As the year wraps up, we decided to look at who paid their cryptocurrency taxes in 2022.

Cryptocurrencies, such as Bitcoin and Ethereum, have gained significant attention and adoption in recent years. While cryptocurrencies offer many benefits, such as decentralization and increased security, they also raise unique tax issues for individuals and businesses. In this research paper, we estimated the tax payment rate for cryptocurrencies in various countries worldwide.

The primary conclusion drawn from our research is that it is evident that an overwhelming number of cryptocurrency owners have not paid taxes on their cryptocurrency. We estimate that globally just 0.53% of cryptocurrency investors declared their cryptocurrency activity to their local tax authorities in 2022.

Estimating tax compliance (Methodology)

In this study, we adopted a multi-step approach to estimate the tax payment rate for cryptocurrencies in various countries. The methodology involved using official government figures, search volume data, and available cryptocurrency ownership data.

Our research used a combination of official government figures and search volume data to estimate the number of cryptocurrency investors who declared their activity to their local tax authorities.

Step 1: Establishing Relationship between Tax Declarations and Search Volume Data

We began by analyzing the relationship between the number of people who declared their cryptocurrency in their tax returns and the search volume for cryptocurrency tax-related keywords in a country.

Step 2: Estimating the Number of Cryptocurrency Taxpayers

Using the established relationship from Step 1, we leveraged search volume data as a proxy to estimate the number of cryptocurrency taxpayers in each country where official figures on the number of cryptocurrency taxpayers were not available. This approach assumes that the number of searches performed before filing a tax report has no significant variation across different countries.

Step 3: Calculating the Tax Payment Rate

To calculate the tax payment rate, we compared the estimated number of cryptocurrency taxpayers from Step 2 to the total number of cryptocurrency investors in each country, as reported in Statista's Global Cryptocurrency Report. The resulting percentage represents the tax payment rate for cryptocurrencies in each country.

Limitations and Assumptions

Please note that we are not assuming that everyone who pays cryptocurrency taxes performs a search before they pay their taxes, only that the overall search volume for cryptocurrency taxes is related to the number of cryptocurrency taxpayers in a country.

It is essential to acknowledge the limitations and assumptions within our methodology:

-

Search volume data might not accurately represent the number of cryptocurrency taxpayers in a country, as not everyone searches for tax-related information online.

-

The study might be biased towards countries with higher internet penetration and more reliable search volume data.

-

Tax regulations and requirements differ between countries, which can impact the tax payment rate.

-

The methodology relies on the assumption that the search volume data is representative of tax declaration behavior across countries, which may not always hold true.

-

The number of cryptocurrency users in a country is take from the data found in Statista's Global Cryptocurrency Report. If the figures provided are too high, for example, then our tax payment rates may be underestiamted.

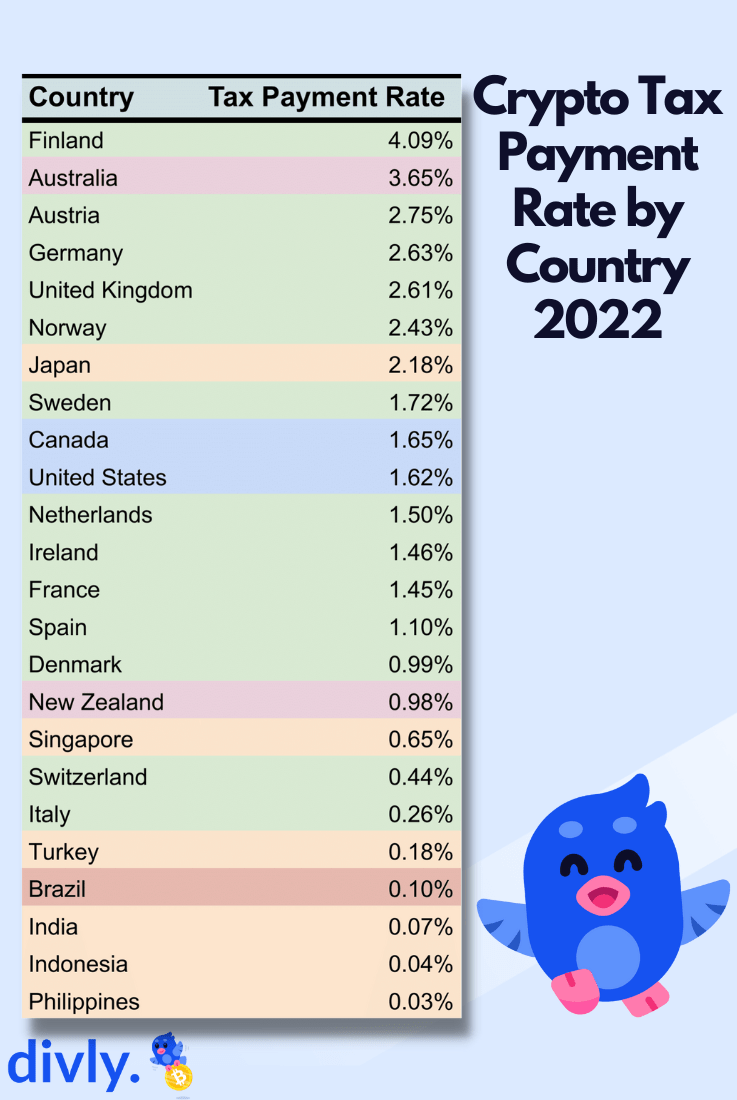

Tax Payment Rates by Country

The table below indicates the estimated percentage of cryptocurrency investors in a country that has paid taxes over their cryptocurrency in 2022. The table is color-coded by continent.

The research shows that crypto tax payment rates on cryptocurrencies vary by country and continent, with Finland having the highest rate at 4.09% and the Philippines having the lowest rate at 0.03%.

In the US, an estimated 1.62% of cryptocurrency investors declared their crypto to tax authorities in 2022. Therefore, the US has the 10th highest crypto tax payment rate out of the 24 countries analyzed.

Amongst the European countries looked at, Finland had the highest payment rate in Europe and Italy the lowest at 0.26%. One reason for the low payment rate in Italy might be that In 2022, Italians only had to declare their cryptocurrency if the individual held more than €51,645 in crypto. The 2023 budget has implemented many changes for Italy, which should result in a higher tax payment rate in the future, as more people will be obligated to pay taxes on their cryptocurrencies.

In Asia, Japan had the highest tax payment rate at 2.18%. Ongoing efforts by Japan’s government and the Japanese Cryptoasset Business Association(JCBA) to facilitate the crypto tax calculation and declaration process seem to be paying off. The Philippines, on the other hand, where paying taxes on cryptocurrency is mandatory but where regulations are ill-defined, sits at the bottom of the list of countries analyzed.

Global cryptocurrency tax compliance comparison

Our analysis revealed that, on average, the probability of an individual who owns cryptocurrency having also paid taxes on it in 2022 is 0.53%. However, it is important to note that this low average is affected by certain countries, specifically those with a large number of cryptocurrency traders who did not declare their assets to the tax authorities in 2022.

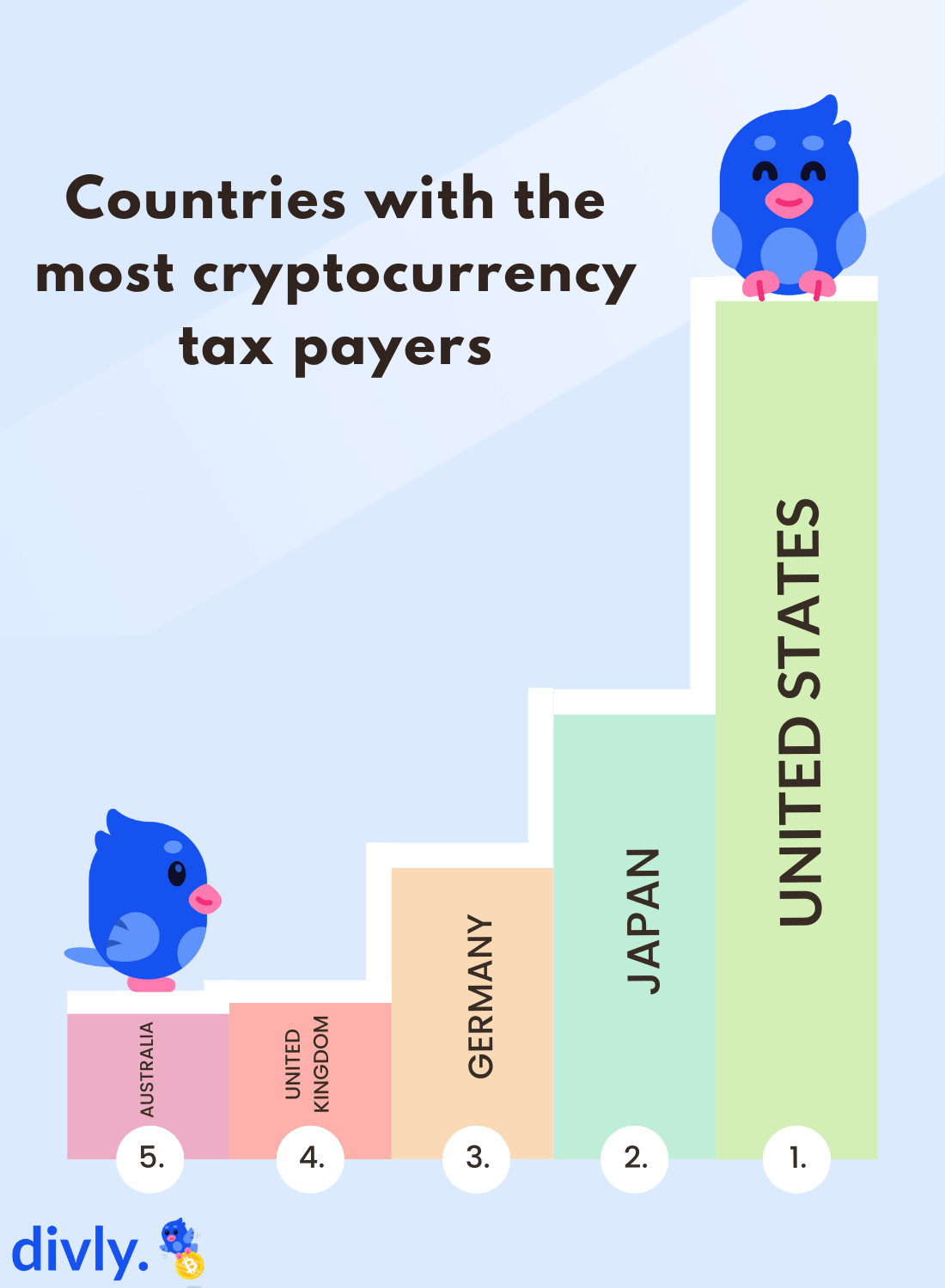

Although the United States is at the bottom of the top 10 in tax payment rate with 1.62%, its significant cryptocurrency adoption and population results in almost twice the number of tax declarations involving cryptocurrency than the country with the second most declarations.

Possible reasons for variations in tax payment rate

Several factors may contribute to the variations in the tax payment rate for cryptocurrencies by country. Some of these factors include:

-

Public awareness: Public awareness of cryptocurrency reporting requirements will likely vary amongst countries.

-

Tax payment rate outside of cryptocurrencies: Global differences in tax compliance are not unique to cryptocurrencies.

-

Government policies: Government policies and attitudes towards cryptocurrencies may also influence the tax payment rate. Countries with more complete cryptocurrency tax reporting requirements could facilitate higher compliance.

-

Owning crypto does not always mean taxes are due: Although a certain number of people may own cryptocurrency, ownership alone is rarely taxed. Most countries require their crypto traders to only pay taxes on profits. However, countries such as Norway require their citizens to declare their crypto holdings for their wealth taxes.

-

The difficulty of calculating cryptocurrency taxes: Although a number of cryptocurrency tax calculators, such as Divly, have sprung up over the past few years, most countries are not sufficiently supported by the software available. A strong focus from tax calculators on countries such as the United States, Japan, and Germany has made the payment of cryptocurrency taxes more accessible to its crypto users.

-

Government enforcement: Some authorities have been more proactive in enforcing crypto taxation amongst their citizens.

Overall, the variations in the tax payment rate for cryptocurrencies by country are likely due to a combination of these and other factors.

Trends in Cryptocurrency tax compliance

In 2015 less than 900 US citizens reported their cryptocurrencies to the IRS, when more than 5.9 million accounts were active on Coinbase alone. This would mean that at most 0.02% of cryptocurrency, investors declared crypto to the IRS.

In 2018 Credit Karma reported that 0.04% of tax filings made via its service contained crypto. If we account for the expected 5% crypto ownership at the time, roughly 0.8% of cryptocurrency investors declared their crypto in 2018.

We estimate that 1.62% of cryptocurrency investors reported their crypto to the IRS in 2022. A doubling of the compliance rate since 2018.

Notably, survey data has indicated a much higher compliance rate than our estimates. Cointracker’s survey in 2022 showed that at a time when 40% of individual returns had been filed, 4% of cryptocurrency investors had reported their cryptocurrencies. The study, however, had a moderately small sample size of 100 US cryptocurrency investors. Cointracker estimates that the survey result does not vary +/- 10% points from the scenario where all crypto investors would have been interviewed.

Coinledger’s survey in 2021 indicated an even larger compliance rate, with over 50% of survey respondents indicating that they declared their crypto on their tax returns.

There may be several reasons why our results differ significantly from survey data. For one, cryptocurrency investors may be unwilling to indicate that they have not been paying taxes owed. Furthermore, surveys may suffer from self-selection bias. Participants who chose to complete an online survey on cryptocurrency taxation may differ from those that chose not to. These factors may cause survey data to overestimate the number of cryptocurrency taxpayers.

On the other side, flaws in the determination of what constitutes a cryptocurrency tax keyword, incorrect estimates of cryptocurrency ownership by country, or the degree to which search is a reliable indicator of the number of taxpayers may also result in under or overestimating the tax payment rate.

One such case where there may be a flaw is for Germany. The BMF(Bundes Finanz Ministerium) has recently come out with new cryprocurrency tax regulations. The news of these new introductions may have increased interest in cryptocurrency taxes, pushed up search traffic, but may not have had a proportional increase in the number of tax payers.

More inter-country cryptocurrency comparisons

Tax compliance is only one aspect that may define the cryptocurrency landscape in a country. For a more holistic overview of cryptocurrency adoption between countries you could check out Coincub's global cryptocurrency rankings.

Conclusion

This research aimed to estimate the tax payment rate for cryptocurrencies in various countries. According to the results, the tax payment rate for cryptocurrencies ranged from 0.03% in the Philippines to 4.09% in Finland. With the global tax payment rate being 0.53%.

Overall, our analysis provides only a snapshot of the current state of cryptocurrency taxation worldwide, and changes may be rapid. We’ll likely see these numbers improve as countries implement new regulations and seek improved enforcement.

India, amongst others, has only recently released cryptocurrency tax regulations. These more defined regulations should encourage cryptocurrency traders to declare their crypto to the tax authorities.

Furthermore, proposed changes to the DAC (Directive on Administrative Cooperation) by the European Union would force cryptocurrency exchanges to share data with local governments, providing more knowledge to local tax authorities on who owes taxes.

Therefore, although many have, up to now, gotten away with not declaring their cryptocurrencies, we expect many traders to have to declare their taxes eventually and perhaps even face fines for missing previous declarations. If you have thus traded with cryptocurrencies and owe taxes it is important to make declaring your cryptocurrencies a priority.

EN

EN