Do I need to pay taxes after using BTCX?

If you have traded crypto using BTCX, it is likely that you need to declare your activity to the local tax authority. A typical customer will either have bought or sold crypto for SEK (Swedish Krona). Fear not, doing your BTCX taxes can be quite simple if you have only used BTCX and this guide is here to help you!

Please note, It is your responsibility to ensure that you are reporting your profits or losses to your local tax authority. If you have traded on BTCX, it is most likely that you are a Swedish citizen that needs to declare to Skatteverket. You can choose to do the calculations manually in a program like excel and declare it to your local tax authority. We have an extensive crypto guide tax for Swedish citizens that can help. However, this process is greatly simplified using a specialized crypto tax platform like Divly.

Regardless of the method you choose to do your taxes, all of them will require you to get a full list of all of your transactions. To help you in your journey, the rest of this guide will explain how to find your crypto transaction history on BTCX and import it to Divly so that you can confidently declare to Skatteverket.

How to export your BTCX transaction history

File import

You can import transactions from BTCX into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

-

Sign in to BTCX.

-

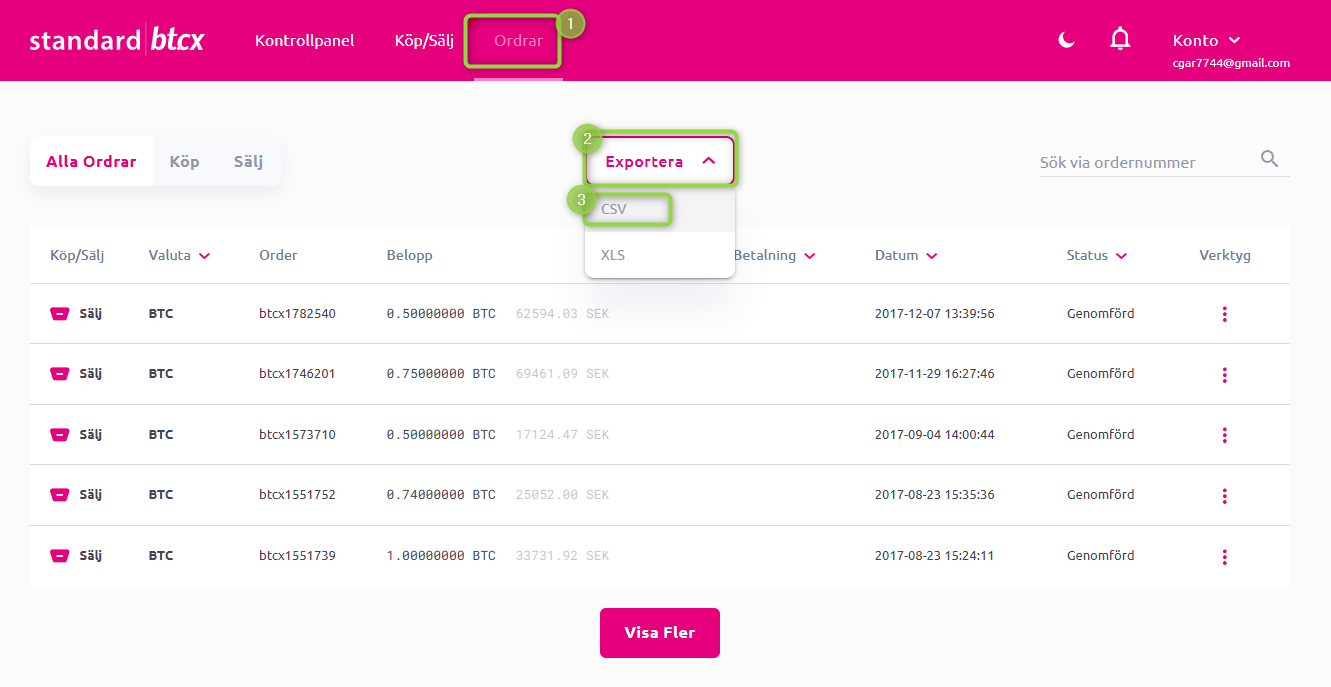

In the navigation bar at the top click on Orders.

-

Click on the button Export and select CSV. The CSV file will download.

-

Drag and drop the CSV file into Divly. Divly will import the transactions and calculate your taxes.

BTCX and Divly partnership

BTCX and Divly are official partners and that has made us experts at understanding BTCX crypto transactions. BTCX and Divly have worked together to ensure that transactions are handled appropriately when calculating your taxes! Furthermore, BTCX customers enjoy a 30% discount when using Divly.

How to declare your BTCX crypto to Skatteverket

After you have downloaded your transaction history from BTCX and imported it to Divly, you still need to declare your gains and losses to Skatteverket. Do this by downloading a K4 form from Divly and following the instructions in our specialized guide to declare to Skatteverket.

If you are unsure about any of the steps of using Divly we highly recommend our Getting Started Guide that helps walk you through the entire process of using Divly to do your crypto taxes. If you get stuck, feel free to reach out to our customer support (we speak Swedish as well!) by clicking on the chat icon on the bottom right corner of our website.

Will Skatteverket find out if I don't declare my crypto?

It is very likely that Skatteverket will find out if you have traded crypto within the next few years. The EU has agreed to adopt a proposal known as DAC8 that will require all exchanges and dealers to share information about their clients to tax authorities within the EU starting 1 January 2026. In Sweden Skatteverket can look back 6-10 tax years an require unpaid taxes to be settled.

Therefore, if you have traded crypto using BTCX stay compliant and declare your taxes for this and previous years proactively. If you have forgotten to declare crypto taxes for previous years you can always ammend this in Sweden without being fined by submitting a Självrättelse. Divly can help you declare for all years including the ones you missed.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN