Once those staking rewards start piling up, you must eventually face the harsh truth that the Federal Central Tax Office(BZSt) has come looking for its share. The Federal Ministry of Finance (BMF) released new guidelines for crypto taxation in May 2022. These guidelines have also provided a lot of clarification for staking taxes.

The most important things to know from the guidelines on staking taxes in Germany are:

-

You pay staking taxes at your personal income tax rate of up to 45%.

-

You are tax-exempt on staking income if you earn less than 256 euros.

-

You pay taxes over the value of your staking rewards on the day you receive them.

-

The tax-free holding period for staking rewards is one year instead of ten years.

-

You should declare your staking income in Anlage SO.

We will cover each of these points in greater detail below.

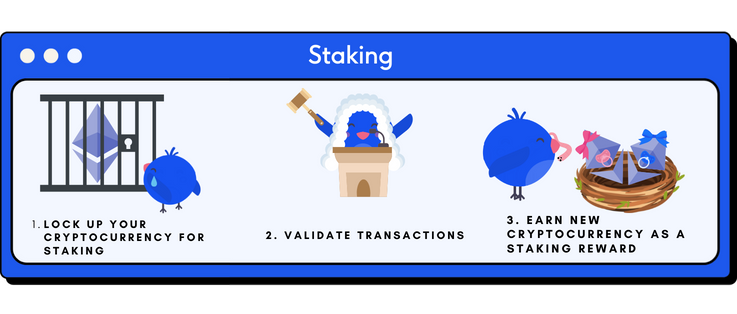

What is Staking?

Staking (Proof-of-Stake) is when users lock up their crypto assets to help validate transactions and add new blocks to the blockchain. For the blockchain to work, these functions are essential. Therefore, in return for performing these functions, stakers earn staking rewards based on the number of tokens staked and the amount of time they have staked. To the staker, the process is similar to putting money into a savings account and earning interest.

The original model for creating new coins is mining (Proof-of-Work). Proof-of-Work facilitates the creation of new blocks through the energy-intensive solving of complex mathematical algorithms. POW is the mechanism used by Bitcoin. POW has been criticized for the energy it requires to mine. According to the Cambridge Bitcoin Electricity Consumption Index, the annual electricity consumption for Bitcoin is 4/5th the size of the entire electricity consumption in the Netherlands.

A study by researchers at the University of London suggests that POW may require 1000x more energy than some of the more intensive POS mechanisms, even under favorable assumptions! Furthermore, staking energy requirements were more in line with and had the potential to be below traditional transaction-validating methods such as VisaNet.

Due to the energy concerns, It is no wonder that many blockchains are making the switch to Proof-of-Stake. The second largest cryptocurrency, Ethereum, just switched from Proof-of-Work to Proof-of-Stake. But such a large cryptocurrency switching to POS doesn’t only have an impact on electricity consumption. Tax questions for those who stake cryptocurrency also come into play.

How much are taxes on staking?

Receiving staking rewards is tax-free if you earn less than €256. If you earn above €256, you are taxed on the total amount. Your income from receiving and selling staking rewards is taxed at your income tax rate of up to 45%.

When is staking taxed?

In principle, you are taxed twice for staking. Once when you receive the staking rewards, and then again when you sell your staking rewards. You should declare your staking income by July 31st of the following year.

When you receive new staking rewards, you should declare their market value to the BZSt. As staking rewards occur so frequently, keeping track of your staking income transactions can become difficult without a cryptocurrency tax calculator.

When you sell staking rewards at a profit, you earn income on private sales transactions. You must pay taxes on the increases in value between the acquisition and sell dates. If you sell your received staking rewards as soon as you receive them, your staking rewards will not have increased in value, and selling them will be tax-free.

The crypto crash has not been kind to most crypto investors. The total crypto market cap crashed from $4.7 trillion to $1.4 trillion between November 2021 and July 2022. When you sell staking rewards at a loss, you can deduct losses from your private sales transaction income, including cryptocurrency income. You can also carry back losses to the preceding year and future years.

When are staked coins tax-free?

Your income from earning staking rewards is tax-free if you earn less than €256 from staking, mining, and cryptocurrency lending.

Until recently, the tax-free holding period for staking rewards was ten years. BFM’s updated guidance has brought staking rewards in line with other cryptocurrency transactions. Therefore, the sale of staking rewards is tax-free if you hold them for longer than one year.

Am I taxed as a business or as a private individual?

Sometimes, your staking activity is a commercial operation instead of private activity. If you are participating in a commercial activity, you must also pay a trade tax. Whether income from staking is seen as a commercial activity depends on whether a few requirements are met.

-

The activity must be an independent, sustainable activity.

-

The activity must be approached with the intention of generating income and is suitable for profit generation in the long term.

The independence of a person participating in a staking pool may be questioned. Stakers generally lock up their cryptocurrency for a period of time, meaning they cannot access them. Thereby, they lose the ability to dispose of their cryptocurrency. On the other hand, staking is a repeatable activity with the intention of generating income.

The BFM identifies two types of people involved in staking but acknowledges that the terms are usually used interchangeably. They refer to the “forgers/validators” and “stakers/staking participants”. The forgers are involved in block creation. Participants in a staking pool are allocated rewards by the forgers. Stakers only provide a stake and do not take over block creation.

If you merely stake cryptocurrency on a platform such as Coinbase or Kraken, or join a staking pool, this is usually seen as private asset management. Therefore, you would be taxed as a private individual.

Because of the nuances involved, we recommend contacting a tax lawyer if you are uncertain about your specific situation.

Staking tax examples

Earn Staking Rewards

Mia wants to earn some passive income and noticed a profitable staking opportunity on Binance Earn. She decides to stake her 400 BUSD at an APY of 4%. She has to lock up her BUSD for a period of 120 days.

Mia earns 16 BUSD from her staking activity. Because she is participating in private asset management and earns less than 256 euros from staking, she does not need to pay taxes on her staking rewards.

Sell Staking Rewards

Emil has received SOL staking rewards valued at €300. He has already declared all of the €300 in Anlage SO. However, before a 12-month holding period was up, Emil decided to sell all of his staking rewards as the value of his SOL increased heavily. Emil sold his staking rewards for €1000. Therefore his profit on the sale is €700. Because he has made a profit of over €600 from private sales transactions, Emil will have to pay taxes over the entire profit amount of €700.

How do I declare my staking income to the BZSt?

We recommend using a cryptocurrency tax calculator to keep track of your staking income as well as any other cryptocurrency activity you may have. Divly is a cryptocurrency tax calculator made for Germany and supports staking taxes. You can read more about how Divly works for Germany on our product page.

Once the calculations are complete, you can fill in Anlage SO on BZSt’s online tax portal. You must report other income from mining, lending, staking, or masternodes under Leistungen (Services) if they total over €256.

On your Anlage SO under Leistungen, you must declare your staking income as follows.

-

Einnahmen aus: Enter the source of your income. If your income is more complicated, you may want to provide an attachment such as the Divly tax report and note “sie anlage” here.

-

Line 10: Your total staking income from the year. You may use line 11 if you have other income to declare here.

-

Line 12: Sum of line 10 and 11.

-

Line 14: If you have any advertising-related expenses for your other income, you should deduct this from Line 12 and enter the net amount here.

If you sell staking rewards within a year, you will also have to pay taxes on their value increase. You can read more about the tax treatment of selling cryptocurrency in our crypto tax guide for Germany which we will release shortly.

If you sell staking rewards within a year, you will also have to pay taxes on their value increase. You can read more about the tax treatment of selling cryptocurrency in our crypto tax guide for Germany which we will release shortly.

—---------

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN