What cost basis method should I use for capital gains tax?

Quick Answer

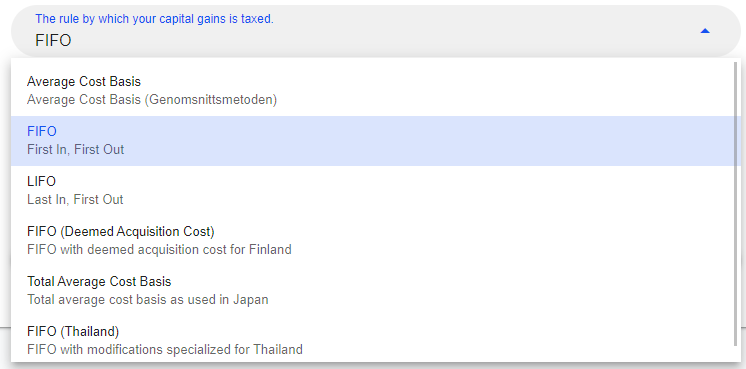

Set the cost basis method to the one accepted by your local tax authority. We recommend using the default one set by Divly based on your home country.

Detailed Answer

To calculate your capital gains or losses, we need to apply a specific cost basis method. When you sell a cryptocurrency, we need to calculate what that cryptocurrency was purchased for.

Different tax authorities will have different requirements on how to calculate the costs. In some cases Divly has built unique cost basis methods for specific countries.

The most common cost basis methods are:

-

ACB (Average Cost Basis) - Uses the average cost of the asset you purchased to calculate the capital gains/losses. In Sweden this is called Genomsnittsmetoden.

-

FIFO (First in First Out) - Uses the cost of the first asset you purchased to calculate the capital gains/losses.

-

LIFO (Last in First Out) - Uses the cost of the last asset you purchased to calculate the capital gains/losses.

Divly will have set this automatically based on your country.

EN

EN