How do I fix "Missing purchase history"?

Quick Answer

This warning flags that Divly can’t find a historical record of where you purchased the cryptocurrency you are currently selling or withdrawing.

Solve this by ensuring that you have imported ALL of your past transactions into Divly. You can choose to ignore the warning in which case Divly will assume you purchased the crypto for free.

Detailed Explanation

Divly automatically calculates the cost basis of every cryptocurrency you have transacted with. The cost basis is the same thing as the price you paid to purchase your cryptocurrency (including associated trading fees).

The larger the cost basis, the lower your taxable gains. Unless provided, Divly will assume you purchased the cryptocurrency for 0 in your local currency. Consequently, it is important to include all historical transactions to ensure the cost basis is correct and you don’t overpay in taxes!

How to Resolve the Warning

Firstly, ensure that you have imported ALL of your transactions into Divly. We use your historical transaction data to calculate your cost basis. There are several methods you can use to import your transactions. Assuming your transactions are all included, then this warning should be resolved in most cases.

In some cases there may be limitations in what transactions are included in your wallet import. If the warning still persists after you have imported all your wallets, please contact our support to debug the case further.

If you happen to have lost transaction records and don’t know what to do then follow these steps:

-

If you know WHEN you acquired the crypto, then add a deposit manually in Divly for that crypto on the correct date. Divly will calculate the value for the crypto on the date provided. Only do this if you can provide supporting evidence that your local tax authorities will accept.

-

If you have no recollection of when the crypto was acquired or for what price, then don't do anything. It is safest to assume the purchase price was 0 in your local currency even if that means you might pay more in taxes.

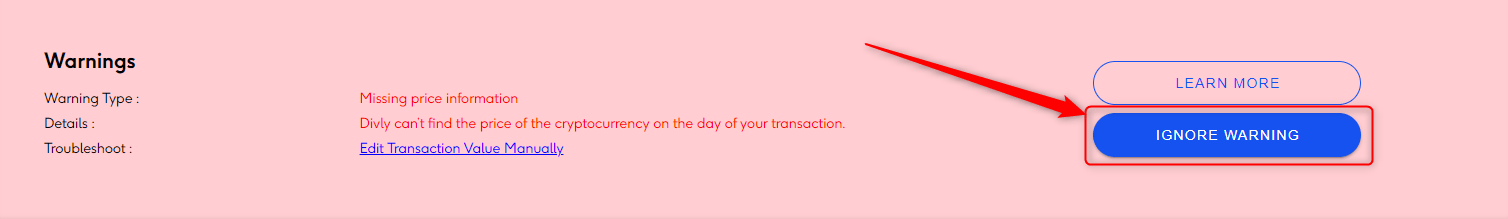

How to Ignore the Warning

If there is no reasonable way for you to attain the value of a transaction, then you can choose to ignore the warning. On the transaction, click on the blue text How do I fix Missing purchase history? and then click the button Ignore Warning. The red exclamation mark will be replaced by a green check mark.

EN

EN