Calculating your cryptocurrency tax can be difficult. Is trading crypto to crypto taxed? How do I calculate the profit on a transaction? What happens if I don’t pay taxes?

This article aims to serve as a complete guide on calculating and paying taxes on cryptocurrency (for example, Bitcoin and Ethereum) for individuals in Japan. We will be covering the following topics in this guide.

This guide will be updated and maintained regularly to account for changes made by the National Tax Agency and new types of transactions. Suppose you find any errors or outdated information. In that case, it is greatly appreciated that you let us know by sending an email to [email protected] or via our support chat at the bottom right corner of our website.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

Important dates 2023

The tax year in Japan runs from January 1st till December 31st.

-

16 February 2022 - The first day you can declare your income taxes

-

15 March 2022 - The final day to declare your income taxes

How are cryptocurrencies taxed in Japan?

In Japan, cryptocurrency income is taxed as miscellaneous income. The cryptocurrency tax rate is 5%-45% depending on your income tax bracket and other income sources. Any profits made on trading, exchanging, and mining cryptocurrencies are taxable.

The Miscellaneous Income tax rate

Japan has a number of income types

-

interest income

-

dividend income

-

real estate income

-

business income

-

salary income

-

retirement income

-

forest income

-

transfer income

-

temporary income.

Any income that does not fit into any of those nine categories is miscellaneous income. Miscellaneous income includes other income sources, such as side jobs (Uber Eats, Youtube, affiliate income, online sales), pensions, income from cryptocurrencies, and other not classified income.

The miscellaneous income tax rate is progressive and depends on your income tax bracket. Therefore, the higher your income, the more tax you will pay. Your amount of taxable income, which includes employment and miscellaneous income, is taxed at a rate of 5%-45%.

The table below from the NTA includes the current income tax brackets.

| Taxable Income Amount (Yen) | Tax Rate | Deduction Amount (Yen) |

|---|---|---|

| 1,000 - 1,949,000 | 5% | 0 |

| 1,950,000 - 3,299,000 | 10% | 97,500 |

| 3,300,000 - 6,949,000 | 20% | 427,500 |

| 6,950,000 - 8,999,000 | 23% | 636,000 |

| 9,000,000 .17,999,000 | 33% | 1,536,000 |

| 18,000,000 - 39,999,000 | 40% | 2,796,000 |

| 40,000,000 | 45% | 4,796,000 |

For example, if your income is 7,000,000 yen then the amount of tax you will pay is 7,000,000*0.23 - 636,000 = 974,000 yen.

However, you do not have to pay taxes on your miscellaneous income in some situations. Suppose you are employed and make less than 200,000 yen in a year in miscellaneous income. In that case, you do not have to declare your cryptocurrencies in the final tax return. Even if you think that your miscellaneous income is lower than 200,000 yen, it would still be useful to use a cryptocurrency tax calculation tool like Divly. It can be difficult to be certain about your profits because profit does not only occur when you convert crypto to yen. Any trade between cryptocurrencies can also result in a profit.

Virtual currency cost calculation method allowed in Japan

You need to calculate your income to do your cryptocurrency taxes. You can do this by finding the difference between your revenue from a sales transaction and the acquisition cost of the cryptocurrency you sold. Calculating the revenue can be pretty simple. For the revenue, you have to use the amount of yen received or the market value of the acquired cryptocurrency at the time you receive it.

Calculating the cost can be challenging. This is not often as simple as finding the purchase price of your sold cryptocurrency. You may have purchased a cryptocurrency over multiple transactions at different prices. It can be challenging to know which purchase price to use when calculating income from a sale.

You must use the proper methods to calculate the acquisition cost. So which methods does Japan allow for cryptocurrencies? Japan supports both the Total Average Cost Basis method and the Moving Average Cost Basis method. You must let the tax authorities know which cost basis method you use. You must inform them of the method in the year you first received the currency by the final tax return deadline (March 15th of the following year). You can do so by submitting the Notification Form for Evaluation Method of Cryptocurrency Assets for Income Tax to the tax authorities. You should do this for each cryptocurrency. If you want to change methods later, you must also inform the NTA.

If no such form is filled, the cost basis method must be the total average cost basis method. You may not then use the moving average cost basis method.

For a breakdown of how each method works and whether the Total Average Cost Basis Method or the Moving Average Cost Basis Method is best for you, see our guide on the best ways to make cryptocurrency tax savings.

What can I deduct from my cryptocurrency income?

Necessary expenses that can be deducted are - Any fees or selling, general and administrative expenses

-

usage fees for the internet and smartphones that are directly used to make cryptocurrency income

-

Purchase costs of personal computers that are directly used to make cryptocurrency income.

Make sure only to deduct the proportion of the expenditures involved in your cryptocurrency activity. For personal computers that you can use for more than one year, you should divide the purchase price into depreciation expenses over the useful life of the equipment. You can’t use the entire lump sum for the year.

Do I need to declare income if I've made a loss from virtual currencies?

If you’ve made a loss on cryptocurrencies, you do not need to file a cryptocurrency tax return. However, if you have made other miscellaneous income, you can use the loss in cryptocurrencies to offset the gain. You cannot use the loss in miscellaneous income to offset salary income.

What happens if I do not declare or pay my cryptocurrency tax?

If you do not declare cryptocurrency taxes by the tax deadline, then you will have to pay a 15% fee on the first 500,000 of taxes payable and 20% for any amount above that.

Even if you are late in filing cryptocurrency taxes, you will have to pay a fine between 7.3% and 14.6% of the taxes payable. The exact tax rate depends on how many days past the filing date you declare your taxes.

If you choose not to declare, there is a risk that the NTA will find out. The NTA can require domestic exchanges to provide users’ financial information. The same goes for banks. Foreign crypto exchanges aren’t safe either. Japan is a member of the Asia-Pacific Group on Money Laundering. The NTA may receive your transaction history through tax treaties with foreign countries or direct requests to the exchange. The NTA can even find decentralized transactions. The blockchain provides a public transaction history for all wallets. Several organizations are working on using this publicly available information to ensure that taxpayers declare their cryptocurrencies.

Therefore, It is probable that the NTA will discover whether you have or have not paid your cryptocurrency taxes.

Do I have to declare crypto in the foreign property & debt record?

Cryptocurrency does not need to be included in the foreign property & debt record. Cryptocurrency assets are “outside the country,” depending on the location of the person’s residence.

What do I do if I don’t know the value of my purchased cryptocurrency?

If you cannot find your virtual asset’s purchase price, then it is allowed to assume that the purchase price was 5% of the sales price. This rule could save you a bit in taxes if you cannot find the purchase price. If your account is set to Japan, then Divly automatically applies the 5% rule when it benefits you. You can also check our guide on what to do if you’ve lost part of your transaction history in our guide on how to resolve “Missing Purchase History” errors.

Detailed tax information on different cryptocurrency transaction types

It is important to know how each transaction is taxed. Below is a master list for your reference; we will go through each in detail in this guide. Each transaction has a label in Divly for those using our service to automate their tax reporting.

| Transaction Type | Tax Classification | Divly Label |

|---|---|---|

| Buy crypto | None | Buy |

| Sell crypto | Miscellaneous Income Tax | Sell |

| Trade crypto for crypto | Miscellaneous Income Tax | Traded crypto |

| Initial Coin Offering (ICO) | Miscellaneous Income Tax* | Traded crypto |

| Purchase goods & services with crypto | Miscellaneous Income Tax | Goods/Services |

| Pay trading fee with crypto | Miscellaneous Income Tax | *Fee Included in Trade |

| Pay transfer fee with crypto | Miscellaneous Income Tax | *Fee Included in Transfer |

| Transfer crypto between your own wallets | None | Transfer |

| Lost or stolen crypto | None* | Lost/Stolen |

| Give crypto as a gift | None | Gifted Away |

| Receive crypto as a gift | Gift Tax | Received Gift |

| Donate crypto | None* | Donation |

| Airdrop | Miscellaneous Income Tax* | Airdrop |

| Hard Fork | Miscellaneous Income Tax* | Fork |

| Mining | Miscellaneous Income Tax | Mining |

| Staking | Miscellaneous Income Tax | Staking Reward |

| Income (e.g., freelancing,sidejob) | Miscellaneous Income Tax | Income |

| Lend out Crypto | Miscellaneous Income Tax | Interest Received |

| Borrowing Crypto | Miscellaneous Income Tax | Interest Paid |

| Margin Trading | Miscellaneous Income Tax | Realized Profit/Loss |

| Futures / Derivatives Trading | Miscellaneous Income Tax | Realized Profit/Loss |

| NFTs | Miscellaneous Income Tax | In progress, not yet available |

*Please read below for more specific information on the transactions in question. Whether you need to pay income tax may be situation dependent.

Buying cryptocurrency

You are not taxed when buying cryptocurrency. However, make sure to record the price you paid for your cryptocurrency. This value will be needed when determining the profits incurred once you trade or sell your cryptocurrency. If you purchased the crypto in a foreign currency (e.g., USD or SEK), remember to convert it to the value in local currency on that day.

You can add the trading fee to the cost basis when buying crypto. Adding the trading fee will help reduce your taxes. For example, if you purchase 1 ETH for 150,000円 and pay a trading fee of 1000円. Your cost basis for 1 ETH is 150,000 + 1000 = 151,000円. If you purchase more cryptocurrency, you will have to keep track of it via the Moving Average Cost Basis Method or the Total Average Cost Basis Method.

Selling cryptocurrency

Selling cryptocurrency is a taxable event. You will have to pay taxes on any profits incurred. You can subtract the trading fee from the sale price when selling crypto. Deducting the trading fee will help reduce your taxes again. Once again, it's important to calculate the selling price in local currency at the time of sale.

Trade Crypto for Crypto

In Japan, trading crypto for crypto is a cryptocurrency tax event. You must pay tax on the gains made on the cryptocurrency you sold. To calculate the gain or loss, you should use the market value of the received cryptocurrency in yen.

To determine the gain on your transaction, you should determine the acquisition price of the cryptocurrencyyou sold. You can then subtract this amount from the market value of the received cryptocurrency

Initial Coin Offering

An ICO is an event where a company tries to raise capital through a new crypto project. When you invest your crypto (usually Ethereum) in an ICO, you are provided a token for that project. From a taxation point of view, this functions the same as a crypto-to-crypto trade. Essentially, you send cryptocurrency in exchange for a token from a new project.

Although we are not aware of concrete regulations regarding ICOs, participating in an ICO will likely function the same as a crypto for crypto trade.

Purchase Goods & Services with Crypto

When you purchase a good (e.g., new computer, gift card) or service (e.g., VPN service) using crypto, you must pay miscellaneous income tax. The sale price should equal the product’s price in yen, including consumption tax. You then have to pay a tax on the value increase of the crypto used to purchase the good or service.

If there is no yen price for the goods you purchased, you may use the market value of the cryptocurrency in yen at the time of the purchase.

Pay Trading Fees in Crypto

Typically, when you trade crypto for crypto, you will also have to pay a trading fee in crypto. Then you need to convert the cryptocurrency you used to pay the trading fee into yen. The cryptocurrency is taxed if its value has increased.

The transaction fees are added to the purchase price to create the acquisition cost of the crypto assets. This is beneficial to the trader as it will increase the acquisition cost and thus lower any gains made on the sale of crypto.

Pay Transfer Fees in Crypto

When you pay transfer fees in crypto you have to pay capital gains tax on the crypto used to pay the fees.

Transfer Crypto Between Your Own Wallets

Transferring crypto between your wallets is not a taxable event. The same is true for sending crypto to your account on an exchange. You must track these transfers properly to avoid paying unnecessary taxes.

Lost or Stolen Crypto

You do not have to pay taxes on stolen property. Whether you can get a deduction may be case-dependent. It may be best to contact the NTA directly to ask for advice on your situation. You can read more about deductions for theft on the NTA website.

Give Crypto as a Gift / Receive Crypto as a Gift

When you receive a gift, you can set its acquisition cost to the market value when you receive it. If there is no market price, then the cryptocurrency’s value needs to be determined by considering the content and nature of the crypto asset.

You will also have to declare this acquisition cost for gift or inheritance tax purposes. If you trade away your gift, you will have to pay taxes over the difference between the market value when you trade your cryptocurrency and its acquisition cost.

Airdrop

An airdrop is typically considered as a gift from the token holder or blockchain. Airdrops are usually a very small or negligible amount. The NTA does not mention airdrops in its cryptocurrency guidelines. However, the likely tax treatment is that receiving an airdrop is seen as income. In most cases, the value of an airdrop is 0円, so no income is earned at the time of acquisition. You will have to pay taxes on your airdrops if you sell them in the future.

Hard fork

A hard fork occurs when the blockchain splits. In that case, you are gifted crypto based on your ownership of the forked cryptocurrency. If the branched asset has a price at the time of the split, you have to pay taxes. However, the split branch likely has no value at that time. Therefore, no income is earned at the time of acquisition, and the acquisition cost is set to 0 円.

Mining, Staking, Lending (Interest)

Any income you earn from mining, staking, or lending will be taxable as miscellaneous income. The market value of the received cryptocurrency at the time of acquisition is the amount that will be taxed. You can deduct expenses incurred in the acquisition process. You can read more in the above section titled “What can I deduct from my cryptocurrency income?

Income From Other Activities (e.g. freelancing, side jobs)

Receiving payment for your work in cryptocurrency has to be declared. If this money is earned through a salary, taxes are generally withheld by the company. Income from sidejobs is also classified as miscellaneous income.

Margin trading, Futures, and Derivatives trading

Margin trading involves borrowing crypto to make trades. The information that cryptocurrency exchanges generally provide is the realized profit or loss on the trades.

In these cases, the realized profit is taxable income. If you make a loss, it works the same as if you sold the coins for 0 yen. The recorded loss is equal to the acquisition cost of the cryptocurrency.

Suppose you are using the Cryptocurrency Statement to determine your crypto income. In that case, you must report your profit and losses in boxes specifically for margin trading.

NFTs

NFT regulations are relatively limited. Under the current framework, NFTs are often seen as miscellaneous income. Divly treats it as any other cryptocurrency. In some instances, however, NFT income can be seen as salary or business income.

The Financial Services Agency (FSA) is developing more methods to deal with decentralized finance and other matters such as NFTs. We will keep you updated as regulations develop.

How to file a virtual currency tax return

To calculate your cryptocurrency taxes, you can use multiple methods. You can use both the cryptocurrency statement, Divly, or both.

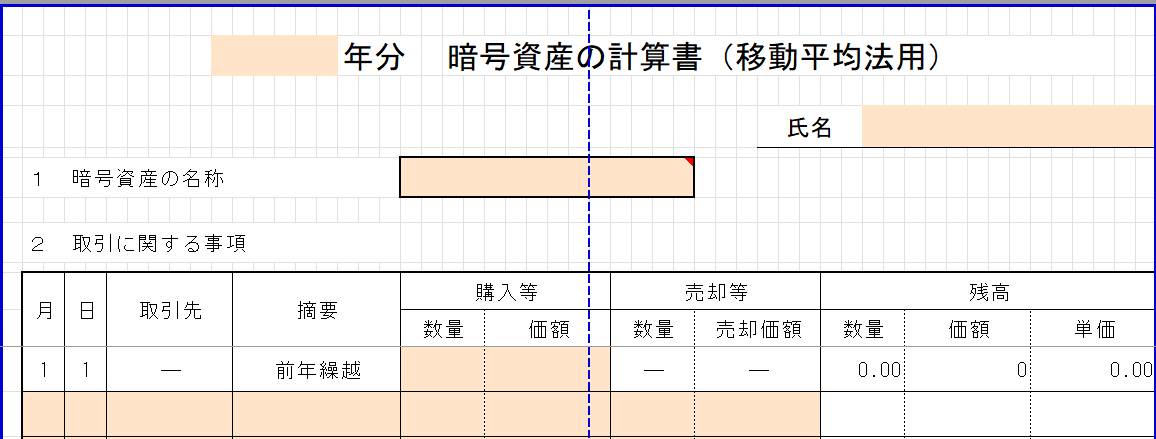

Using the Cryptocurrency Statement (暗号資産の計算書)

Many people in Japan use the Cryptocurrency statement. This is an excel sheet provided by the NTA to determine your cryptocurrency income. You can fill this document in using the “Annual Transactions Reports” provided by domestic Japanese exchanges. You can download the cryptocurrency statement from the NTA. However, this method has a few downsides.

The Cryptocurrency Statement does not support international exchanges (without using Divly).

Local Japanese exchanges provide Annual Transactions Reports as far back as 2017. You can use them to fill in the cryptocurrency statement. However, foreign exchanges do not provide these documents for you. Foreign exchanges are very popular in Japan as they provide more cryptocurrency products and currencies.

Although the exchanges do not provide the Annual Transaction Reports, Divly can produce them for you. You can then combine your local exchanges’ Annual Transaction Reports with the Annual Transaction reports for overseas cryptocurrency exchanges created by DIvly.

The Cryptocurrency Statement does not support the moving average cost basis method. In some cases, the moving average method provides lower tax dues than the total average method. As you are free to select either method, the cryptocurrency statement may not be able to help. This is because you cannot use the Annual Transaction reports for the moving average method.

Be aware that the moving average method can only be used if you submit a Notification Form for the Evaluation Method of Cryptocurrency Assets for Income Tax or an Application for Approval of Change in Evaluation Method for Income Tax Cryptocurrency Assets. Suppose you do want to use the moving average method. In that case, the Cryptocurrency Statement will not be able to calculate your income for you. Divly can support the moving average cost basis method and provide samples of the necessary documents to submit to the NTA.

The Cryptocurrency Statement does not support any transactions made outside of exchanges. Suppose you’ve mined a cryptocurrency or participated in an ICO. In that case, the Annual Transaction Reports provided by local exchanges will not be sufficient. However, you can use Divly to help you determine the income you’ve earned through these transactions.

Does Divly help with the Cryptocurrency statement?

Divly can create the Annual Transaction reports for all your exchanges. You can use these to fill in your cryptocurrency statement.

Why would I choose this method? Divly supports many local Japanese exchanges. But you may have crypto on a Japanese exchange not supported by Divly. Or you may be missing the annual statement from foreign exchanges. Then you can still combine the annual transaction reports from that local exchange with the foreign exchanges provided by Divly to fill in the cryptocurrency statement. So Divly can help you even if we do not support your local exchange!

Directly have Divly calculate your cryptocurrency profits/losses in yen

You can use Divly’s cryptocurrency tax calculation tool. Divly will calculate your profits or losses from cryptocurrency after you’ve uploaded your transaction history. You can also use Divly to determine whether the total average cost basis or the moving average cost basis is better for lowering your taxes.

We support over 50 different blockchains and cryptocurrency exchanges. You can also fill in your annual transaction report information to Divly (total average cost basis method). This can be very helpful if we don’t support your exchange via CSV or API. Then you can still submit your information.

How do I submit my virtual currency tax return online?

If you want to declare your cryptocurrency tax return to the NTA, you can follow the following method.

-

Make an account with Divly and upload your transaction history.

-

Either use the annual statements produced by Divly for each exchange you’ve used to fill in the Cryptocurrency Statement or let Divly calculate your profits for you.

-

Visit the National Tax Agency’s tax portal and register or sign in to an account.

-

Go to relevant income and select salary (給与)

-

Select miscellaneous income (雑(その他)) then confirm (確定)

-

Select the e-Tax number for your submission.

-

Enter the amount of miscellaneous income in JPY as indicated by our tax report or through the Cryptocurrency Statement. For the profit amount (収入金額) you should fill in your cryptocurrency income. Under (必要経費)you should enter your necessary expenses.

-

Make sure that for the category (種目) you select crypto assets(暗号資産)

-

Enter the name of the exchanges you’ve used and the legal addresses.

Congratulations on getting through our guide. Feel free to check out some of our other cryptocurrency tax content or contact our support team if you have any questions!

EN

EN