What is Kvarn X?

Kvarn X is a fully regulated digital asset brokerage and investment company, supervised by the Finnish Financial Supervisory Authority (FIN-FSA). They specialize in providing advanced investment solutions for digital assets, catering to both individual and institutional investors. Known for their transparency, reliability, and innovative approach, Kvarn combines experienced professionals with scalable, secure technology to deliver high-quality services.

Kvarn X and Divly are partners!

Kvarn X and Divly have worked together to create a solution tailored for Kvarn X users to simplify their tax declaration. As an added benefit, if you are a Kvarn X customer that is looking to automate your crypto taxes, then you will enjoy a 20% discount with Divly. Simply enter the discount code provided by Kvarn X to claim your discount.

Step 1: Calculate Your Gains and Losses

To calculate your gains and losses, you'll need access to your entire trading history on Kvarn X. You can then calculate your tax obligations manually, with a tax professional, or by using a crypto tax tool such as Divly. If you plan to use Divly, simply upload your Kvarn X transaction history, and Divly will handle the calculations for you.

File import

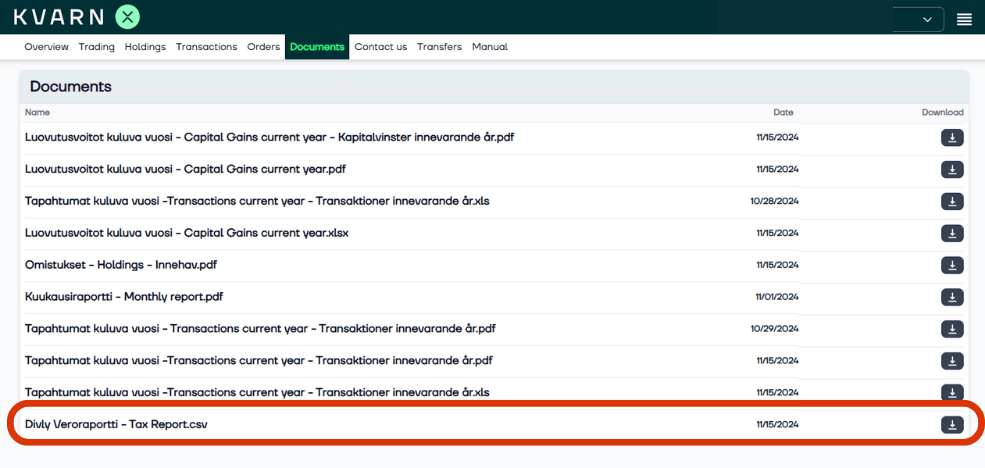

You can import transactions from Kvarn X into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

You can import transactions from Kvarn X into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

- Sign in to Kvarn X.

- Click on Reports in the navigation bar at the top of the platform.

- Download the file named Divly Veroraportti - Tax Report.csv. If you have traded on KvarnX for multiple years, you may need to download one file for each year.

- Drag and drop the CSV file into Divly. Divly will import the transactions and calculate your taxes.

Step 2: Declare to the Tax Authority

After uploading your transaction history to Divly, Divly will provide you with a report you can use for your declaration. Divly also provides clear instructions on how to declare and any necessary attachments for your declaration.

A great place to start is to read our crypto tax guide for your country. Check the last section about how to declare to the local tax authority for details.

Alternatively sign up to Divly and purchase a tax report with all the information provided to you in a nice package! If you are lost feel free to follow our Getting Started guide.

Will the tax authorities know if I own cryptocurrencies?

Currently, the tax authorities do not have direct access to the details of your account or transaction histories on Kvarn X. However, a major change is expected with the introduction of the European Union's DAC8 directive, which will take effect in January 2026.

According to this directive, crypto asset exchange platforms like Kvarn X will be required to share their European clients' information with EU tax authorities. This measure aims to strengthen transparency and tax cooperation in response to the decentralized nature of crypto assets.

Therefore, it’s crucial to be proactive and start declaring your cryptocurrency transactions now to avoid potential penalties once DAC8 comes into force.

To help you correct any errors or omissions in your cryptocurrency tax return, we recommend consulting this helpful guide.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN