Crypto taxes on Coinmotion: You’re in the right place

Filing cryptocurrency taxes can feel overwhelming. The rules are not always clear, and official guidance often doesn’t answer all the important questions.

Meanwhile, the Tax Office is gaining more access to data from crypto exchanges, including platforms like Coinmotion. Many exchanges are now required to share information about your transactions.

That’s why Divly exists. We built a tool that guides you step by step to file your taxes correctly and with less stress. In this guide, we’ll show you exactly how to report your transactions made on Coinmotion.

Coinmotion and Divly are official partners

If you are a Coinmotion customer that is looking to automate your crypto taxes, then you will enjoy a 20% discount when importing Coinmotion transactions into Divly. Coinmotion and Divly have worked together to ensure a seamless tax experience.

When Should I Declare My Cryptocurrencies?

Using Coinmotion does not change your tax calendar. You should declare your crypto activity according to your country’s tax rules, usually when you file your annual income or capital gains tax return.

In most countries, you must declare for the tax year in which the event happened. This typically means reporting once a year by your local filing deadline. Some places may also require estimated or advance tax payments during the year if you realize large gains or earn crypto income.

You usually need to declare when any of the following happen on Coinmotion (or any other wallet or exchange):

- You sell crypto for fiat.

- You trade one crypto for another.

- You spend crypto on goods or services (including crypto cards).

- You earn crypto (staking/yield, interest, airdrops, mining, referral or cashback rewards).

- You receive crypto as income (e.g., for freelance work or salary).

Commonly not taxable (but keep records):

- Buying crypto with fiat.

- Moving crypto between your own wallets or between your Coinmotion account and your self-custody wallet.

If you had no sales but did earn crypto, you may still need to declare that income at the fair market value on the day you received it. Losses should also be declared so you can offset gains where allowed.

Deadlines vary by country. For example, in Finland you generally report crypto with your annual tax return in spring; check Vero (MyTax) for your exact date. Always confirm your local rules and due dates.

How to export your transaction history from Coinmotion

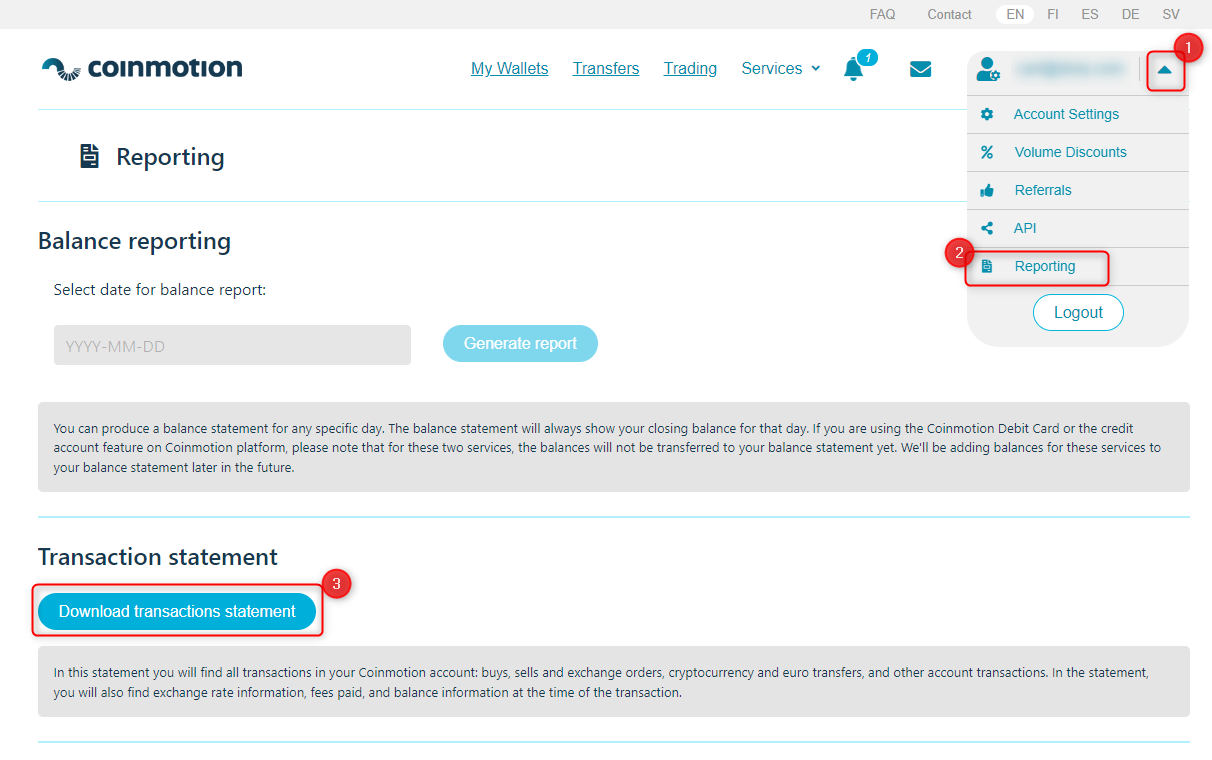

File import

You can import Coinmotion transactions into Divly by downloading and importing a CSV file. Make sure to download the CSV file every time you want to include the latest transactions.

- Sign in to Coinmotion.

- Click on the account icon in the top right and select Reporting in the dropdown.

- Under Transaction statement click on the button Download transactions statement. A CSV file will download.

- Drag and drop the CSV file into Divly. Divly will import the transactions and calculate your taxes.

Why is Divly the best choice for Coinmotion taxes?

Why is Divly the best choice for Coinmotion taxes?

Divly is built specifically for each country with a focus on accuracy. Unlike generic tools, we automatically generate the compliant, localized tax report you need for your country. We handle all the complex local rules of your local tax legislation so you don't have to.

-

Fast Import: Fast import of Coinmotion transactions that combines with your other wallets/accounts.

-

Accurate Calculations: Accurate calculation of your taxes with gains/loss and the right cost method (e.g. FIFO).

-

Local Tax Report: Simple download of local tax report with guide on how to declare in your country.

Frequently asked questions (FAQ?)

Yes, in most countries you are required to pay taxes on crypto. For more details see your country-specific crypto tax guide.

Crypto typically incurs a capital gains tax in the majority of jurisdictions. This means you need to pay taxes on the difference between what you bought crypto for and what you sold it for (minus fees).

If you received crypto through other methods (e.g. salary), methods like income tax will apply.

Yes, you can use Divly to declare crypto taxes for previous years that you missed. In many countries you can self-report mistakes and not get penalized for it.

Divly provides localized guides on how to fix previous years for many of our supported countries.

It is a criminal offense to not pay your taxes. It is also difficult to avoid since crypto transactions are recorded publicly on the blockchain and exchanges have been forced to hand over information to local tax authorities.

Yes, you need to file a tax report even if you lost money. The good news is that by filing your losses you may be able to reduce your taxes.

Divly is a premium service to help people calculate and submit their crypto taxes. We use industry standard practices to secure your data.

- We do not sell your information to third parties such as other companies or government agencies.

- We do not perform any KYC. Divly only requires an email address and your pseudonymous crypto transactions to generate your taxes.

Feel free to use a temporary email / protonmail. You can also delete all your transactions and synched wallets at any time.

Yes. You can safely ask your accountant to create and manage a new Divly account for you, or invite them to see and/or edit your existing Divly account. Divly provides accountants with a special feature to manage multiple clients with crypto.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN