How do I know if my crypto tax results are correct?

Quick Answer

Divly is an automated Do-It-Yourself platform and as such it relies on the actions of the user to calculate taxes properly. This in turn allows Divly to offer a service many times cheaper than the average accountant or tax lawyer.

There are several steps you can take to check if your taxes are reasonable which are mentioned below, however if you want personalized and specialized help then you should always seek professional advice from your accountant or tax lawyer. Divly does not provide personalized tax advice.

Detailed Answer

Fortunately, we work hard at Divly to make the process of calculating your crypto taxes as smooth as possible. We spend a lot of time continuously iterating and improving our platform to simplify the process.

Below are a few steps you can follow to minimize the risks that there are errors in your crypto tax report.

-

Make sure you import ALL of your crypto transactions from the very beginning. You can read here why this is so important.

-

Once you have successfully added all your wallets, go to the Transactions page in Divly and double check that you can see the transactions you expect for each wallet.

-

Check if there are any auto-generated warnings. There are two types of warnings that are called Missing Crypto Purchase History and Missing Price Information. These warnings exist to help users discover potential issues.

-

Check that all your transfers between wallets have been correctly matched. Divly automatically matches transfers when possible, but does occasionally miss some. You can read more about how to match transfers manually here.

-

Apply labels to Deposits and/or Withdrawals when applicable. There are different tax rules for different types of crypto transactions. Often Divly auto-labels this in the import if the wallet provides Divly enough data, otherwise it is up to the user to do this. Read more about labels here.

-

Check that no duplicate transactions exist (Divly filters out duplicates when importing but its worth doing a check).

-

On the Tax Report page you can scan your profits and losses for each cryptocurrency. If a number looks very high, filter by that currency in the Transactions page to see if there is something that looks off.

-

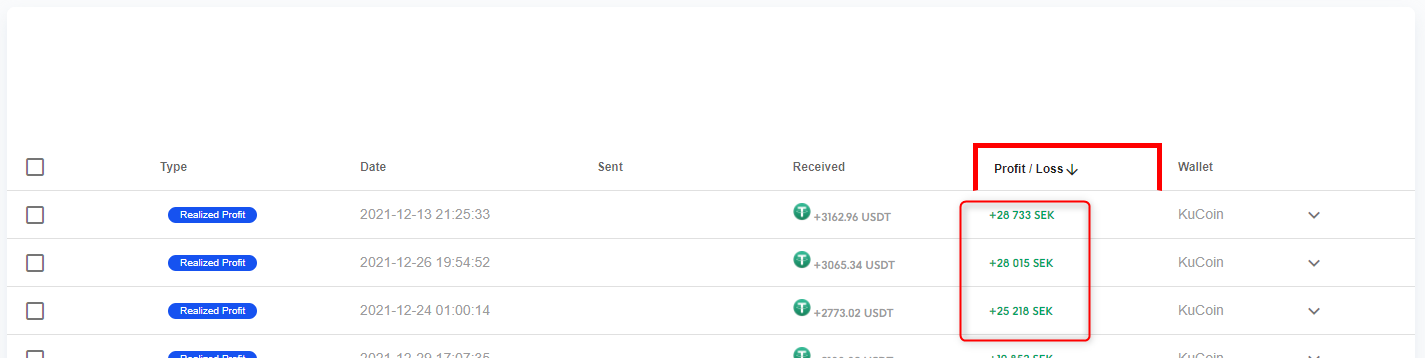

On the Transactions page you can sort by your taxable gains to see that there are no transactions that stick out and look incorrect.

If you need help with any of the above feel free to reach out to our customer support.

EN

EN