Crypto taxes on eToro: You’re in the right place

Filing cryptocurrency taxes can feel overwhelming. The regulations are unclear, and official guidance often fails to answer all the important questions.

Meanwhile, tax authorities are gaining more and more access to data from crypto platforms, including eToro. A growing number of exchanges are now required to share information about your transactions.

That’s exactly why Divly exists. We created a tool that guides you step-by-step through filing your taxes in full compliance with local regulations, without the stress or uncertainty. In this guide, we’ll show you exactly how to report your transactions made on eToro.

What transactions are taxable on eToro?

This can depend on the asset type you have been trading (crypto, stocks, CFDs, etc). It is true regardless of whether it is a copy trade or a transaction your decided to make proactively.

The following is a list of transactions on eToro that explains how a typical tax authority will view them.

- Buying Crypto: Generally, purchasing cryptocurrency isn't a taxable event. However, it's crucial to record the purchase price. This information is key for accurately calculating potential profits or losses when you decide to sell.

- Selling Crypto: In most countries, selling cryptocurrency is typically a taxable event, with few exceptions.

- Trading Crypto-to-Crypto: Many countries mandate declaring taxes on the crypto you dispose of during such trades. Nonetheless, there are exceptions, like France, where this might not be required.

- CFDs: Contracts for Difference are often taxable when they are closed and a profit or loss is realized. The underlying instrument is less important when it comes to how to declare the outcome.

- Staking: Staking rewards are usually taxable. The tax is computed by summing up the total value of the staked assets in your local currency over the year.

- Dividends: Like staking, earning dividends is typically a taxable event. The total value of interest earned throughout the year, converted to your local currency, is used for tax calculations.

- Withdrawals & Deposits: Moving funds between wallets or exchanges you own is generally not taxable. However, if transaction fees are paid in cryptocurrency, that could constitute a disposal event for the amount of the fee.

- Receiving Airdrops: Obtaining crypto through airdrops is often not taxable in itself, only when you decide to dispose of the airdrop. However, this can differ quite a bit between jurisdictions.

Although the above are guidelines, to be more informed ensure to read the crypto tax guide relevant to your country and jurisdiction.

How to export your eToro transaction history

To determine if you need to declare taxes on your crypto transactions, it's essential to gather all your transaction data first. For eToro users, the most efficient method is to download the platform's xlsx file, which contains all the necessary transaction details for tax calculation purposes.

File import

You can import transactions into Divly by downloading and importing a XLSX file. Make sure to download the XLSX file every time you want to include the latest transactions.

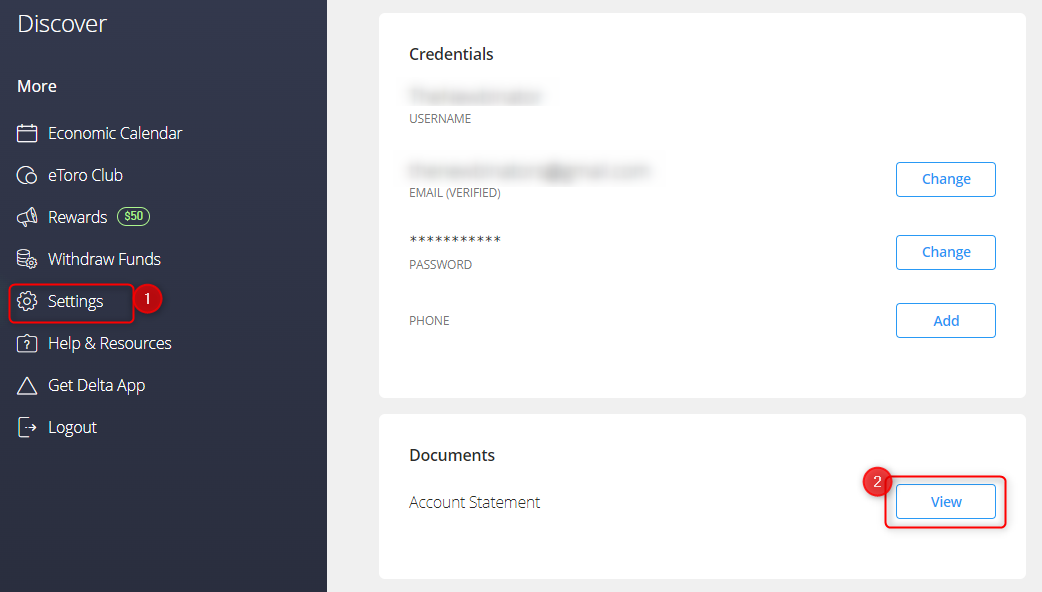

- Sign in to eToro.

- Click on the Settings in the sidebar.

- Click on the box Account.

- Next to Account Statement, click the button View.

