can reduce your crypto taxes, feel free to read this guide.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN