What does "accumulated cost basis" and other terms represent in the Overview?

Quick Answer

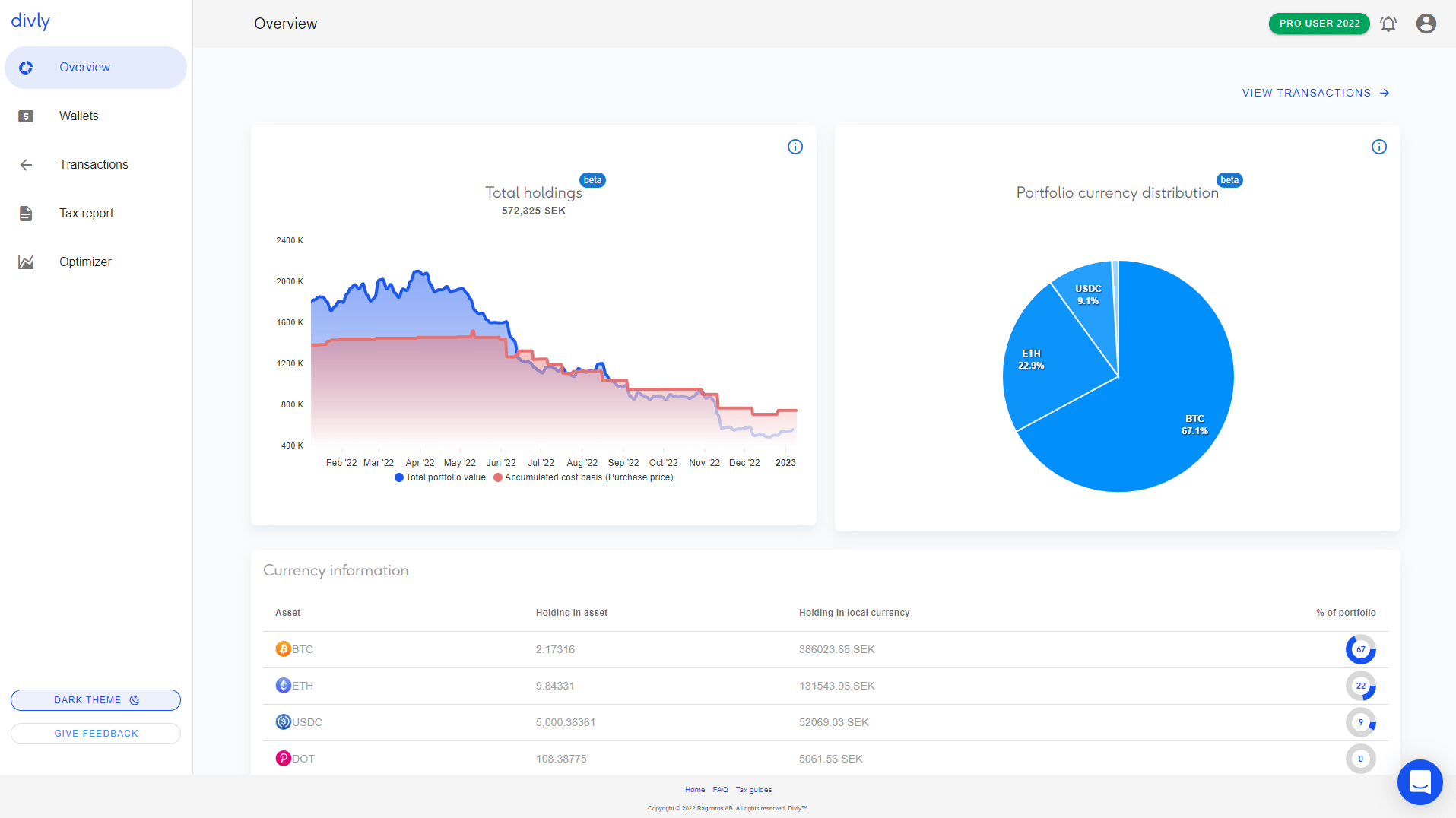

The accumulated cost basis represents the total acquisition price of the crypto you currently hold. This is currently shown on an aggregated portfolio level in the Total Holdings graph.

Detailed Answer

Below are a list of terms used on the Overview page in Divly.

Total Portfolio Value

The value in local currency of your total crypto portfolio. This does not include fiat currencies like USD, EUR, or SEK. It may also exclude smaller cryptocurrencies where Divly does not have pricing data stored.

Accumulated cost basis

The total cost basis of your crypto portfolio based on the cost basis method set in your Settings. This is typically Average Cost Basis, FIFO, or LIFO. The cost basis is set dynamically based on your country as dictated by your local tax authority. You can also see this as the acquisition price of all the crypto you currently hold. It is currently aggregated across the portfolio.

If the Total holdings are greater than the Accumulated Cost Basis, then this is an indication that you have positive capital gains across your portfolio. However, this is on an aggregated basis and can vary greatly between the different cryptocurrencies you own. We plan to update this chart so it is possible to view by individual cryptos in the future.

Holding in asset

The amount you hold of each cryptocurrency.

Holding in local currency

The amount you hold of each cryptocurrency converted to your local fiat currency.

Portfolio currency distribution

The amount you hold of each cryptocurrency relative to all other cryptocurrency's value in your local currency.

EN

EN