This guide is written to help users understand how to do their TradeOgre taxes. It is intended for anyone having used the TradeOgre platform and needs to pay their taxes for the current tax year and/or prior tax years.

Introduction to TradeOgre

TradeOgre is a cryptocurrency trading platform established in 2018. It hosts a range of trading pairs which includes over 50 cryptocurrencies at the time of writing. It does not support fiat currencies like USD, EUR etc. TradeOgre has a flat 0.2% trading fee. Withdrawal fees are dynamically calculated but tend to be quite low compared to industry standards.

Do I need to pay taxes when using TradeOgre?

This depends on the country you pay taxes in. For a better answer please see your country crypto tax guide on our blog. Check whether your country requires you to pay taxes on crypto to crypto trades. In most countries, they are taxable events.

How to export your TradeOgre transaction history

To export transactions from TradeOgre, you will need to download three different CSV files. Make sure to download all three to ensure that your taxes are done correctly. This applies regardless of whether you are doing your taxes in excel, using a tax lawyer, or using Divly to automated your taxes.

File import

You can import TradeOgre crypto transactions into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

-

Sign in to TradeOgre.

-

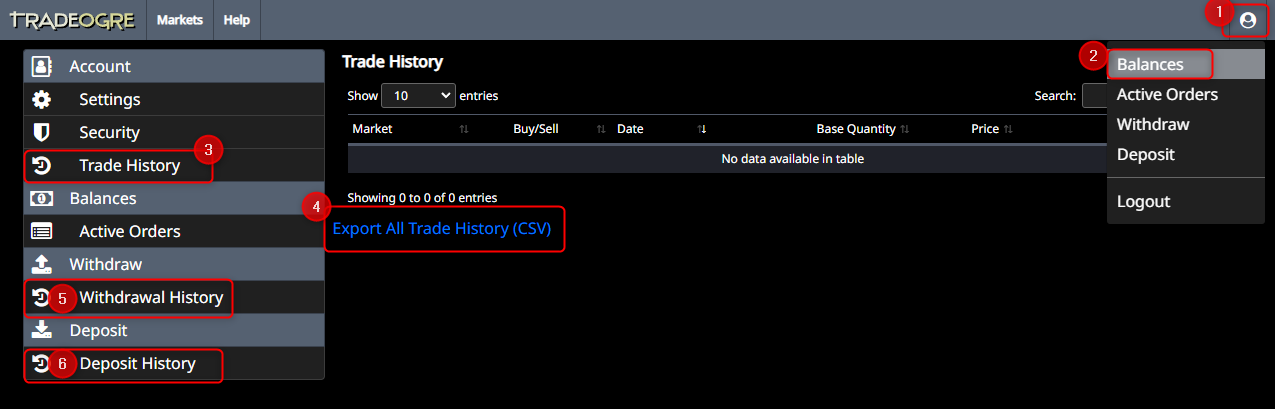

Click on the account icon in the top right, select balance from the drop down.

-

In the sidebar click Trade History. At the bottom of the page, click Export All Trade History (CSV).

-

In the sidebar click Withdrawal History. At the bottom of the page, click the Export All Withdrawal History (CSV).

-

In the sidebar click Deposit History. At the bottom of the page, click the Export All Deposit History (CSV).

-

In Divly, drag and drop the CSV files to where it says Upload CSV. Divly will import the transactions.''

TradeOgre transaction types

If you have utilized TradeOgre for cryptocurrency trading, then you will likely have made deposits, withdrawals, and trades. There are no other transaction types that we are aware of that are possible to be made via TradeOgre.

When accounting for your trades, it's good practice to utilize the fees to lower your taxes. If you use a service like Divly, this will be handled automatically. Divly can read and import both withdrawal fees and trading fees from TradeOgre, as well as ensure they are automatically accounted for in the tax calculations.

Common issues when doing your TradeOgre taxes

Typically our customers do not experience any issues when calculating their TradeOgre taxes. TradeOgre transactions are straightforward and the transaction file is easy to read. There are however two things worth mentioning:

-

Make sure you have exported ALL of the different transaction files to ensure you are not missing any transactions. This includes the Deposits file, the Withdrawals file, and the Trades file. Missing one of the files can have tax implications.

-

Divly imports TradeOgre transactions with the assumption that the timestamps in the file are set to UTC. This is expected. If for some reason the transaction timestamps in the file are not UTC, select the relevant timezone when uploading to Divly. This will ensure transfers are matched automatically for deposits and withdrawals.

If you have any issues with calculating your TradeOgre taxes, feel free to contact our support team which is available via the online chat on the bottom right hand corner of our website. Good luck!

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN