Welcome to the latest post on Divly's blog, where we're passionate about helping people avoid a headache when dealing with crypto taxes! In light of this, we're excited to share a resource crafted by CMS, a global firm of tax professionals with over 5,000 lawyers across 40 countries.

CMS has published a comprehensive guide called the CMS Expert Guide on Taxation of Crypto-Assets. It’s free to access and explores some of the most important questions regarding crypto taxation. If you would like to complement your understanding of taxation in your country, we recommend visiting the guide and selecting your country.

What do we like about this guide?

Written by local tax experts

One of the key challenges in crypto taxation lies in the global variance of tax laws. Each country has its own set of regulations and guidelines when it comes to taxing cryptocurrencies. This diversity creates a labyrinth of legal frameworks for crypto investors and enthusiasts to understand and comply with.

What's special about the CMS guide is that the information provided by CMS is written by local tax professionals from each relevant jurisdiction. For example, in Sweden the answers are provided by Wistrand which has over 100 years of experience helping Swedish citizens with taxation. They were also one of the first to help clients with specifically crypto taxation in Sweden. That said, you can be confident that the information provided in the CMS guide is thoroughly vetted.

Great European coverage

At Divly we have a strong focus on Europe since we realize that crypto tax platforms have not tailored their services to smaller countries. We’ve spent a lot of time building support for these countries and are glad to see that others are getting involved in demystifying crypto taxes in these jurisdictions. The CMS guide has coverage for almost 20 countries in Europe!

If you are an EU citizen it is good to know that a new directive in the EU called DAC8 is in the pipeline. This directive will require Crypto-asset service providers (e.g. crypto exchanges) to share client information to tax authorities within the EU. DAC8 is planned to be enforced starting 1st of January 2026, so please make sure you have read the CMS guide and are up to date with declaring your crypto taxes by then!

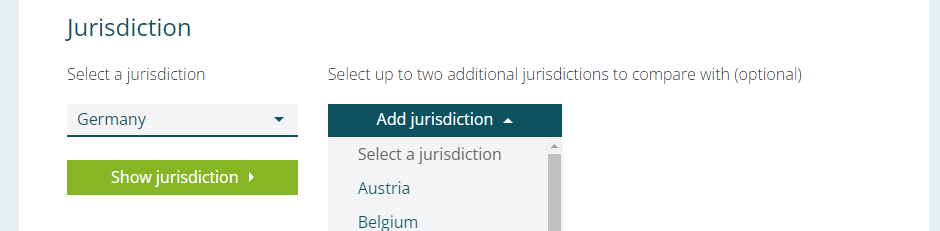

Compare different countries side-by-side

One nifty feature is that you can compare multiple countries side-by-side. This can be useful in cases where you are a dual-citizen or just simply want to explore tax rules in different jurisdictions. Quite a unique feature for a crypto tax guide that we love.

Find specialized tax advice as a crypto user

When building Divly we have often struggled finding tax lawyers with a deep understanding of crypto in the countries we expand to. If you are looking for professional help, it can be very expensive to go to a generic tax lawyer without previous experience working with crypto. Either they will require many billable hours of work to research and figure out how to resolve your query, or they simply won’t offer to help at all.

The CMS guide provides a list of key contacts for the country you have selected so that you can find someone directly to help. This is something that we would have loved to have found in the early years of building Divly.

Wrapping it up

Overall we are happy to see these initiatives crop up from tax specialists and applaud the effort by CMS. Every step towards making crypto taxes less unbearable is a step in the right direction.

If you are interested in declaring your own crypto taxes, you can always start by free by signing up to Divly. You can then choose to pay to get access to your country's tax reports. If you want specialized tax advice or prefer that someone does everything for you, we encourage you to explore the CMS guide and reach out to the key contacts they provide for your country. Good luck!

EN

EN