Are you mining as a hobbyist or as a business?

Mining is taxed differently depending on whether you are an individual mining as a hobby versus a for-profit organization/business. Most people using Divly will fall into the hobby category, but if you are unsure you can use the following guidelines provided by Skatteverket to see if you meet the criteria of a business. The criteria to be considered as a business can be summarized in english as:

-

The operations are conducted regularly in a professional and cost-effective manner over a longer period of time with appropriate equipment.

-

The operations can be expected to generate a surplus over the entire financial calculation period.

-

That the equipment's computing capacity can be assumed to generate more than 25 bitcoin annually (or equivalent value in the form of transaction fees or other virtual currency).

If you are unsure then you can always contact Skatteverket directly, or seek professional tax advice. The rest of this guide will assume you have been classified as a hobby miner for tax purposes.

How are taxes on mining calculated?

Profit earned from mining is classified as income generated from a hobby (In Swedish: “Inkomst av tjänst (hobby)”) and is taxed accordingly. Income implies that you will need to pay both social contributions (In Swedish: “Egenavgifter”) and income tax which is based on your marginal tax rate.

You only need to declare your mining income if you made a profit (assuming you are classified as a hobby miner for tax purposes). There is no need to declare anything if you made a loss. However, there are reasons to save your calculations for the future since you can deduct losses in previous years against profits in future years.

Mining profits are calculated by taking your mining income and subtracting that by your expenses (e.g. hardware and electricity). This sounds simple, but unfortunately can be quite tricky depending on the scenario.

Social contributions are taxed at 28.97% if you were born in 1955 or later. Since the size of social contributions is unknown at the point of declaration, you use a standard deduction (In Swedish: “Schablonavdrag”) which in most cases is 25%. See section about Egenavgifter on Skatteverkets website for more information.

After you have paid social contributions, your marginal tax rate will be applied on the profits remaining after social contributions have been deducted. This percentage will vary from person to person depending on where in Sweden you live, what your total income is, your age, and if you are a member of the church. We recommend using an income tax calculator if you are unsure what your marginal tax rate is.

Bob mined 12 000 SEK worth of crypto in 2020. He could deduct 2 000 in expenses related to mining. Hence, Bob made 12 000 - 2 000 = 10 000 in mining profits.

Bob will first need to pay 2 500 SEK in social contributions on the profit in the form of a schablonavdrag (25%). On the 7 500 SEK remaining after social contributions have been deducted, Bob will have his marginal tax rate applied which in his case is 31%. After all taxes are paid Bob will have 10 000 - 2 500 - 2 325 - 5 175 SEK left.

Calculating mining income

Mining income needs to be converted to Swedish Krona (SEK) on the day you receive it. Once you have converted all transactions into SEK, you sum up everything so you get one figure that represents the year.

Day 1: Receive 1 ETH in mining income. Value of ETH is 5 000 SEK.

Day 2: Receive 1 ETH in mining income. Value of ETH is 6 000 SEK.

Day 3: Sell 2 ETH for 12 000 SEK.

In the above example you will have earned 5 000 + 6 000 = 11 000 SEK in mining income. The sale of crypto does not affect your mining income in regards to taxes.

Take note that once you have accounted for your mining income, any value appreciation from the existing crypto you hold will be taxed as capital gains. In the example above, the 2 ETH will have a cost basis (In Swedish: "Omkostnadsbelopp") of 11 000 SEK. However, since you sold them for a total of 12 000 SEK, you will have made a profit of 1 000 SEK (12 000 SEK - 11 000 SEK) that needs to be declared as capital gains in the K4.

Calculating mining expenses

Even though calculating mining income can be time consuming, it is fairly straightforward and can be automated through tools like Divly. However, that is not always the case for mining expenses. To be considered a valid deductible expense, you need to be able to isolate and measure the cost correctly. You may also want to use depreciation (In Swedish: “Förslitning”) when deducting the costs.

It is important to understand whether a cost can be deducted from your mining income. Typically you would want to deduct hardware costs and electricity costs when possible. It’s hard to give an accurate answer to what is considered a valid expense, but the following is a good start:

-

Hardware: If you have purchased hardware and built a rig which has solely been used for mining, then it will be easier to argue that the cost is valid and should be deducted. However, if you have used your gaming PC to mine crypto whilst also using it for other activities, then it is unlikely that Skatteverket will consider the GPU as a valid expense.

-

Electricity: If you are planning to deduct electricity costs, then it is useful to install a meter to measure how much electricity the mining rig has consumed. This will make it easier to prove how much of the cost is directly associated with the mining. If you use your gaming PC then you will probably not be able to deduct electricity costs as it's too hard to isolate from your other activities.

If your mining equipment cost less than half a price base amount (In Swedish: “Ett halvt prisbasbelopp”) then you can deduct the costs directly from the mining income on the year you purchased the hardware. In 2025 this amounts to 29 400 SEK, you can find information on all other years on the SCB website.

If your mining equipment exceeds half a price base amount and is expected to last for more than 3 years, then you need to depreciate the assets. You will need to assess for each GPU or ASIC your purchase whether its expected lifetime is shorter or longer than 3 years. You may also want to depreciate other mining equipment like mining frames for larger rigs.

Depreciation is calculated by taking the purchase cost and dividing it by the amount of years it is expected to last. For example, if you purchase mining equipment for 60 000 SEK and expect it to last for 3 years, you would deduct 20 000 SEK each year from your mining income.

If you sell the equipment and have already deducted the losses or depreciated the assets, then the sale should be treated as a profit.

Bosse purchases GPUs for 50 000 SEK that is used only for mining. The life span is estimated to be 5 years, which means that the asset is depreciated 20% per year.

Year 3, Bosse sells the GPU for 35 000 SEK. At this point the asset has been depreciated by 20 000 SEK. The calculation is as follows: 35 000 + 20 000 – 50 000 = 5 000 SEK. The profit is treated as according to _kapitalvinstreglerna_ and is declared in section 7.2.

Deducting losses from previous years

If you have had losses from mining in any of the five previous tax years, you can use that loss to offset mining profits when you declare. For example, if you have mining profits for the tax year 2025 (declared in 2026), then you can offset the profits with any losses you made from mining since 2020. You can only deduct losses that amount to the profit you made.

Take note, only deduct losses made from mining! It is not possible to deduct losses from other hobbies or vice versa.

If you have not declared mining losses from previous years, then you can do that retrospectively when declaring your mining profits for the current tax year. This is why it's important to keep records of all your expenses for six years even though you don’t need to declare years where you made a loss mining.

Bob has been mining as a hobby for multiple years.

Year 1 mining loss: 20 000 SEK

Year 2 mining loss: 5 000 SEK

Year 3 mining profit: 15 000 SEK

Year 4 mining loss: 5 000 SEK

Bob does not need to declare his mining activities until Year 3 as it was the first time he made a profit. Bob can deduct his mining profits of 15 000 SEK from the losses he made in Year 1. The entire profit in Year 3 is negated by the losses from Year 1.

How to submit mining taxes to Skatteverket

To declare your mining taxes, you need to fill in the T2 form. There are two ways you can do this:

-

Fill in the T2 digitally on Skatteverkets online portal.

-

Fill in the T2 PDF version, print it out and mail it to Skatteverket. This is necessary if you are doing a Självrättelse.

If you have used Divly to calculate your crypto taxes, you will be able to view your mining income for every year converted to SEK. You can find this on the Tax Report page and in the downloadable PDF.

Below we will guide you through filling out the T2 when using Skatteverkets online portal.

-

Log in to Skatteverkets online portal with BankID.

-

Navigate to Bilagor > Inkomst av hobby, internetinkomster m.m. (T2).

-

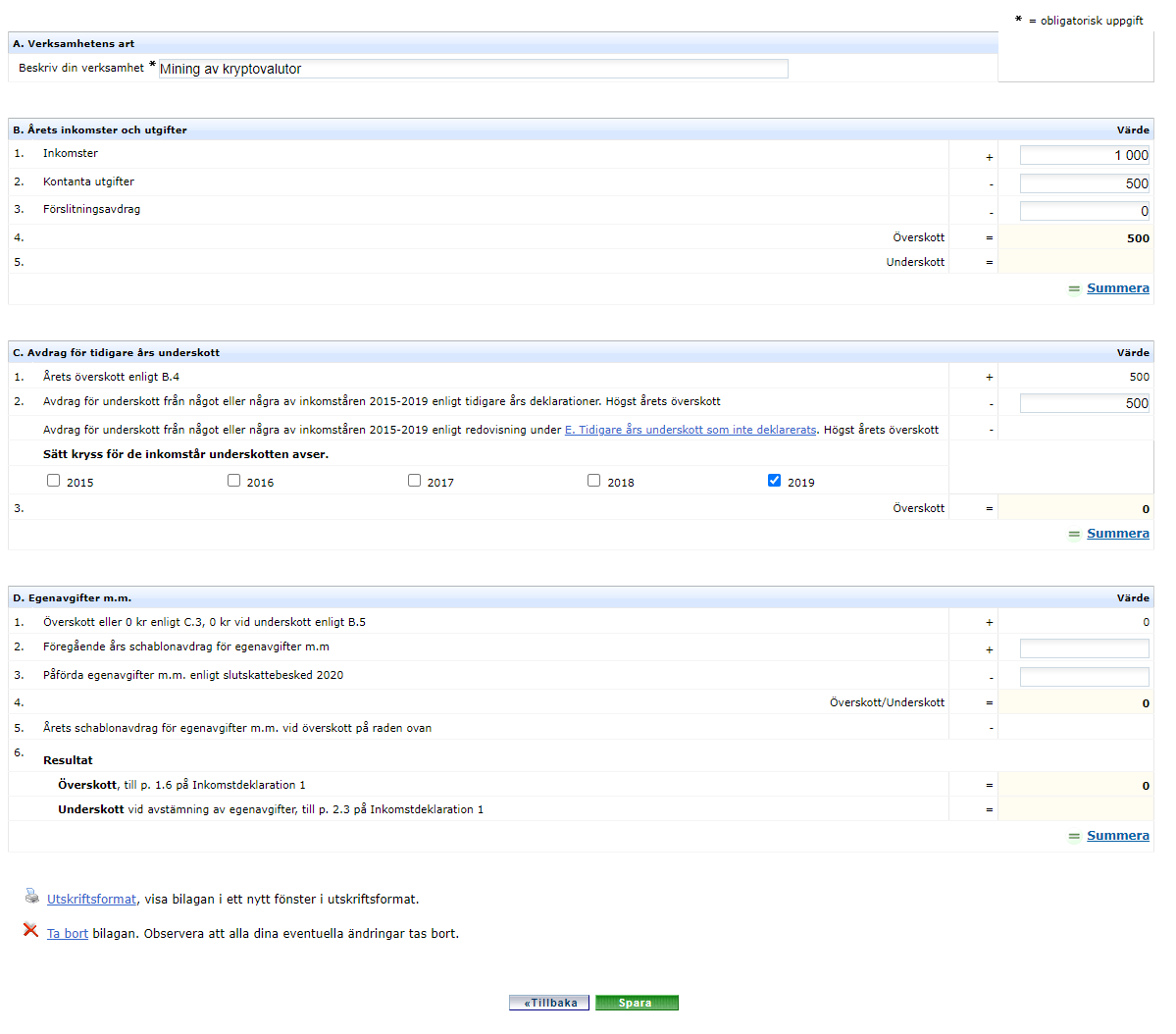

In Section A type “Mining av kryptovaluta”.

-

In Section B input your mining income for the tax year in Inkomster. Input any mining expenses incurred during the tax year in Kontanta utgifter. Input any depreciation related expenses in Förslitningsavdrag. Click Summera.

-

In Section C input whether you want to deduct mining losses from previous years in row 2. Select which year or years the mining losses come from that you wish to deduct. Remember you can’t deduct more than you received in income during the current tax year. Click Summera.

-

In Section D input whether you had a Schablonavdrag last year and egenavgifter in row 2 and 3. Click Summera. If you did not report mining profits for the previous year you can skip this step.

We hope you found this guide useful. We also have a longer article available if you are looking for a comprehensive guide on crypto taxes in Sweden. Good luck with your mining!

Any tax-related information provided by us is not tax advice, financial advice, accounting advice or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN