Today we will teach you everything you need to know for your crypto taxes in Germany. We've compiled this summary of the newly established regulations by the BMF as well as how they would apply to you. Let's see what we'll be covering in this guide.

-

Important dates

-

How cryptocurrencies are taxed

-

Tax Exemptions

-

When do you pay tax on cryptocurrency

-

How does the BZSt know about my cryptocurrency

-

What happens if I do not pay cryptocurrency taxes

-

-

How to save money on cryptocurrency taxes

-

Detailed information about different transaction types

-

How to submit your tax report to BZSt

This guide will be updated and maintained regularly to account for changes made by the BMF and BZSt. It has recently been updated to include “Einzelfragen zur ertragsteuerrechtlichen Behandlung von virtuellen Währungen und von Sonstigen Token” which was published in May 2022.

Suppose you find any errors or outdated information. In that case, it is greatly appreciated that you let us know by sending an email to [email protected] or via our support chat at the bottom right corner of our website.

Important dates 2026

The important dates for your cryptocurrency taxes are as follows:

January 1st - The online tax portal ELSTER (ELektronische STeuerERklärung) opens

July 31st - The deadline to fill in crypto in your tax declaration. For crypto, you should be prepared to fill in Anlage SO and, depending on your activity Anlage KAP. We will review each transaction type and where it should be declared throughout this guide.

How are cryptocurrencies taxed in Germany?

How much are taxes on cryptocurrency?

Cryptocurrency trades are private sales transactions. Therefore, your profits are subject to your income tax rate of up to 45%. If you've made over €600 in profits from cryptocurrencies acquired within a year of the sale, then you have to pay taxes—other than trades, you will also be taxed on crypto earned from mining, staking, and lending.

Exemptions from Crypto Taxes

€600 exemption limit on crypto profits

You have a €600 exemption limit on crypto profits. Therefore, you will not be taxed if you have made less than €600 in profit from private sales transactions. However, if you surpass the €600 threshold, you have to pay taxes over the entire amount.

Private sales transactions do not only include crypto but can also include things such as art or cars. You can carry losses forward to offset gains on private sales transactions.

12-month holding period

You do not have to pay taxes on cryptocurrency you hold for more than a 12th month period.

€256 exemption limit on crypto income

Other services such as mining, staking, and airdrops have a combined €256 exemption limit. Therefore, if you surpass the €256 limit you have to pay taxes over the entire amount.

Buying & Transferring crypto

If you buy and hold cryptocurrency you are not taxed. If you send crypto between your own wallets you are also not taxed.

When do you pay tax on cryptocurrency

You should pay cryptocurrency taxes when you perform the following transactions and have surpassed your relevant exemption limits

-

Sell crypto

-

Trade crypto

-

Participate in an ICO

-

Purchase goods or services

-

Pay trading fees

-

Mine crypto

-

Stake crypto

-

Lending crypto

-

Receive an income in crypto

-

Receive margin or futures trading income

Personal Income Tax Rate

Most of your cryptocurrency income is subject to your personal income tax rate. In these situations, you will have to fill in Anlage SO.

| Single Taxpayers | Married Taxpayers | Tax Rate |

|---|---|---|

| Up to €11,604 | Up to €23,208 | 0% |

| €11,604 - €66,760 | €23,208 - 133,520 | 14-42%* |

| €66,760 - 277,825 | 133,520 to €555,650 | 42% |

| More than €277,825 | More than €555,650 | 45% |

Capital Income

If you've participated in margin trading, you will also have to pay capital gains tax. You will have to declare your margin trading in Anlage KAP. Capital income from cryptocurrency is taxed at a 25% flat rate.

Calculating profits on Crypto Transactions

To determine your profit or loss on crypto transactions, you should evaluate the transaction's revenue and costs. If you're using a cryptocurrency tax calculator such as Divly, then Divly will do these calculations for you.

Calculating the Revenue on a Crypto Transaction

If you sell cryptocurrency for euros, then calculating the revenue will be fairly straightforward. In this case, the revenue is the euro value received.

If you trade cryptocurrency for another cryptocurrency, then you won't have an easily accessible euro value to determine your revenue. In the case of a crypto-for-crypto trade, you should use the market value of the received cryptocurrency in euros on the date of the transaction. If such a value is not available to you, you may use the market value in euros of the currency you sold.

You can use the value on reputable exchange platforms or a web-based cryptocurrency market data aggregator such as Coinmarketcap.

Example: Handling Small Cryptocurrencies

This example illustrates how to calculate the revenue from trading a major cryptocurrency for a smaller, less-known one when reliable pricing information is not available:

| Transaction Type | Crypto Amount | Crypto Name | Value in Euros |

|---|---|---|---|

| Trade Out | 1 BTC | BTC | €19,500 |

| Trade In | 10 million CATVERSE | CATVERSE | - |

On 29-09-23, you traded 1 BTC for 10 million CATVERSE. Since CATVERSE is a smaller cryptocurrency you were unable to find reliable daily price information, therefore you use the price of the sent currency (BTC) to determine the transaction's revenue. The value of 1 BTC on that date was €19,500, which is therefore taken as the revenue for this trade.

Revenue from Transaction = €19,500

If you purchase a good or service using cryptocurrencies, the revenue should be the agreed-upon fee in euros for the good or service. If no such amount is agreed on, the value of the cryptocurrency at the time of the transaction should be used.

If you receive a cryptocurrency, such as through mining or staking, you will have to determine its market value at the time you receive the cryptocurrency. This amount should be declared to the BZSt.

Calculating the Costs on a Crypto Transaction

In Germany, you should use the first-in-first-out (FIFO) method to determine your acquisition costs. The FIFO method states that the first sold cryptocurrency should be the first one bought. Essentially FIFO determines the order in which you sell your cryptocurrency.

FIFO Method in Crypto Transactions

Let's explore how the FIFO (First In, First Out) method applies to cryptocurrency transactions.

| Transaction | BTC Amount | Transaction Value (€) |

|---|---|---|

| Purchase | 1 BTC | €1,000 |

| Purchase | 1 BTC | €10,000 |

| Sale | 1 BTC | €20,000 |

In this scenario, you initially purchased one Bitcoin for €1,000 and later bought another Bitcoin for €10,000. When you sold one Bitcoin for €20,000, using the FIFO accounting method, the first Bitcoin purchased (for €1,000) is considered the one sold. This method leads to a profit calculation as follows:

Profit = €20,000 (Sale Price) - €1,000 (First Purchase Price) = €19,000

You can also subtract any fees used to facilitate transactions as costs. This includes, for example, trading fees. If you are mining cryptocurrency, you can also deduct relevant expenses from your mining profits.

How does the BZSt know about cryptocurrency?

The tax authorities may request information from you or exchanges to discover your cryptocurrency activity. Because of crypto's digital ledger technology, the tax authorities can also track your transactions outside of exchanges.

"Unlike other forms of fraud in fiat, with cryptocurrency in the blockchain… there's a record… and that transparency and speed of accessing that record globally, make investigations of these types of fraud accelerate over traditional finance. "

---Gurvais Grigg, Former FBI Assistant Director, and Chainanalysis CTO

As the government's efforts to track cryptocurrency transactions increases, the likelihood that the government will become aware of your cryptocurrency activities increases as well. At such a point that you are discovered not to have paid taxes on your transactions, then you could be fined by the government. It is, therefore, essential to start tracking and declaring your cryptocurrency as soon as possible.

What happens if you do not pay taxes on cryptocurrencies?

Cryptocurrency tax evasion is a serious matter. If you are guilty of breaking tax evasion laws, you may be fined or face imprisonment for up to 10 years for significant offenses. If you deliberately attempt to avoid taxes and large sums of money are involved, then you are more likely to face a more severe penalty.

You may avoid penalties if you voluntarily declare and pay your tax liabilities. To avoid penalties, you should resolve issues before an investigation is opened into your cryptocurrency activity.

Cryptocurrency tax classifications

Most cryptocurrency transactions are seen as private sales transactions (23 EStG). However, depending on your activity, your crypto income can also be classified as income from commercial operations (15 EStG), income from employment (19 EStG), income from capital assets (20 EStG), or other income (22 EStG).

Detailed information on different transaction types

Certain transactions trigger the types of taxation listed above differently. Below is a master list for your reference; we will go through each in detail in this guide. Each transaction has an associated tax classification and the corresponding label in Divly for those using our service to automate their tax reporting.

| Transaction Type | Tax Classification | Divly Label |

|---|---|---|

| Buy Crypto | Not taxed | Buy |

| Sell Crypto | Income Tax | Sell |

| Trade Crypto For Crypto | Income tax | Traded Crypto |

| Initial Coin Offering (ICO) | Income Tax | Traded Crypto |

| Purchase Goods & Services | Income Tax | Goods/Services |

| Pay Trading Fee with Crypto | Income Tax | Fee Included in Trade |

| Pay Transfer Fee with Crypto | Income Tax | Fee Included in Transfer |

| Transfer Crypto Between Your Wallets | Not taxed | Transfer |

| Lost or Stolen Crypto | Not taxed/Not deductible | Lost/Stolen |

| Give Crypto as a Gift | Not Taxed | Gifted Away |

| Receive Crypto as a Gift | Not Taxed | Received Gift |

| Donate Crypto | Not Taxed | Donation |

| Airdrop | Not Taxed* | Airdrop |

| Hard Fork | Not Taxed* | Fork |

| Mining | Income Tax* | Mining |

| Staking | Income Tax* | Staking Reward |

| Income (e.g. freelancing, salary) | Income Tax | Income |

| Lend out crypto | Income Tax | Interest Received |

| Margin Trading | Capital gains tax | Realized Profit/Loss |

| Trade/Mint NFT | Income Tax | In progress, not yet available |

Buy Crypto / Buy Crypto with Fiat

There are no taxes involved when buying crypto. However, you need to ensure that you keep track of the price you paid for it for your cost basis calculation. Furthermore, you should keep track of the date you purchased your crypto, as its sale will be tax-free if done outside the one-year holding period.

You can add the trading fee to the cost basis when buying crypto. Adding the trading fee will help reduce your taxes

Example: Trading Fees On Purchase

Consider this trading fee example:

- Purchase: 1 ETH for €1,000

- Trading Fee: €10

- Total Cost Basis: €1,000 + €10 = €1,010

By adding the €10 trading fee to the purchase price, the cost basis for the 1 ETH becomes €1,010. This adjustment ensures that when you sell the ETH, the profit calculated will be €10 less than it would have been without accounting for the trading fee, thereby reducing your taxable gain.

Sell Crypto / Sell Crypto for Fiat

Profits from the sale of cryptocurrencies that were held as private assets are taxed if the period between the acquisition and the sale is not more than one year. The profits are tax-free if the profits on the sale from private sales are less than 600 euros. If your profits from private sales are over the 600 euro tax-exempt amount, then you will have to pay taxes over the entire amount.

The profit or loss from the sale of cryptocurrencies is calculated from the sale proceeds minus the acquisition costs. Acquisition costs also include any fees incurred in acquiring the crypto asset. This will help decrease your tax burden once you sell.

Trade Crypto for Crypto

Trading crypto-to-crypto as a private sales transaction is subject to income tax in Germany. Therefore you are taxed if you trade cryptocurrency that has been held for more than one year. If you make a profit of more than €600 on these transactions, you are taxed on the entire profit amount.

The market price of the received crypto asset at the time of the trade is used to determine sales proceeds. If this market value cannot be determined, then it is acceptable to use the market value of the units sent out instead.

Initial Coin Offering (ICO)

An ICO is a way for blockchain companies to raise funds by selling tokens to potential investors. When you invest your crypto (usually Ethereum) in a new project, you are provided a token for that project.

Participating in an ICO works just like trading crypto for crypto. You will pay taxes if you sell the received tokens within a year and make more than €600 in profits.

Purchase Goods & Services with Crypto

When you purchase a good (e.g., a new computer, amazon gift card) or service (e.g., VPN service) using crypto, you must pay income tax on any gains as a result of disposing of your crypto. The gain must be calculated using the agreed-upon remuneration for the goods in euros. If there isn't such an agreement, then the market value of the cryptocurrency is used instead.

Pay Trading Fees in Crypto

Typically, when you trade crypto for crypto, you will also have to pay a trading fee in crypto. If you held the crypto you used for the fee for less than one year, you must pay taxes over its increase in value since the acquisition.

Transfer Crypto Between Your Own Wallets

Transferring crypto between your wallets is not a taxable event (this includes sending crypto to your account on an exchange). You must track these transfers properly to avoid paying unnecessary taxes!

Lost or Stolen Crypto

In Germany, you cannot claim privately held assets that were stolen as a loss. You can only deduct assets involved with business operations that were stolen if the cause is business related.

However, as stolen crypto is not a sale, you also do not realize a gain or loss on the disposal of the asset.

Give Crypto as a Gift / Receive Crypto as a Gift

Whether and how much taxes you pay on gifts depends on your relationship with the donor or donee, as well as the value of the gift. The tax-free exemption limit ranges from €20,000 for friends and siblings to €500,000 for spouses. The value of the gift is the fair market value on the date the gift is received.

The gift tax rate varies between 7% and 50% on the amount of the gift's value above the tax exemption limit. The tax exemption limits are applied over the previous 10-year period. Therefore, if you've accumulated €22000 in gifts during the last ten years from a sibling, then you are taxed on the €2000 above the €20,000 exemption limit.

For a full bracket of tax-free allowances, you can visit this page.

Donate Crypto

Donations up to 20% of your annual income are tax-exempt if made to eligible charities. You can carry donations over 20% forward. Donations made can be entered in Anlage Sonderausgaben. However, there are no specific guidelines regarding donations made in crypto. Therefore, if you plan to make a donation in crypto to an approved charity, we recommend that you contact a tax lawyer.

Airdrops & Bounties

An airdrop is typically considered a gift from the token holder or blockchain. Airdrops are usually a very small or negligible amount. Airdrops and bounties are seen as two different things in Germany. An airdrop is received without performing any service. Examples of services include mentioning the project on social media or providing personal data beyond the minimum required to receive an airdrop. If you provide a service, the remuneration received is classified under § 22 of the EStG, and is therefore considered other income. In Divly these are considered bounties .

An airdrop will be subject to gift tax regulations if the recipient provides no service.

For both bounties and airdrops, income or gift amount is recognized to be the market rate at the time of acquisition. If no such market rate exists, then they can be valued at €0.

If you sell your received airdrop/bounty within a 12-month period, it is subject to personal income taxes.

Hardfork

A hard fork occurs when the blockchain splits. In that case, you are given crypto based on your ownership of the forked cryptocurrency. You do not realize an income when a hard fork occurs. Instead, you will be taxed once you sell the forked crypto within a year of the purchase date of the original asset. Essentially the crypto received through the fork inherits the cost basis of the original asset.

If no value can be attached to the new blockchain, then the cost basis is set to 0, and the original asset keeps its entire purchase price as its acquisition cost.

Mining & Staking

Mining and staking rewards may be seen as income from commercial activities or as other income ( § 22 of the EStG). Whether your income has arisen through commercial activities depends on whether your actions classify as a commercial enterprise. We cover this aspect in a bit more depth in our staking tax guide. Generally, participating in a staking pool is considered as other income.

Your mining and staking income is valued at the time of acquisition. Your other income from mining and staking is exempt from taxes as long as you earn less than €256 in a year.

Lending your crypto

Income from lending crypto is taxable according to § 22 of the EStG. Therefore any units of a crypto asset received as compensation for lending out crypto is seen as income. The value to be declared corresponds to the market value at the acquisition time.

Margin & Futures Trading

Margin trading involves borrowing to take leveraged positions on crypto. Often the outcome of the trades is provided as realized profit or loss after margin fees are accounted for. Margin and futures transactions are seen as capital income and taxed at a flat rate of 25%. You must enter your net realized profits or losses in Anlage KAP.

Income From Employment

Crypto earned from employment free of charge or at a reduced rate is taxable. Your wages include all income to the employee from an employment relationship. It is irrelevant in what form this income is received. Therefore it can still be considered income if you earn cryptocurrency.

Income is earned when the employee has received the cryptocurrency and can dispose of it. A promise by the employer to provide the crypto in the future is insufficient to recognize income.

If you receive the awarded crypto at a discount, then taxes must be paid over the difference between the market value of the received crypto and the amount paid to receive the crypto.

NFT

The BMF has not provided concrete regulations for the trading of NFTs. However, as with cryptocurrencies, NFTs are likely seen as "other economics goods," and sales would be private sales transactions. Therefore, you will be taxed on the sale of NFTs if held for less than a year, and your profits on private sales transactions are under €600.

There is also a lack of regulation regarding the minting/creation of NFTs. Your income may be seen as income from artistic or commercial activity. Which income type applies to you is very situation-specific, and it is best to contact a crypto tax lawyer to help you make the determination.

We will update this guide as crypto tax regulations develop.

Using a cryptocurrency tax calculator for your taxes

Because of the tedious and time consuming nature of doing your cryptocurrency taxes by hand we suggest using a cryptocurrency tax calculator such as Divly.

Divly is a cryptocurrency tax calculator built around BMF’s guidance. Simply sync your trading history from your wallets & exchanges with Divly, and Divly will do the calculations for you.

How to submit your tax report to BZSt

Once all the tax calculations are done and BZSt's tax portal is open, it is time to declare your taxes before the deadline in July. Depending on which transactions you've performed, you may have to fill in Anlage SO, Anlage KAP, and in some cases, Anlage G, Anlage Sonderausgaben, or Anlage N. A quick summary of each is provided below as well as what needs to be declared in each.

Anlage SO (Sonstige Einkünfte/Other Income)

Anlage SO is used to declare other income. Most of your crypto activity will have to be declared in Anlage SO. This includes any capital gains and losses incurred as a result of private sales transactions. Your mining, staking, or lending income may also be reported here if they do not qualify for commercial activities.

On the Anlage SO, you can report your gains or losses incurred on crypto transactions in line 49, box 116. In Line 44, you can enter your selling prices, and in line 45, the acquisition costs. If you are using the online tax portal ELSTER then line 49 should be calculated automatically.

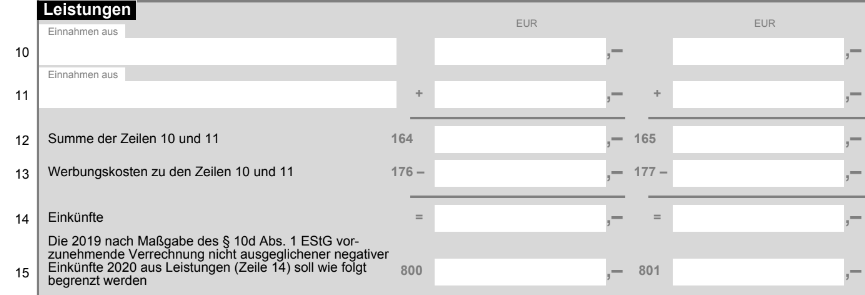

You must report other income not earned from commercial activities such as mining, lending, staking, or masternodes under Leistungen (Services). Here you must declare where your income is coming from and the total amount in the corresponding box on line 10. You must then combine this income with your income from services and enter that sum in line 12, box 164. Finally, after deducting related expenses, you should write the final amount in line 14.

Anlage KAP

Anlage KAP is used to declare income from capital gains. You should declare any income you earn from margin trading in Anlage KAP.

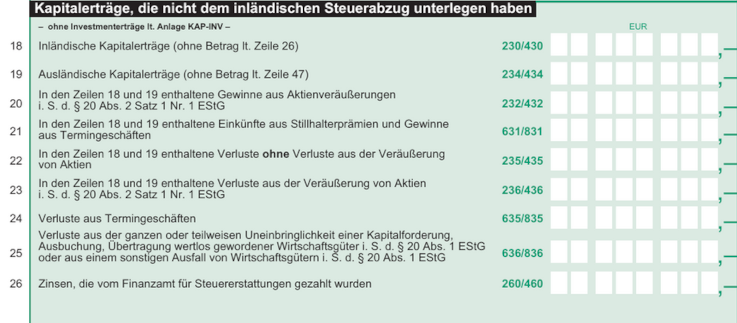

Your net income from margin trading should be entered in line 19 for foreign investment income unless earned on a german exchange. You must then enter the overall income earned on margin trading in line 21. Losses and fees incurred from margin trading are entered in lines 22 as well as 24.

Anlage N

Any crypto income from employment should be reported in Anlage N. Income from non-self-employed work (§ 19 EStG) includes all remuneration and benefits that are granted for employment. It is irrelevant whether the payments are ongoing or one-off (Section 19 (1) sentence 2 EStG) or whether they are money or benefits in kind.

Anlage G

Any crypto earned from commercial activities needs to be reported in Anlage G.

Anlage Sonderausgaben

Donations made in crypto need to be reported in Anlage Sonderausgaben.

—---------

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN