Do you want to learn more about crypto taxes? Or are you looking to declare your cryptocurrency transactions to the tax administration? We aim to answer all your questions and set you on the right path to declare your crypto taxes in Finland. In this guide, we will be covering the following:

-

Important dates to know

-

How cryptocurrencies are taxed

-

How to use the deemed acquisition cost to lower your taxes

-

Can I offset losses made on cryptocurrency trading?

-

-

Tax treatment of different cryptocurrency transaction types

-

How to calculate your cryptocurrency taxes

-

How to submit your tax report to Verohallinto

This guide will be updated and maintained regularly to account for changes made by the local tax authority (Verohallinto) and new types of transactions. Suppose you find any errors or outdated information. In that case, it is greatly appreciated that you let us know by sending an email to [email protected] or via our support chat at the bottom right corner of our website.

Important Dates 2025

The tax authorities will make your tax return available to you sometime between March and April. The deadline for updating and submitting your tax return depends on the date indicated on your tax return. You may have any of the following deadlines, 2 April, 7 May, 17 May, or 21 May.

Notice: In 2025, the deadlines for submitting tax returns have been moved earlier. The new deadlines are April 15th, April 22nd, or April 29th. Be sure to check your personal deadline on your tax return, and submit your cryptocurrency information on time!

How Are Cryptocurrencies Taxed in Finland?

In Finland, cryptocurrency traders are taxed if their transactions’ total sales prices exceed €1000. The tax rate on cryptocurrencies is 30% for profits below €30,000 and 34% on the amount above this threshold. Additionally, income from crypto mining is subject to earned income tax of up to 44%.

Luckily, not all transactions are taxed. Cryptocurrency purchases are not taxed, nor is transferring crypto between your own wallets and exchanges.

Finland also has a very unique rule that is very beneficial for assets that fluctuate a lot in price such as cryptocurrencies. The deemed acquisition cost rule allows you to make sure your profits never exceed 80% of the sales price, or 60% if you’ve held the asset for more than 10 years.

Capital Income Tax

Most cryptocurrency transactions are taxable. You should report any Bitcoin or other cryptocurrency sales as capital gains. You can generally expect to pay crypto taxes if you’ve performed any of the following transactions.

-

Exchange a cryptocurrency for one or more other cryptocurrencies.

-

Trade a cryptocurrency for a fiat currency (e.g., USD or EUR).

-

Pay with cryptocurrency when buying a product or service.

-

Trade NFTs.

-

Stake cryptocurrency.

-

Earn income from margin/futures trading.

Calculating capital gains for income tax

When performing capital gains calculations, you should subtract the acquisition cost, including fees, from the sales price. To do this, you should use the FIFO (First-in-First-out). The FIFO method assumes that each time you sell a cryptocurrency, you are selling the first one you’ve acquired.

🔍 Capital Gains Example

Let's apply this theory to a practical example. Consider the following cryptocurrency transactions in 2023:

| Date | Type | Amount | Price (€) |

|---|---|---|---|

| 2 Feb | Purchase | 2 ETH | €4000 |

| 14 Feb | Purchase | 1 ETH | €3000 |

| 5 Nov | Sale | 1 ETH | €4000 |

Step 1: Calculate Cost Basis

First, we identify the cost basis of the ETH sold, using the FIFO method. The first purchased ETH has an acquisition cost of €2000.

Cost Basis = €2000

Step 2: Determine Sale Price

The sale price of the ETH was €4000.

Step 3: Calculate Capital Gain

Finally, we calculate the capital gain as the difference between the sale price and the acquisition cost.

Capital Gain = €4000 (Sale Price) - €2000 (Cost Basis)

Capital Gain = €2000

Use the Deemed Acquisition Cost to lower your crypto taxes

In Finland, you can deduct either the actual or the deemed acquisition costs from the selling price. The deemed acquisition cost rule means that your deductible acquisition costs will always be at least 20% of the sale price. This percentage increases to 40% if you’ve held the asset for at least ten years. The deemed acquisition cost is beneficial for volatile assets such as cryptocurrencies.

You can also use the deemed acquisition cost if you cannot find pricing information for one of your cryptocurrencies. The deemed acquisition cost is especially beneficial for smaller cryptocurrencies for which pricing information is not readily available.

🔍 Tax Savings Example: Deemed Acquisition Cost

Here's how understanding and applying the deemed acquisition cost can significantly reduce your taxable profits:

| Transaction | BTC Amount | Value in Euros | Fees (€) |

|---|---|---|---|

| Purchase | 1 BTC | €1,000 | €20 |

| Sale | 1 BTC | €20,000 | - |

In this scenario, a Bitcoin was purchased in 2017 for €1,000, with an additional €20 in trading fees, totaling an acquisition cost of €1,020. Upon selling the Bitcoin in 2022 for €20,000, the straightforward calculation of profit would normally deduct the acquisition cost from the sales price, yielding a profit of €18,980.

However, using the deemed acquisition cost principle, which never allows the deductible acquisition costs to be lower than 20% of the sale price, you can instead deduct €4,000 (20% of €20,000). This adjustment reduces the taxable profit to €16,000, saving €2,980 in taxable profits.

Actual Profit = €20,000 (Sale Price) - €1,020 (Acquisition Cost + Fees) = €18,980

Profit Using Deemed Acquisition Cost = €20,000 (Sale Price) - €4,000 (Deemed Acquisition Cost) = €16,000

Tax Savings = €2,980

Can I Offset Losses Made on Cryptocurrency Trading?

Your cryptocurrency losses are subject to § 50 of the Income Tax Act. Generally, selling your cryptocurrencies at a loss is tax deductible as long as the total sales prices are over €1000. You can deduct losses from your gains on the sales of other virtual currencies in the tax year and five subsequent years. You can only deduct losses if you’ve sold your cryptocurrencies. If your currencies have decreased in value, but you still own them, you cannot deduct any losses.

Earned Income Tax

If you have earned crypto for some form of work or effort, you need to pay typical income taxes. This is also the case if you’ve made any income from mining cryptocurrency. The value of the cryptocurrency at the time you gain access to them should be reported to the tax authorities.

Earned Income Tax Rates

| Income Tax Bracket | Total tax at lower limit | Tax rate above lower limit % |

|---|---|---|

| 0–20 500 | 0,00 | 12,64 |

| 20 500–30 500 | 2 591,20 | 19,00 |

| 30 500–50 400 | 4 491,20 | 30,25 |

| 50 400–88 200 | 10 510,95 | 34,00 |

| 88 200–150 000 | 23 362,95 | 42,00 |

| 150 000– | 49 318,95 | 44,00 |

Source: Verohallinto

Tax Treatment of Different Cryptocurrency Transaction Types

Certain transactions trigger the types of taxation listed above differently. Below is a master list for your reference; we will go through each in detail in this guide. Each transaction has an associated tax classification and the corresponding label in Divly for those using our service to automate their tax reporting.

| Transaction Type | Tax Event | Divly Label |

|---|---|---|

| Buy crypto | None | Buy |

| Sell crypto | Capital IncomeTax | Sell |

| Trade crypto for crypto | Capital Income Tax | Traded crypto |

| Initial coin offering (ICO) | Capital IncomeTax | Traded crypto |

| Purchase goods & services with crypto | Capital Income Tax | Goods/Services |

| Payment of trading fees with crypto | Capital IncomeTax | Fee included in Trade |

| Payment of transfer fees with crypto | Capital Income Tax | Fee included in Transfer |

| Transfer crypto between your wallets | None | Transfer |

| Lost or stolen crypto | None | Lost/Stolen |

| Give crypto as a gift | None | Gifted Away |

| Receive crypto as a gift | Gift Tax | Received Gift |

| Donate crypto | None* | Donation |

| Airdrop | Capital Income Tax* | Airdrop |

| Fork | None | Fork |

| Mining | Earned Income Tax | Mining |

| Staking | Capital Income Tax | Staking Reward |

| Income (e.g., freelancing, salary, rewards, online gaming) | Earned Income Tax | Income/Reward |

| Cashback | Capital Income tax* | Reward |

| Lend out crypto | Capital Income Tax* | Interest Received |

| Borrowing crypto | Capital Income Tax* | Interest Paid |

| Margin trading | Capital Income Tax | Realized Profit/Realized Loss |

| Futures / derivatives trading | Capital IncomeTax | Realized Profit/Realized Loss |

| Create & Sell NFT | Earned Income Tax | Imported as NFT-Identifier |

| Resell NFT | Capital Income Tax | Imported as NFT-Identifier |

*Please read below for more specific information on the transactions in question. Whether you need to pay income tax may be situation dependent.

Buy Crypto / Buy Crypto with Fiat

There are no taxes involved when buying crypto. However, you need to ensure that you keep track of the price you paid for your acquisition cost calculation. If you purchased the crypto in a foreign currency (e.g., USD or SEK), you should convert it to the value in local currency on that day.

You can add the trading fee to the acquisition cost when buying cryptocurrency. Adding the trading fee will help reduce your taxes.

🔍 ETH Acquisition Cost Calculation

To understand how acquisition costs are calculated, consider this straightforward example:

Acquisition Cost = Purchase Price + Trading Fee

Acquisition Cost = €1,000 (Purchase Price) + €10 (Trading Fee)

Acquisition Cost = €1,010

Sell Crypto / Sell Crypto for Fiat

Selling cryptocurrency will always require you to declare capital gains tax, whether at a profit or loss. Once again, it’s essential to calculate the selling price in local currency at the time of the sale. You can subtract the trading fee from the sale price when selling cryptocurrency. Subtracting the trading fee will help reduce your taxes.

The order in which you sell crypto is the order in which you’ve acquired the crypto unless you can prove otherwise.

🔍 ETH Sale Profit Calculation

Building on the previous example, let's calculate the profit from selling ETH after considering acquisition costs and trading fees:

Sale Price = €2,000

Acquisition Costs + Sale Trading Fee = €1,010 (Acquisition Costs) + €30 (Sale Trading Fee)

Total Costs = €1,040

Profit = Sale Price - Total Costs

Profit = €2,000 - €1,040 = €960

Trade Crypto for Crypto

In Finland, trading crypto for crypto is a capital gains tax event. You must pay capital income tax on the gains made on the cryptocurrency you sold. To calculate the gain or loss, you should use the market value of the bought cryptocurrency in euros. For example, if you sold 1 BTC for 10 ETH, the selling price is the value of 10 ETH in euros.

Finally, you would account for the acquisition cost of the Ethereum you purchased. The acquisition cost is the same as the value above, 10 ETH in euros on the day you receive the ETH.

Suppose you cannot determine the market value of either cryptocurrency. In that case, the purchased crypto inherits the acquisition cost of the sold crypto. In this situation, no gain or loss is recognized. However, you must still report this transaction to the tax authorities.

Initial Coin Offering (ICO)

An ICO is a way for blockchain companies to sell pre-mined crypto to potential investors. When you invest your crypto (usually Ethereum) in a new project, you are provided a token for that project.

From a taxation point of view, this functions the same as a crypto-to-crypto trade. Essentially, you send cryptocurrency in exchange for a token from a new project. You follow the same principle where you sell your crypto for the value of the ICO token in local currency. The crypto you send is subject to capital income tax, and the received token inherits its cost basis.

Purchase Goods & Services with Crypto

You must pay capital income tax when you use cryptocurrency to purchase a good (e.g., a new computer, amazon gift card) or service (e.g., VPN service). Using cryptocurrency for payments works the same way as selling your cryptocurrency. The selling price is what the good or service costs in euros. To determine the profit, you should deduct the acquisition cost of your sold cryptocurrency from this amount.

🔍 Taxable Event Example

Here's a simple example to illustrate how a transaction can become a taxable event:

| Transaction | Amount | Value (€) |

|---|---|---|

| Purchase BNB | 3 BNB | €300 |

| Exchange for Laptop | - | €700 |

In this case, you've made an investment by purchasing 3 BNB for €300. Later, you exchanged those BNB for a new laptop valued at €700. This transaction represents a taxable event.

Calculation:

The profit from this transaction is calculated as the difference between the value of the laptop received and the purchase price of the BNB.

Profit = €700 (Laptop Value) - €300 (BNB Purchase Price)

Profit = €400

Therefore, you should declare a profit of €400 to the tax authorities as part of your tax obligations.

Cash-Back Rewards

You may receive cashback rewards when you use a crypto credit card such as the Crypto.com card. If you receive cashback rewards in cryptocurrency, these are taxable as capital income tax. You should declare the value of the cryptocurrency at the time you receive them. If you later sell the cryptocurrency you received from a cashback, you should pay taxes over the gain in value between the sale date and the acquisition date.

Pay Fees in Crypto

Typically, when you trade crypto for crypto, you will also have to pay a trading fee in crypto. In these cases, you need to convert the crypto you used to pay for the trading fee into your local currency and then pay capital gains on it. Trading fees also contribute to the acquisition cost for the purchased cryptocurrency.

Transfer Crypto Between Your Own Wallets

Transferring crypto between your wallets is not a taxable event (this includes sending crypto to your account on an exchange). You must track these transfers properly to avoid paying unnecessary taxes!

Although sending cryptocurrency between wallets is not taxed, any fees you incur are taxed if you pay for them in cryptocurrency.

Lost or Stolen Crypto

If your cryptocurrency has been stolen, you will not have to pay taxes over it. However, there are no deductions for stolen property except for businesses.

Give Crypto as a Gift / Receive Crypto as a Gift

For taxation purposes, the acquisition cost or cost basis of the received gift is the value determined by the tax authorities. In general, we assume this to mean the market value of the received crypto.

If you receive cryptocurrency as a gift and sell it within a year, you inherit the acquisition value of the donor.

You would then have to pay taxes over the difference between the sales price and the acquisition value.

If the total value of the gifts you receive from the same donor over a 3-year span is more than €5000, you must pay gift tax. Depending on who gives the gift to you, you are taxed differently.

Bracket 1: Closest relatives and family members

| Market value of gift | Tax at the lower limit | Tax rate on the value above the lower limit |

|---|---|---|

| €5,000-€24,999 | € 100 | 8% |

| €25,000-€54,999 | €1,700 | 10% |

| €55,000-€199,999 | €4,700 | 12% |

| €200,000-€999,999 | €22,100 | 15% |

| €1,000,000+ | €142,100 | 17% |

Bracket 2: other than close relatives

| Market value of gift | Tax at the lower limit | Tax rate on the value above the lower limit |

|---|---|---|

| €5,000-€25,000 | € 100 | 19% |

| €25,000-€55,000 | €3,900 | 25% |

| €55,000-€200,000 | €11,400 | 29% |

| €200,000-€1,000,000 | €53,450 | 31% |

| €1,000,000+ | €301,450 | 33% |

Source: Verohallinto

You must file a gift tax return within three months from the date of the gift. You can file your gift tax in Verohallinto’s online tax portal MyTax.

Donate Crypto

Verohallinto does not provide concrete guidelines for donations paid in crypto. However, we can assume regulations are in line with fiat donations. In Finland, donations made with money are only tax-deductible by corporations. The purpose of the donation must be to support scientific research, arts, or Finnish cultural heritage.

Airdrop

An airdrop is typically considered a gift from the token holder or blockchain. Airdrops are usually a very small or negligible amount.

There have yet to be any concrete regulations implemented regarding airdrops. However, we were informed by the Finnish Tax Administration that it is best to declare your airdrop income until regulations are more defined. If you receive an airdrop based on your ownership of another crypto, it should be considered capital income, as with staking rewards. We will update this guide as Finland’s crypto tax regulations evolve.

Hardfork

A hard fork occurs when the blockchain splits. In that case, you are gifted crypto based on your ownership of the forked cryptocurrency. You do not have to pay taxes when you receive additional cryptocurrency from a hard fork. But you do have to pay taxes when you sell the received currency. You can assume its acquisition cost is €0. Therefore you will be taxed over the total market value when you sell them.

Mining

You have to pay earned income tax over your income from mining. You must report the value of your mining income at the time you gain access to your mined crypto in euros.

You can also calculate your income from mining per day or month based on that period’s average exchange rate. But you have to stay consistent with this period throughout the year.

You can deduct expenses you’ve incurred while mining from your income. You may only declare the proportion of your expenditure used directly for mining. Any energy used for the computer or device used in mining that is not directly involved in mining is not tax-deductible. The purchase price of mining equipment is also deductible. If you use the equipment for personal use from time to time, you can still deduct some expenses. The amount you can deduct depends on how often you use the equipment for purposes other than mining.

You can deduct 25% if you provide evidence of occasional use of your equipment to earn mining income.

You can deduct 50% if you provide evidence of regular use of your equipment to earn mining income.

You can deduct 100% if you can provide evidence that your equipment’s primary use is for earning mining income.

If you can use the hardware used for mining for more than three years, you should deduct expenses according to a series of depreciation expenses of no more than 25% per year.

Staking

Staking, an alternative to mining, contributes to your capital income and is seen as a capital gain. This classification is different from mining because staking is a reward for owning crypto assets. You must report the value of your staking income in euros at the time you receive the tokens. This value is also considered the acquisition cost.

Lending Your Crypto

There are no concrete guidelines for interest received specifically from crypto lending. It is safest to assume it works the same as with fiat lending. The interest you earn from lending is taxed as capital income. You must report the value of the interest received in euros as it was when you received it.

Borrowing Crypto

Again there are no concrete guidelines for interest payments in cryptocurrency. Generally, Interest expenses are deductible if the loan was for the production of income, such as interest income. Then your interest expenses are fully deductible from your capital income. If your costs exceed your capital income, 30% of your costs can be credited from your earned income.

Income From Other Activities (e.g. freelancing, salary, rewards, online games)

Taxable earned income includes salary and benefits or compensation received; this includes cryptocurrency.

Verohallinto mentions the taxation of virtual currency rewards from games. In some online games, you can earn a currency unique to that game (gold, gems, etc.). You must pay taxes upon converting this currency to a tradable cryptocurrency, fiat, or other assets (cashing out of the game). You should use the market value to determine your taxable income when cashing out.

Any losses you make in a game are not tax-deductible. Those losses are seen as losses from recreational activities and considered living expenses. If you participate in a game of chance, you may be tax-exempt if the lottery belongs to an EEA country.

Consequently, activities performed through Coinbase Earn are income as you performed some action in exchange for crypto. If you have received a reward from referring a friend, sharing a post, or any other required effort, then you need to declare the reward for income tax purposes.

Margin Trading, Futures, and Derivatives Trading

Verohallinto has indicated that crypto derivatives are subject to securities and derivatives regulations.

Margin trading involves borrowing to take leveraged positions on crypto. Often the outcome of the trades is provided as realized profit or loss after margin fees are accounted for. You will have to pay capital income tax on this realized profit. You can deduct losses made on the transfer of property from gains made during the tax year and the following five years.

NFTs

NFTS are non-fungible tokens. These are unique digital identifiers that cannot be copied or divided. NFTs allow for the sale and transfer of digital assets, usually digital artworks. Because NFTs have unique identifiers, it is possible to verify the ownership of an NFT.

In June 2022, Verohallinto released its guidance on NFTs. NFTs are taxed in two ways, depending on your connection to the NFT.

If you are the creator/artist of the NFT, then any income you earn on its sale and commissions from subsequent sales is taxed as earned income. The realized income is the value of the received cryptocurrency in euros on the date of the sale.

As the artist, you can deduct the expenses that you incurred in producing the art. This includes fees for the NFT marketplace and drawing software. These expenses are declared under the same section as mining expenses: “Expenses for the production of other income than wage income”.

The resale of NFTs is treated the same as trading a cryptocurrency. You should pay taxes over the gains incurred on the resale of an NFT.

🔍 NFT Transaction Tax Example

Understanding the tax implications of NFT transactions can be tricky. Here's an example to clarify how gains are calculated for tax purposes:

| Transaction | ETH Amount | Value in Euros |

|---|---|---|

| Purchase NFT | 1 ETH | €2,000 |

| Sell NFT | 2 ETH | €5,000 |

In this scenario, you purchased an NFT for 1 ETH, valued at €2,000 at the time of purchase. Later, you sold the NFT for 2 ETH, which at the time of sale was valued at €5,000.

Calculation:

The taxable gain is not simply 1 ETH, which would be worth €2,500. Instead, it's the difference between the euro value of the ETH at the time of sale and the purchase price.

Taxable Gain = €5,000 (Sale Value) - €2,000 (Purchase Price)

Taxable Gain = €3,000

Therefore, for tax purposes, you must report a capital gain of €3,000 from this transaction.

How Do I Calculate My Cryptocurrency Taxes?

There are two ways to calculate your cryptocurrency taxes in Finland. First, we’ll cover the free calculation method. And then, we’ll cover the process we recommend. Not very surprisingly, Divly recommends that you use Divly for your crypto taxes.

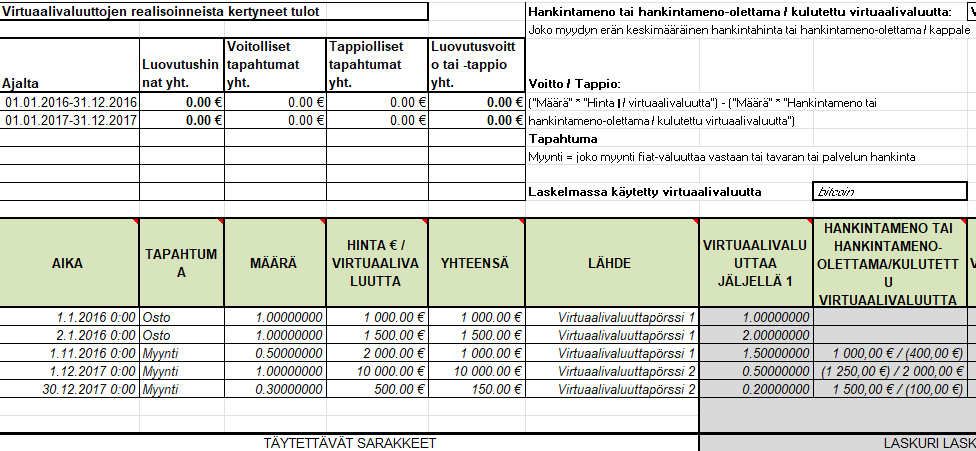

The Free Crypto Tax Calculation Method

Verohallinto has a number of tax calculators available for taxpayers, including one for cryptocurrencies. You can only use the excel sheet for one currency at a time. You must manually input every transaction you’ve made that involves that currency. For each transaction, you should input the following

-

The date and time of the transaction

-

The transaction type (limited to buy or sell)

-

The amount of the currency bought or sold

-

The value per cryptocurrency

-

The total value of the transaction minus fees

-

(optional) the exchange you’ve used.

After finishing the sheet, you hit the button Käynnistä makro, and the excel sheet will calculate your gains and losses.

Using the excel sheet can be quite a tedious process. The process is as follows for each cryptocurrency.

-

Find all the transactions that involve that cryptocurrency over all of your exchanges.

-

Sort them by date and convert the date to the proper format.

-

Use this guide to determine whether the transaction can be seen as a buy or a sell from the perspective of the tax authorities.

-

Find the market value for each cryptocurrency on the day the transaction took place.

-

Subtract trading fees from the sales prices.

-

Input all this data in the corresponding field

-

Repeat the above process for each cryptocurrency you used in 2023.

The ✨Best✨ Crypto Tax Calculation Method

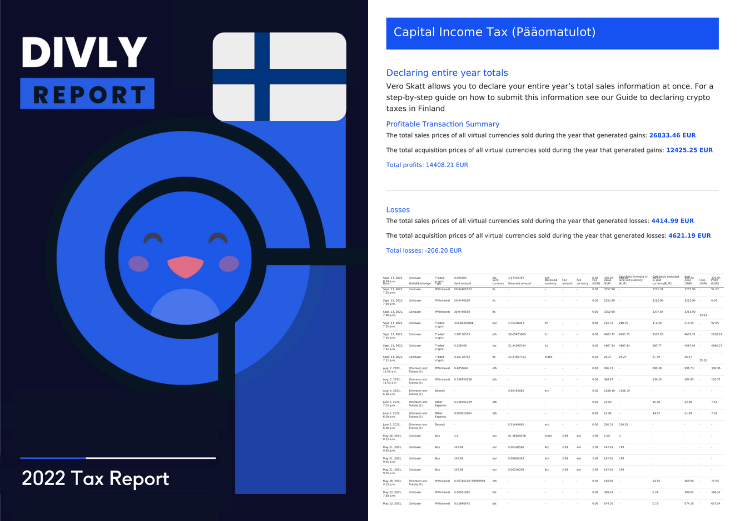

A much faster and more accurate method would be to use Divly’s cryptocurrency tax calculator. Instead of manually inputting every transaction, you can upload your transaction history or connect Divly to your exchange, and Divly will do all the calculations for you. You can also see an overview of your entire portfolio in one place.

Divly is the only premium cryptocurrency tax calculator that implements the deemed acquisition method for Finland. Divly will automatically use the deemed acquisition cost when it lowers your taxes.

It can become easy to misclassify transactions if you do a lot of manual work. Keeping track of the crypto you’ve transferred between exchanges can be especially difficult. Divly automatically detects transfers between exchanges to avoid confusing them for taxable crypto sales or new purchases.

Furthermore, Divly will notify you if it suspects you forgot to upload a transaction. This way, it can be easy to ensure you’ve uploaded everything.

Divly’s provides everything you need to declare your cryptocurrency taxes in Finland

Take advantage of a crypto tax lawyer

For complex tax matters it may help to consult with a tax lawyer. They can provide personalized tax advice and/or prepare your tax return for you. Divly has partnered with Nordic Law, the leading Web3 law firm, resulting in a powerful partnership in the crypto tax space. Best of all, Divly users get a 10% discount for crypto tax services provided by Nordic Law.

How to Declare Your Crypto Taxes to Verohallinto

Once all the tax calculations are done and Verohallinto’s tax portal is open, it is time to declare your taxes before the deadline in May. You can submit your taxes online or by mail. We will primarily focus on the online portal in this guide. Should you want to call Verohallinto, you can do so on weekdays from 9 am to 4.15 pm and 9 am to 3 pm in July via 029 497 050.

To report your crypto taxes, you can use the online tax portal, MyTax.

Steps to declaring your cryptocurrency taxes with MyTax & Divly

Step 1

Log in to MyTax

Step 2

Scroll down to Individual Income tax and Pre-completed tax return 2023 then select Check your pre-completed tax return. To edit your tax return you should then click on Make corrections to the pre-completed tax return.

Step 3

Once here you will see five steps to complete your tax return. Relevant for cryptocurrencies are the sections Pre-completed income and deductions and Other Income

Step 4

On the Pre-completed income and deductions page you can see any information you’ve previously provided about your cryptocurrencies under Capital Income. Here, you have the option to edit the information if necessary.

Step 5

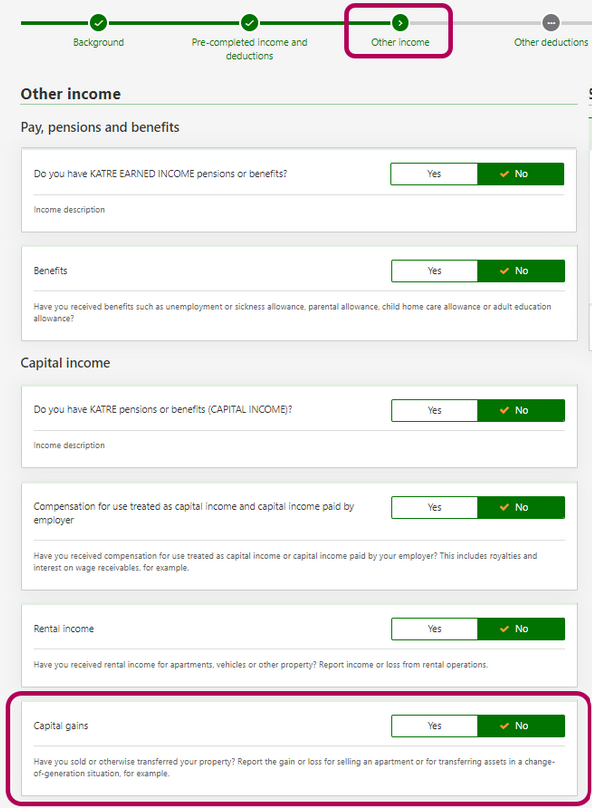

If you haven’t declared your virtual currency transactions yet, move to the Other Income page. This step is essential for those who are declaring their cryptocurrency transactions for the first time.

Step 6

For reporting capital gains from cryptocurrencies, scroll down to Capital Income and select Yes for Capital gains.

Important Information: Make sure to do the following steps twice. Once for all of your transactions that have made a gain, and once for all of your transactions that have made a loss. The pdf provided by Divly will have this information ready for you split by whether you’eve made a profit or loss on your transactions.

Step 7

Click on Add new transfer and Virtual currencies. You are asked to fill in which cryptocurrencies you’ve traded. If you have traded multiple currencies you can also fill in "several".

