Divly is actively working on providing a cryptocurrency tax product for Japan. It is not currently live

If you've traded in cryptocurrency, you likely will have to pay taxes. Suppose you don't keep the tax effect of your cryptocurrency activity in mind ahead of time. In that case, you may have to pay unnecessarily high taxes. We've created a list of the best and easiest methods to achieve cryptocurrency tax savings.

This guide will be updated and maintained regularly to account for changes made by the National Tax Agency and new types of transactions. Suppose you find any errors or outdated information. In that case, it is greatly appreciated that you let us know by sending an email to [email protected] or via our support chat at the bottom right corner of our website.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

The 7 best ways to achieve cryptocurrency tax savings in Japan

-

Selecting the best cost basis method

-

Selling crypto with unrealized losses.

-

Deducting necessary expenses

-

Using the Deemed acquisition cost

-

Offsetting losses within Miscellaneous income

-

Buy but do not sell or trade cryptocurrency

-

Use a cryptocurrency tax calculation tool like Divly

The National Tax Authority (NTA) has built a strong foundation for cryptocurrency taxation in Japan. There are now comprehensive guidelines for most cryptocurrency transaction types. And the NTA is actively enforcing its regulations. If you live in Japan, it is essential to do your cryptocurrency taxes.

You can check our guide to cryptocurrency tax in Japan for a complete overview of cryptocurrency taxes. In it, we will cover which transactions are taxed, the cryptocurrency tax rate, and how to declare them to the NTA.

Selecting the best cost basis method

The first step to making cryptocurrency tax savings is knowing which cost basis method works best for you. The cost basis method affects all of your transactions. Therefore, it can have a significant impact on your taxes. The cost basis method determines your cryptocurrency costs. The higher the costs, the lower the profits! The cost you pay to buy crypto will not increase or change. The cost basis method only affects how to calculate the costs for tax purposes.

In Japan, you may use either the Total Average Method or the Moving Average Method to determine the acquisition price of sold cryptocurrencies. The default choice in Japan is the Total Average Method. This method is selected if a trader does not notify the National Tax Agency (NTA) of the method they plan to use.

These methods are used to calculate the cost of sold cryptocurrency and determine the profits made. For each cryptocurrency sale or trade, you subtract the acquisition cost from the revenue to get to the capital gain. You will then have to pay a tax over the capital gain. Therefore, you want to select the average method that results in the highest acquisition cost.

For a more detailed understanding of calculating the revenue, see our cryptocurrency tax guide for Japan.

How does the moving average method work

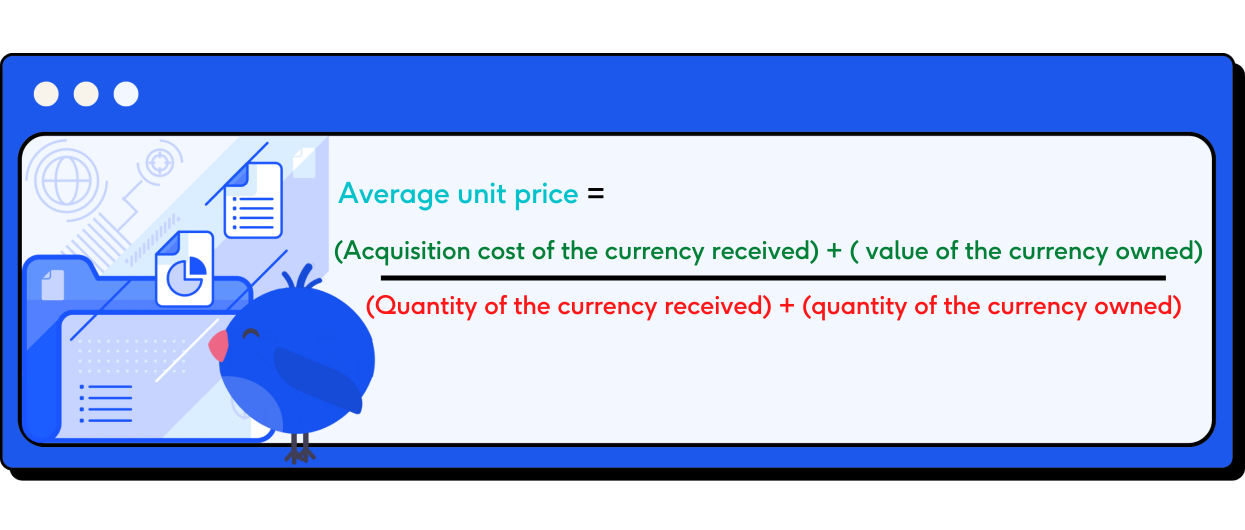

The moving average method calculates the acquisition cost using the average price of all of the crypto of the same type you currently have.

Each time you purchase new cryptocurrency the average price is updated as shown below.

Say you have one Bitcoin purchased for 2,000,000 yen and one Bitcoin purchased for 4,000,000, then your average cost is 3,000,000 yen. If you then sell one Bitcoin for 5,000,000, you will have made a profit of 2,000,000 yen.

Each time a crypto asset is acquired, the acquisition cost is recalculated for the same type of crypto asset. This makes it very difficult to keep track of the cost of your cryptocurrencies. We will provide an example further below.

How does the total average method work

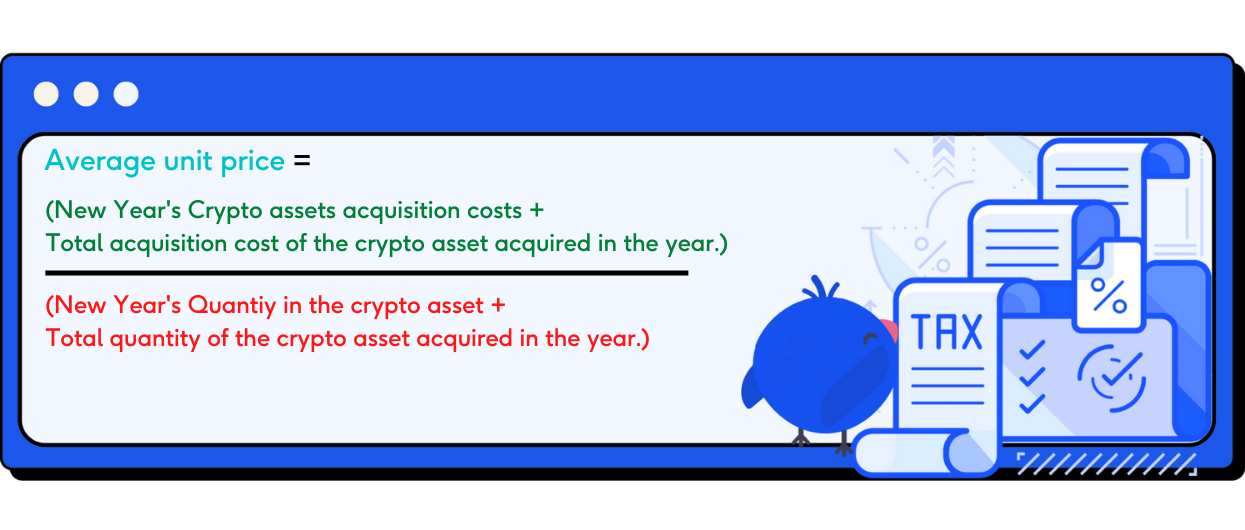

The total average cost basis method works similarly to the moving average cost basis method with one key difference. The total average method keeps two things into account when calculating the cost basis. First, it takes into account all previous acquisitions of a cryptocurrency. Secondly, it also considers any acquisitions of that cryptocurrency that happen in the year of the disposal.

The New Years crypto assets refer to the cryptocurrency assets held at the turn of the year.

Say you've purchased and sold Bitcoin. For the moving average method, each time you sell Bitcoin, all previous purchases of Bitcoin affect its cost. For the total average method, all earlier purchases of Bitcoin and other purchases in the same year affect its cost for tax purposes.

For the moving average method, if you purchase Bitcoin, the new purchase will affect the cost calculations of all future Bitcoin transactions. For the total average method, the new purchase will affect all future transactions and any sales that have already happened in the year.

Using the Moving Average Method, the costs per crypto may differ after every transaction. With the Total Average Method, the costs per crypto will be the same for every transaction in the year.

To avoid confusion, we've provided a detailed example below that compares the two methods.

Comparison Example of Total Average Cost Basis Method and the Moving Average Cost Basis Method

Hinata first started investing in crypto in November of 2021. He's made a number of crypto transactions since and needs to declare his taxes in 2023. Hinata has made the following transactions.

| Date | Transaction Type | Received Amount | Received Currency | Sent Amount | Sent Currency |

|---|---|---|---|---|---|

| November 4th, 2021 | Buy | 1 | BTC | 100,000 | YEN |

| January 14th, 2022 | Buy | 1 | BTC | 200,000 | YEN |

| February 8th, 2022 | Sell | 200,000 | YEN | 1 | BTC |

| June 4th, 2022 | Buy | 2 | BTC | 60,000 | YEN |

| July 9th, 2022 | Trade | 200,000 | YEN | BTC |

Average Cost Basis Method

February 8th

The capital gain incurred on the first sale on February 8th is calculated as follows. We take the average acquisition cost of all previously purchased BTC. So the cost will be (100000+200000)/2 = 150000. Therefore the profit on this transaction will be 200000-150000 = 50000 YEN.

July 9th

On July 9th Hinata has 1 BTC remaining after the sale on February 8th, with a cost basis of 150,000. Hinata has purchased 2 BTC with a combined cost basis of 60,000. Therefore the cost basis calculation is as follows (150,000+60,000)/3= 70,000 YEN per BTC. Hinata sells 1 BTC for 200000 and makes a profit of 200,000-70,000 =130,000 YEN.

Total Average Cost Basis Method

February 8th

First, we calculate the capital gain incurred on the first sale on February 8th. We take the average acquisition cost of all BTC purchased in the previous year still in inventory and the acquisition costs of all BTC purchased in the year. We have 1 BTC purchased at 100000 YEN remaining from the previous year. For the current year, we've purchased 3 BTC for 260000 YEN.

So the cost will be (100000+200000+60000)/4= 90000 per BTC sold. Therefore the profit on this transaction will be 200000-90000 = 110000 YEN.

July 9th

Using the total average cost basis method, the cost basis of 1 BTC stays the same during the year. Therefore, the capital gain incurred on the sale on July 9th is calculated as follows. We had 1 BTC purchased at 100000 Yen remaining from the previous year. For this year, we've purchased 3 BTC for 220000 Yen. So the cost will be (100000+200000+60000)/4 = 90000 per BTC sold. Therefore the profit on this transaction will be 200000-90000 = 110000 Yen

Which method should I use to save taxes, total average cost basis, or moving average cost basis?

In the example above, if we used the Moving Average Cost Basis method, we would have incurred a total of 180000 YEN in capital gains. Using the Total Average Cost Basis method, we incurred 220000 YEN in capital gains. In general, your capital gains will be lower with the moving average cost basis method if the prices of the crypto you have purchased have decreased over the year. Likewise, if crypto prices increase during the year, the Total Average Cost Basis will generally be better for cryptocurrency tax savings.

You can select your cost basis method by cryptocurrency. So for cryptocurrencies whose prices have increased in your later purchases, you would benefit from using the Total Average Cost Basis. For those where purchase prices have dropped, you would benefit from using the Moving Average Cost Basis method.

The calculations may be confusing and challenging to do by hand, so you may want to use a tax calculator such as Divly. On Divly, you can select either cost basis method for your transactions. Therefore, you can check which cost-basis method works best for you.

The default cost basis method for Japan is the Total Average Cost Basis method. If you want to use the Moving Average Cost Basis, you have to inform the NTA in the year that you first acquired the crypto asset type. If you'd like to switch the cost basis method later, you would also have to inform the NTA.

Selling cryptocurrency with unrealized losses

It is possible to offset cryptocurrency gains with cryptocurrency losses. Therefore, if you've made some profits, you may want to sell some poor-performing cryptocurrencies to offset the loss. If your cryptocurrency has decreased in value and you've not sold it, it may be beneficial to you to sell them at a loss. This way, you can use the loss to offset your income from cryptocurrencies and save money on taxes.

Say you've made a profit of 300,000 yen but have an altcoin whose value has dropped by 100,000 yen. Then you may want to sell the altcoin to lower your capital gains taxes. If you sell the altcoin, you will only be taxed on 200,000 instead of 300,000 yen.

Alternatively, it is important not to sell a lot of cryptocurrencies that have increased in value. Suppose you sell or trade a cryptocurrency that has increased in value. In that case, you have to recognize that increase in value as income. This income will then be taxed. If you want to sell some of your cryptocurrency, which cryptocurrency you end up selling is important.

With Divly, you can create mock transactions to see how they would affect your profits depending on your trading history. If you plan on cashing out some of your cryptos, it can save you a lot of money by checking how much profit you would make and have to pay tax over. You might find that you can save money by selling some underperforming cryptocurrencies.

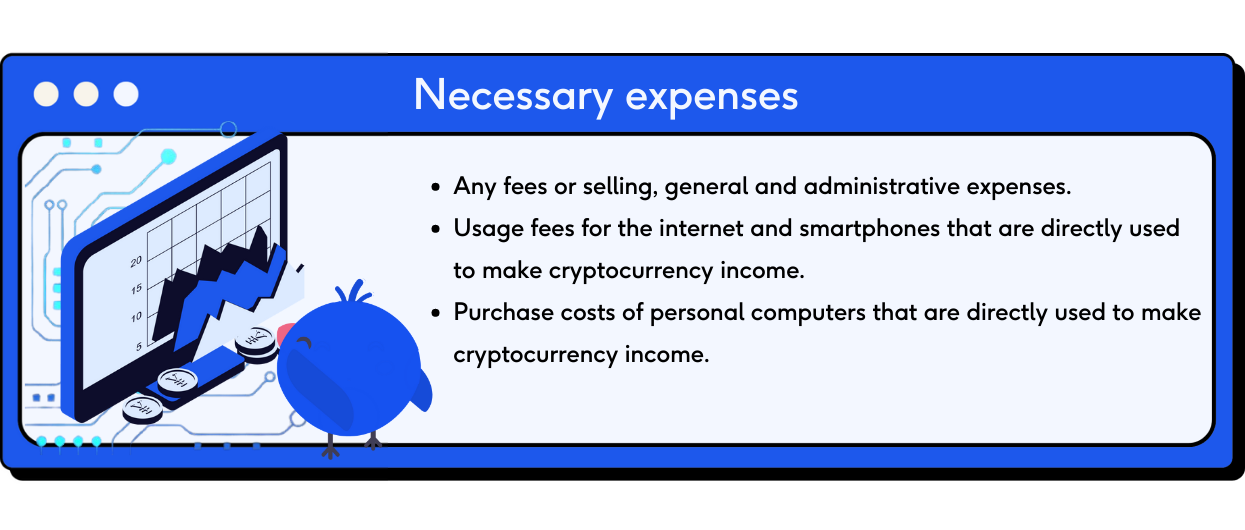

Deduct necessary expenses

One way to save on cryptocurrency taxes is to deduct expenses. These expenses can lower your profits and thereby lower your taxes.

You are able to deduct some necessary expenses from your cryptocurrency gains. The expenses you are able to deduct are as follows.

Fees can lower your taxes twice! If you first purchase cryptocurrency, you can add the fee to the purchase price. If you sell the cryptocurrency later, the profit on the transaction will be lower because the acquisition cost is higher. Once you sell the cryptocurrency, you generally have to pay a fee for the transaction. The fee can again be deducted from the profit. However, be aware that if the fee is paid in cryptocurrency, you must pay taxes on it.

The fees are included in our calculations if you are using Divly to automate your taxes.

You can only deduct the proportion of the expenditures used for your cryptocurrency activities. If you primarily use your computer for other activities such as gaming, then you cannot deduct the full amount.

Suppose the equipment is useful over multiple years. In that case, you need to allocate its cost over those years as well through depreciation.

Deemed acquisition cost

The deemed acquisition cost can help you in two situations.

-

If you've forgotten your purchase price.

-

If your cryptocurrency has increased a lot in value and you want to lower capital gains.

When you sell a cryptocurrency, it is allowed to set its acquisition cost to 5% of the sale price. Say you sell a cryptocurrency for 5 million yen, but its acquisition cost is 100,000 yen. Then you can lower your capital gains by assuming an acquisition cost of 250,000 yen. Divly will automatically do this for you if it lowers your taxes.

Offsetting losses within miscellaneous income

If you've made losses in cryptocurrency, you might want to know if you can offset your income using these losses. The answer is both yes and no. You are not able to offset any losses from miscellaneous income with gains made in any of the following income types.

-

interest income

-

dividend income

-

real estate income

-

business income

-

salary income

-

retirement income

-

forest income

-

transfer income

-

temporary income

You can only offset miscellaneous income gains with losses from miscellaneous income.

If you've made some income in the year, you may want to sell some of your poor-performing cryptocurrency to lower your profit. If you are employed and have made more than 200,000 yen in income other than salary income and retirement income, then you have to file taxes for it. If you can lower your profits to below 200,000 yen, you do not have to declare your miscellaneous income.

Be careful as the calculations can be tricky to do by hand. This is especially true because most cryptocurrency activity is taxed. This includes selling one cryptocurrency for another. You do not have to convert to yen to make a profit.

You can also offset the loss against other miscellaneous income. Miscellaneous income includes income related to side businesses that are continuous for profit.

Buy but do not sell cryptocurrency

Many different cryptocurrency transactions are taxable, e.g., mining, trading, and selling. However, you do not have to pay taxes on purchasing cryptocurrency. Since 2017 cryptocurrency has been no longer subject to the consumption tax act. So buying cryptocurrency is tax-free.

Once you've purchased cryptocurrency, you want to avoid paying taxes in the future. Japan does not have a wealth tax on cryptocurrency. A wealth tax requires citizens to pay taxes based on the value of their cryptocurrency holdings. Because there is no wealth tax on cryptocurrency, you also don't have to pay taxes if you just own crypto.

Use a cryptocurrency tax calculation tool like Divly

Divly can be a great partner for those trying to lower their taxes. Divly helps you calculate your cryptocurrency income for taxes. Divly already automatically takes many of the methods above into account. Trading fees, for example, are already taken into account by Divly. Divly also allows you to test both tax cost methods, total average and moving average methods, to see which works best for you. Divly also takes the 5% rule into account.

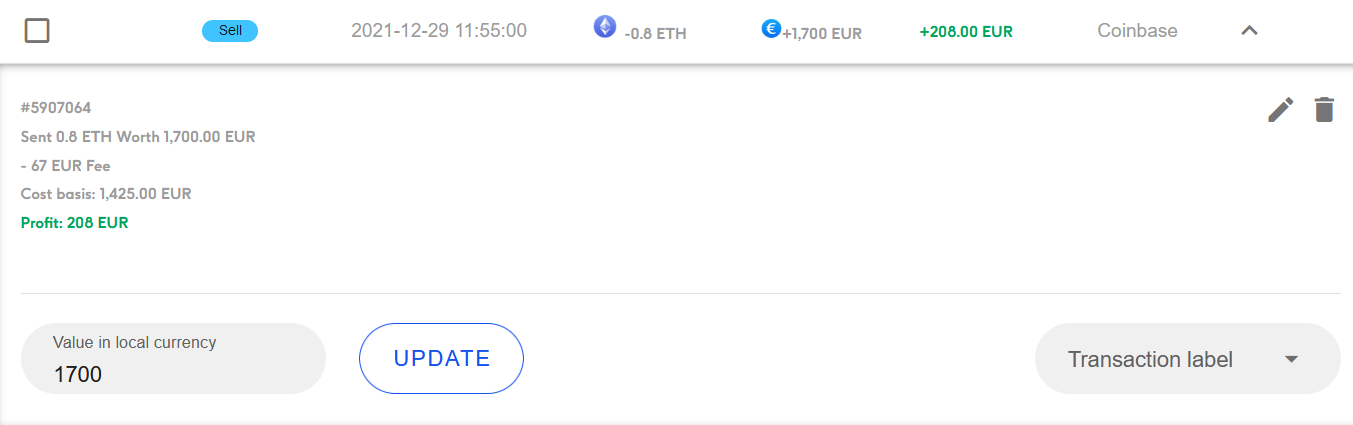

You can also use Divly to test certain transactions to see how they would affect taxes based on your trading history. Are you considering selling some cryptocurrency for yen or making a trade, then put it into divly and see how it affects your income!

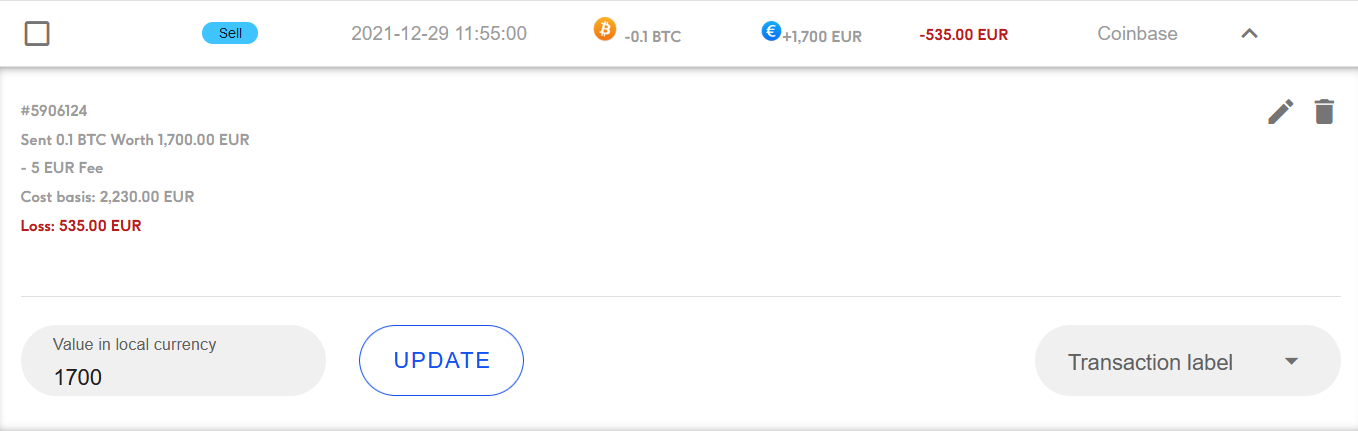

In the above example, I tested selling some of my BTC for EUR and selling some of my ETH for EUR. If I sold BTC I would realize a loss of 535 EUR. If I sold ETH I would make a profit of 207EUR. Knowing that I would realize a loss of 535 EUR if I sold BTC, I decided to sell it to lower my taxes.

Because My income tax rate was 30%, I saved quite a bit of money. Instead of paying a 62 EUR tax on a 207 EUR gain by selling Ethereum, I instead decreased my cryptocurrency profits by 535 EUR by selling BTC. I thereby lowered my cryptocurrency tax by 160 EUR more than if I sold nothing at all!

In total, I could save 222 EUR by checking which currency to sell before I sold them.

Summary

There are many methods you can smartly use to lower your taxes. Although paying taxes is important and vital to society, there is no need to pay too much in taxes. If you stay diligent and keep the methods above in mind, you should be able to find a way to lower your cryptocurrency tax dues!

Best of luck!

EN

EN