Cryptocurrency tax platform

Crypto taxes without

the headache

the headache

- Your taxes done in minutes

- Guides you every step of the way

- #1 choice for crypto taxes in Europe

Featured In

Don’t break your back!

Trading in the crypto market is thrilling, but tax obligations can be a buzzkill. Enter Divly, your solution for crypto taxes. With our step-by-step guidance you can get your crypto taxes done effortlessly. Say goodbye to sleepless nights spent wrestling with spreadsheets!

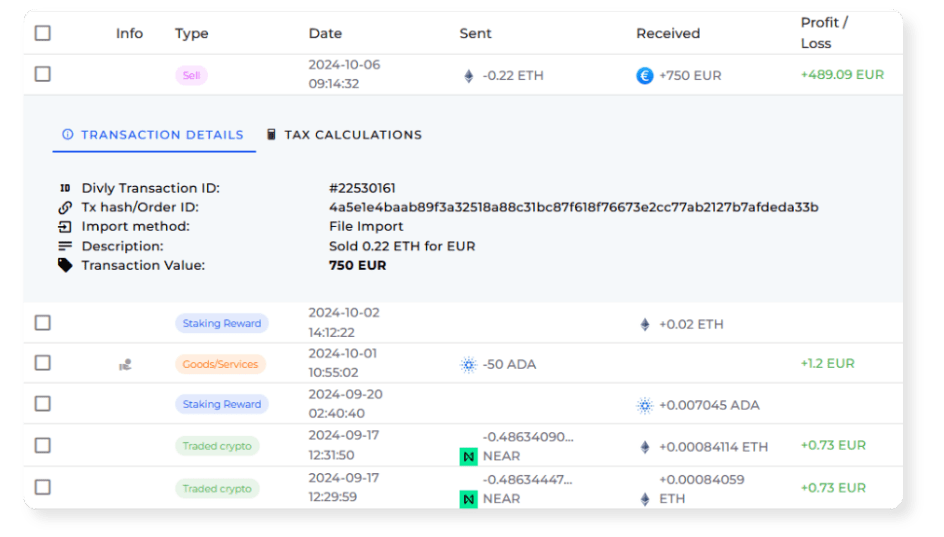

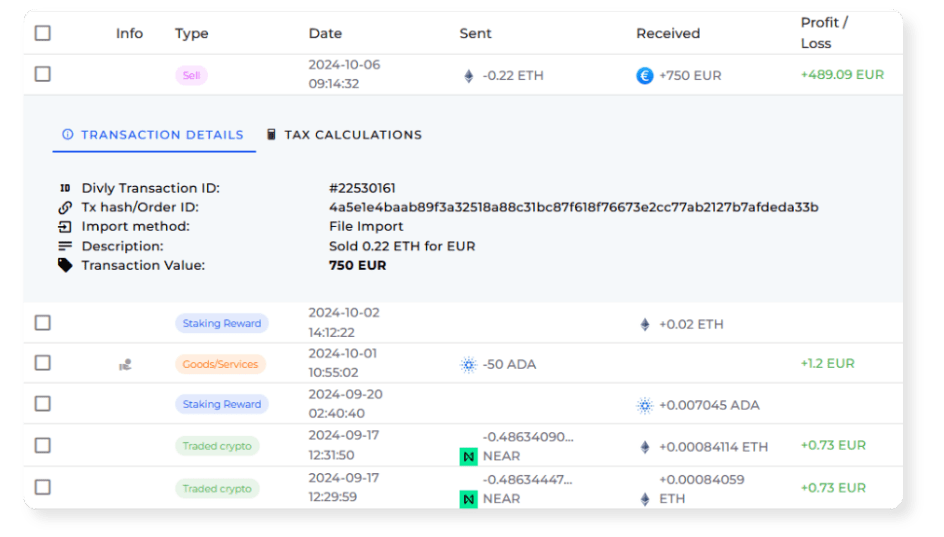

Stay on top of your crypto taxes

With Divly, you get the peace of mind that every transaction is tracked and stored accurately. You can drill down into specific transactions to see the tax calculations. When you're ready, you can download your crypto tax report that includes instructions on how to declare everything to your local tax authority.

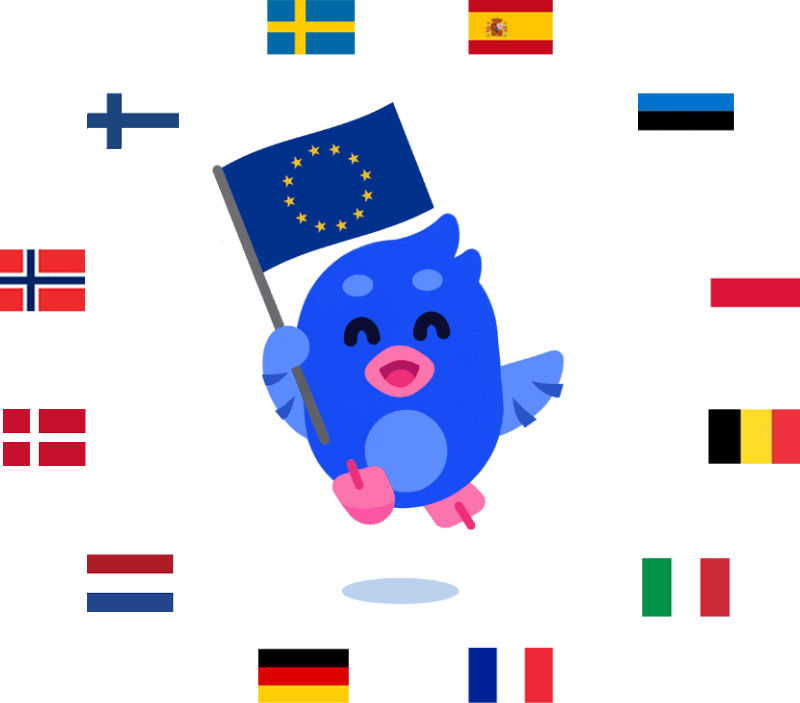

#1 choice for Europeans

Crypto regulations and reporting requirements vary by country. Divly flies the extra mile to provide the most localized service throughout Europe. We provide reports in your country's official language that follow your local tax authority's guidance.

How it works

Divly guides you from start to finish

1. Import

Import transactions from your favorite wallet or exchange

2. Track

Track your portfolio performance and your taxable gains

3. Declare

Download your tax report and submit it to your local tax agency

A few of our integrations

Import your transactions fast and easy with our integrations

Trijo

Bitstamp

BTCX

Blockfi

Ledger

Copay

Binance

Coinbase

Bittrex

Nicehash

Safello

Kraken

Celsius

KuCoin

Exodus

Nexo

FTX

CoinSpot

Poloniex

Bitfinex

Bitmex

Bitvavo

Bybit

Yoroi

Metamask

Gate.io

Uphold

Phemex

Luno

Bitpanda

Gemini

Swissborg

Bitrue

Cake DeFi

eToro

Firi

Trezor

Bibox

TradeOgre

HitBTC

Btcswe

Hoo

Helium

AQRU

Koinly

Abra

Electrum

AdaLite

Coinomi

Daedalus

Enjin

Mycelium

Eternl

Volet

AirGap

Amon

Argent

Bifrost

Nuri

Casa

Edge App

Eidoo

Nami

SafePal

Wallet.io

Zelcore

Moonpay

BYDFi

bitFlyer

CEX.IO

Coincheck

Swyftx

Bitget

AgoraDesk

Bitbank

zipmex

Satang

Zaif

MEXC

Revolut

Quickbit

Bitpoint

Paxful

CoinEx

Solflare

Probit

Xumm

Harmony

Gatehub

Bitmart

Wirex

xt.com

NBX

Xaman

VEVE

Tangem

PayPal

Bison

Kriptomat

Knaken

Kvarn X

Finary

Bitstack

Testimonials

See what our customers are Saying

FAQ

Frequently asked questions

01

Do I need to pay taxes on crypto?

Yes, in most countries you are required to pay taxes on crypto. For more details see your country-specific crypto tax guide .

02

How do cryptocurrency taxes work?

Crypto typically incurs a capital gains tax in the majority of jurisdictions. This means you need to pay taxes on the difference between what you bought crypto for and what you sold it for (minus fees). If you received crypto through other methods (e.g. salary), methods like income tax will apply.

03

Can I use Divly to declare previous years?

Yes, you can use Divly to declare crypto taxes for previous years that you missed. In many countries you can self-report mistakes and not get penalized for it. Divly provides localized guides on how to fix previous years for many of our supported countries.

04

Can I avoid paying taxes on crypto?

It is a criminal offense to not pay your taxes. It is also difficult to avoid since crypto transactions are recorded publicly on the blockchain and exchanges have been forced to hand over information to local tax authorities.

05

Do I need to file taxes if I lost money?

Yes you need to file a tax report even if you lost money. The good news is that by filing your losses you may be able to reduce your taxes.

06

Is it safe to share my transactions with Divly?

Divly is a premium service to help people calculate and submit their crypto taxes. We use industry standard practices to secure your data. We do not sell your information to third parties such as other companies or government agencies. We do not perform any KYC. Divly only requires an email address and your pseudonymous crypto transactions to generate your taxes. Feel free to use a temporary email / protonmail. You can also delete all your transactions and synched wallets at any time.

07

Can I invite my accountant to Divly?

Yes, you can safely ask your accountant to create and manage a new Divly account for you, or invite them to see and/or edit your existing Divly account. Divly provides accountants with a special feature to manage multiple clients with crypto.

Supported countries

Use Divly if you pay taxes in:

In development

Available soon in:

Austria

Bulgaria

Croatia

Czech Republic

Greece

Hungary

Ireland

Latvia

Lithuania

Portugal

Romania

Slovakia

Slovenia

EN

EN