Step 8

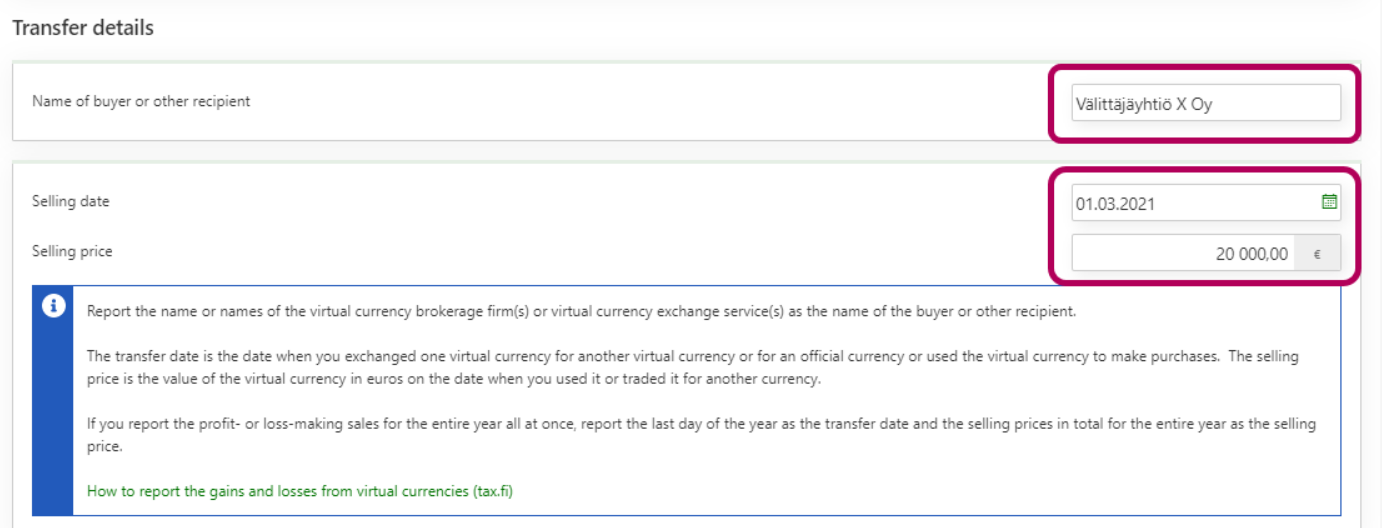

When entering information for your transactions you must fill in the name of the buyer or other recipient, which would be the cryptocurrency exchanges and wallets you’ve used. The Selling date should be the last day of the year 31.12.2023, and the Selling price should be the combined selling prices of every transaction on which you’ve made gains/losses. Divly will provide this information for you.

Step 9

In the Acquisition details and costs section, you can enter 1.1.2023 as the Acquisition date, regardless of when the cryptocurrencies were actually acquired. The Acquisition price should reflect the total acquisition price for all of the currencies you have sold. You can enter any additional selling expenses under the Selling Costs field.

Step 10

Lastly, you will need to attach a pdf file that includes your transaction history and capital gains calculations. To do this scroll down to Attachments, select Add file and then choose Attachment regarding virtual currencies. Here you can upload the calculations file provided by Divly.

Reporting Mining, Staking, NFT and Airdrop Income.

Mining income is reported in the Other income section of MyTax.. You can enter your mining expenses under Deductions -> Expenses for the production of income -> Expenses for the production of other income than wage income.

Income earned from staking crypto must be entered under Other capital income. Any deductions must be reported here as well. The likely location to declare airdrop income is also under Other capital income. We will review this information when Verohallinto updates its regulations.

Filing your returns on paper.

We do not go in-depth here to discuss filing taxes on paper. However, should you want to report your taxes via paper filing, you need to be aware of two forms. First is Form 9, which is for capital gains and losses, and second is Form 50A, for your mining income.

Any tax-related information provided by us is not tax advice, financial advice, accounting advice, or legal advice and cannot be used by you or any other party for the purpose of avoiding tax penalties. You should seek the advice of a tax professional regarding your particular circumstances. We make no claims, promises, or warranties about the accuracy of the information provided herein. Everything included herein is our opinion and not a statement of fact.

EN

EN