Guide to declaring Form 2042 C and 2086 in France

Declaring 2042 C and 2086

This article is part of a series on the forms required for declaring taxes in France. Don't forget to also use our guide to declaring your crypto accounts in 3916-BIS.

In France, you need to be aware of three separate forms: Form 3916-BIS to declare your cryptocurrency accounts, and Forms 2042 C and 2086 to report your capital gains. This article will cover Forms 2042 C and 2086.

Form 2042 C concerns the overall capital gain or loss you’ve made in the year. Form 2086 concerns an itemized list of your taxable transactions.

Calculating Capital Gains

Before you can report your capital gains, you must calculate them. This process can get quite complex without tax software. The formula is:

Sale Price [after fees] - ((Total Acquisition Costs - Previously allocated costs) * Sale Price) / Portfolio Value.

You need to know:

-

The sale price of the transaction.

-

Your total expenditure of fiat on crypto.

-

How much of your total expenditure has been allocated to previous transactions.

-

The portfolio value at the time of the transaction.

Guide for Completing Form 2086 on impots.gouv.fr

Initial Access

Log In: Visit your account on impots.gouv.fr and click “accéder à la déclaration en ligne”.

Navigate to Annex Declarations: Select "Déclarations ANNEXES" to proceed.

Form Selection and Verification

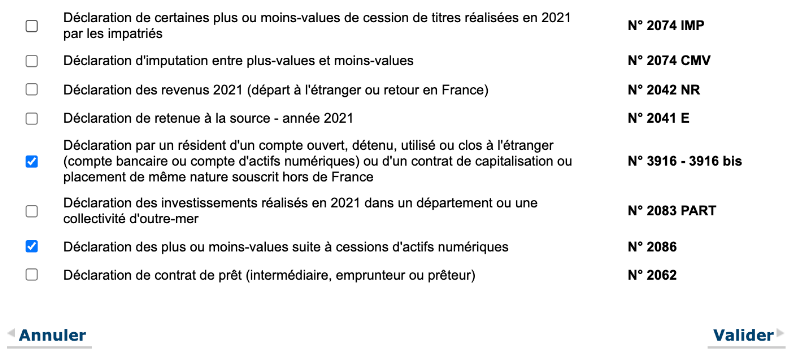

Check Relevant Boxes: Ensure the boxes for 3916-3916 bis and 2086 are ticked. If not, do so.

Proceed with 'Validate': Click on "Valider" to continue.

Annual Declaration: Accounts opened, held, closed, or used abroad must be declared annually. Our full guide for declaring 3916 bis can be found here.

Understanding Annex 2086

No Transactions: If the Annex 2086 provided by Divly is empty, double-check your transaction history uploaded to Divly. If you haven’t made any taxable disposals, you do not need to select "Déclaration de plus ou moins-values suite à cessions d'actifs numériques" (N° 2086).

Completing the Form

Go to Annex 2086: Select the “Annexe 2086” option on the left side of your screen.

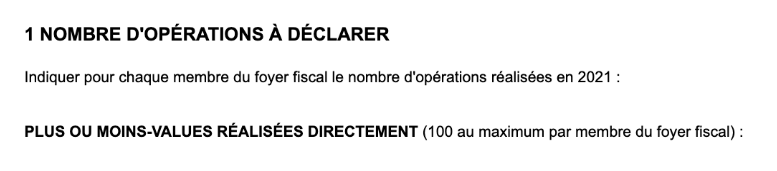

Input Taxable Disposals: Enter the number of taxable disposals you’ve made.

Note: If you have more than 100 taxable disposals, refer to our specific tutorial for more than 100 disposals.

Reporting Figures

Enter Data from Divly’s Annex: Transfer the figures from Divly’s completed annex into the online form.

Confirm Entered Amounts: Click “Suivant” to validate the amounts.

Final Steps

Final Validation: Click “Suivant” or “Déclaration de revenus” to proceed.

Automatic Reporting in Online Declarations: If you’re using online services, your net gain or loss will be automatically included in your income declaration for form 2042 C.

To verify, go back to your main income declaration and check boxes 3AN or 3BN (3BN for net loss).

Note: The tax administration does not display negative figures with a "-" sign. Simply verify and repeatedly click "validate".

What if I have more than 100 transactions?

Form 2086 cannot currently be completed online if you have over 100 transactions to report. There are two ways around this limitation:

Option 1) Contact the Tax Administration

Initiate Communication: Use your secure messaging service to contact the tax authorities.

Explain your situation: Explain that you’ve conducted over 100 taxable transfers during the year but the online space only allows for 100 entries.

Request for Alternative Submission: Ask if you can submit the annual capital gains declaration annex 2086, a document generated by Divly, as an alternative.

Step 2: Submit Declaration Annex via Secure Messaging

Await Response: If you receive a positive response from the tax office (which is common), proceed to the next step.

Prepare Document: Ensure the capital gains declaration annex is in PDF format.

Send Document: Use the secure messaging service to send the PDF version of the Divly-produced declaration annex.

Step 3: Enter Data in the Online Form

Representative Transfer Entry: In the online form, enter data for a single transfer. This entry should reflect your overall capital gain or loss.

Adjusting the Figures: It's recommended to adjust the numbers so that the "224 Overall capital gain or loss" field matches the total capital gain or loss as indicated in the Divly annex.

Option 2) Combine Transactions on the Same Day

If you have over 100 transactions, you may be able to get under 100 transactions by combining transactions that occur on the same day.

Although this might be more difficult for the user, the tax authority has shown a preference for this option.

EN

EN