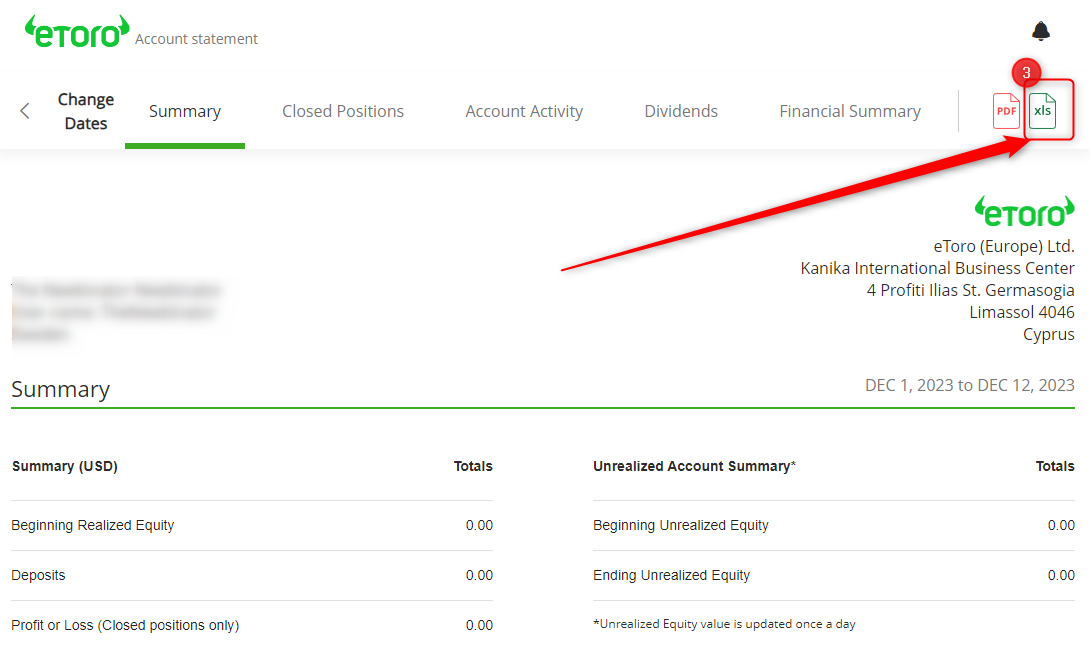

- Select the time frame so it includes ALL your transactions, then click Create.

- In the top right corner, click the xls icon. The file will download.

- Upload the XLSX file to Divly. Divly will import the transactions and calculate your taxes.

How to calculate and declare your eToro taxes (including crypto)

Calculating your crypto taxes can be a complex task. While you can manually calculate them using Excel, it’s often more efficient and accurate to seek professional help. Tax lawyers offer expert advice but can be costly. Alternatively, a crypto tax platform like Divly provides a self-service option that is significantly more affordable (see pricing).

After importing your transactions from eToro and other wallets or exchanges using the earlier mentioned method, Divly automatically calculates your taxes according to the specific rules of your country. Divly imports cryptocurrency transactions and CFDs from eToro.

To complete the process, download your tax report from Divly, which includes detailed instructions for declaring your taxes. Explore sample reports from various countries supported by Divly, guiding you through the declaration process from start to finish.

Does eToro report to the tax authority?

If not already, they will be reporting information on your trading activity soon. Particularly relevant for EU citizens in light of the upcoming DAC8 directive, which mandates exchanges offering crypto to report EU client information to tax authorities starting January 1, 2026.

If you’ve neglected to declare crypto taxes in previous years, it’s not too late to address this. Proactively declaring can prevent future penalties, By uploading your past transactions to Divly, you can access tax reports for all previous years. It’s an excellent opportunity to rectify any past undeclared taxes.

Seeking Help and Assistance with Taxes

For queries, consider contacting your local tax authority or hiring a tax lawyer for personalized advice, though this may involve additional costs.

Divly’s team is also ready to assist you. Reach out to our support team through the online chat on our website’s bottom right corner for any help or guidance. Wishing you the best in your tax journey!

Why is Divly the best choice for eToro taxes?

Why is Divly the best choice for eToro taxes?

Divly is built specifically for each country with a focus on accuracy. Unlike generic tools, we automatically generate the compliant, localized tax report you need for your country. We handle all the complex local rules of your local tax legislation so you don't have to.

-

Fast Import: Fast import of eToro transactions that combines with your other wallets/accounts.

-

Accurate Calculations: Accurate calculation of your taxes with gains/loss and the right cost method (e.g. FIFO).

-

Local Tax Report: Simple download of local tax report with guide on how to declare in your country.

Frequently asked questions (FAQ?)

Yes, in most countries you are required to pay taxes on crypto. For more details see your country-specific crypto tax guide.

Crypto typically incurs a capital gains tax in the majority of jurisdictions. This means you need to pay taxes on the difference between what you bought crypto for and what you sold it for (minus fees).

If you received crypto through other methods (e.g. salary), methods like income tax will apply.

Yes, you can use Divly to declare crypto taxes for previous years that you missed. In many countries you can self-report mistakes and not get penalized for it.

Divly provides localized guides on how to fix previous years for many of our supported countries.

It is a criminal offense to not pay your taxes. It is also difficult to avoid since crypto transactions are recorded publicly on the blockchain and exchanges have been forced to hand over information to local tax authorities.

Yes, you need to file a tax report even if you lost money. The good news is that by filing your losses you may be able to reduce your taxes.

Divly is a premium service to help people calculate and submit their crypto taxes. We use industry standard practices to secure your data.

- We do not sell your information to third parties such as other companies or government agencies.

- We do not perform any KYC. Divly only requires an email address and your pseudonymous crypto transactions to generate your taxes.

Feel free to use a temporary email / protonmail. You can also delete all your transactions and synched wallets at any time.

Yes. You can safely ask your accountant to create and manage a new Divly account for you, or invite them to see and/or edit your existing Divly account. Divly provides accountants with a special feature to manage multiple clients with crypto.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN