Introduction to Luno

Luno was founded in 2013 and is a United Kingdom based crypto exchange. Like many crypto exchanges, it was founded with the mission of giving everyone access to a decentralized financial system. It has grown to have more than 10 million users. The app is very easy to understand and navigate, so it may be beneficial for beginners to use.

Do I pay tax on Luno crypto transactions?

Engaging in trading activities on Luno can often lead to taxable events for many individuals, necessitating a declaration of these transactions. Luno provides crypto trading services as well as crypto interest accounts which are taxed in most countries.

Given the varying tax regulations across different countries, it's challenging to provide a comprehensive guide in this context. For detailed information tailored to your specific country, we recommend exploring the country-specific guides available on Divly or directly consulting your local tax authority for personalized advice.

Does Luno report to tax authorities?

It is highly probable that Luno shares information about its customers' cryptocurrency activities with various tax authorities including the HMRC. For European Union citizens, this practice will become a standard requirement from January 1, 2026, following the implementation of the new DAC8 directive.

To help Luno traders, we have simplified the crypto tax process by providing a three step guide below.

Step 1: Export your Luno transaction history

Regardless of how you are planning to calculate and declare your crypto taxes, the first step involves aggregating your crypto transaction history.

Luno allows you to export your transaction history by downloading CSV files or by exporting it programmatically using their API. Below you will find a detailed step-by-step guide on how to use both export methods. Due to the complexity of the CSV structure, we recommend using the API (Automatic Import).

Automatic import

You can import transactions from Luno into Divly by using our API integration. After you have provided the API keys, Divly will be able to fetch your latest transactions anytime you click "Import Transactions" in the wallet page.

-

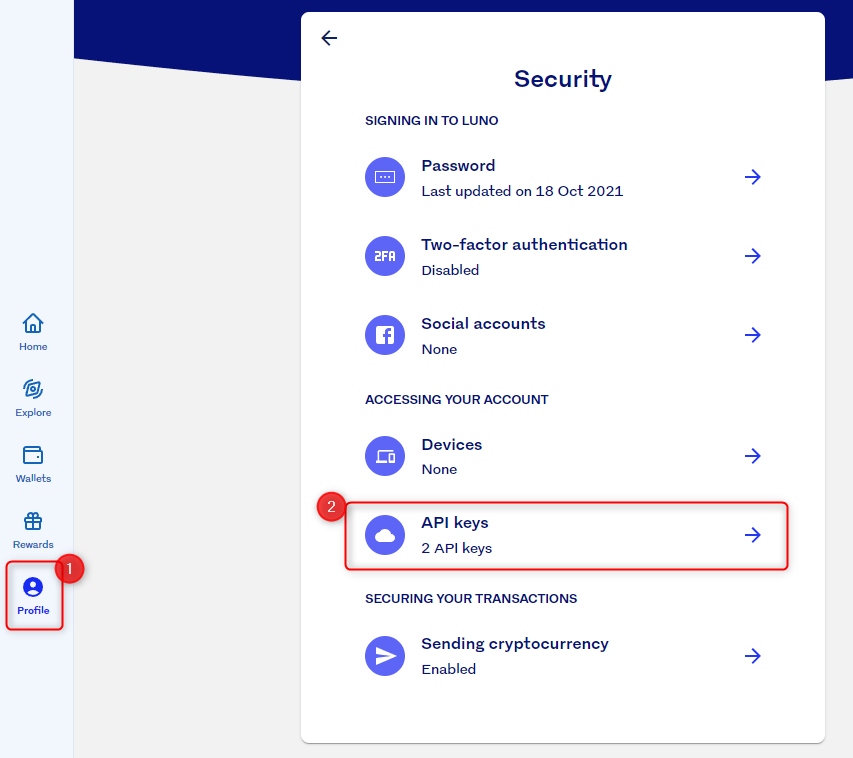

Sign in to Luno.

-

Click on Profile in the navigation bar.

-

Click on Security then select API keys.

-

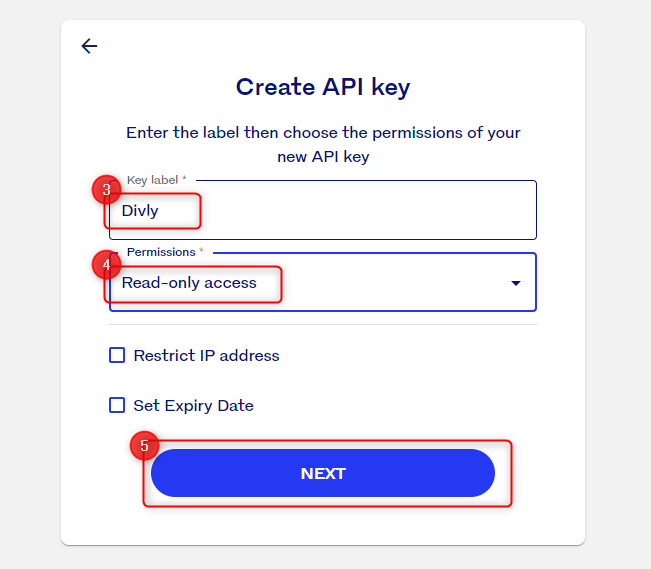

Click the button Create API key. Set your Key label to Divly and Permissions to Read-only access.

-

Copy down the Key ID and Secret somewhere safe.

-

Click Next and then authorize the new API keys by following the instructions sent to your phone by Luno.

-

Copy and paste the API keys in Divly to fetch your transactions.

File import

You can import Luno transactions into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

-

Sign in to Luno.

-

Click on Wallets in the navigation bar.

-

Click on a Wallet that you have used (BTC, ETH, BCH...). Then click on the link DOWNLOAD STATEMENT at the bottom.

-

Select your Begin date, End Date, and select CSV. Then click Create Statement. A statement will be generated within a few seconds.

-

Click Download on the newly generated statement. Unzip the file and extract the CSV file which includes all the transactions for the specified wallet.

-

**Repeat the above steps for every Wallet you have used in Luno (BTC, ETH, BCH, USDC, USDC Savings...).

-

In Divly, drag and drop all the CSV files to where it says Upload CSV. Divly will import the transactions.'

Luno API Setup Screenshots:

Step 2: Calculate your Luno crypto taxes

There are typically three methods to approach your tax calculations, and the one you select depends on your budget and familiarity with your country's tax laws.

Option A: Utilize a tool like Excel to perform all calculations manually. This method is cost-free but demands significant time investment and a thorough understanding of tax regulations.

Option B: Employ a tax platform such as Divly to import your transactions and automate the calculations. This option saves considerable time for a fee.

Option C: Hire a tax lawyer to handle your tax return. While this is the priciest option, it might be the most reassuring if you prefer the expertise and peace of mind that comes with professional assistance.

After choosing your preferred method, you should be aware of the common transaction types from Luno that need to be factored into your calculations.

Step 3: Submitting tax forms to your local tax authority

Tax form structures can vary significantly depending on your country. When using a service like Divly, your tax form is automatically generated in a localized format, complete with guidelines on submission. You can find more details about this feature here.

If you're handling the process on your own, it's crucial to conduct thorough research to understand exactly what needs to be declared. For comprehensive information and assistance, refer to our crypto tax guides.

Common issues

Luno CSV files are quite complex since the trades are duplicated in both currency's when exporting the files. Divly has built processes that automate away this complexity, but please double check that all trades has been imported as expected. If you are having issues with the File Import, we recommend using the Automatic Import instead.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact. This article may contain affiliate links.

EN

EN