Do I need to import all of my transactions?

Quick Answer

It is crucial to add ALL of your crypto transactions from the very beginning if you want Divly to calculate your taxes correctly.

Detailed Answer

Divly needs access to your first transactions in order to calculate the correct cost basis (your acquisition cost). The cost basis is calculated using the purchase price for every crypto.

Even if you are only declaring taxes for the most recent year, you still need to include transactions from all prior tax years!

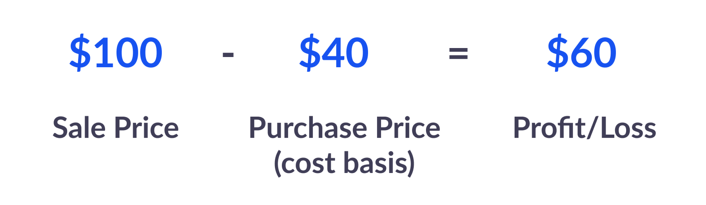

For example, Sam Brokeman purchased 1 ETH for $40 in 2019. He then sold 1 ETH for $100 in 2022.

If Sam imports all of his transactions, then his profit will be $60.

If the purchase from 2019 was not imported, then Divly would have to assume a purchase price of $0. This would mean the profits would be $100 - $0 = $100. More profits means more taxes!

It benefits Sam to import all transactions so his purchase price lowers his profits and taxable gains.

EN

EN