Can I deduct my costs incurred in purchasing a Divly plan?

Quick Answer

You can deduct your expenses from Divly associated with your tax filing.

Detailed Answer

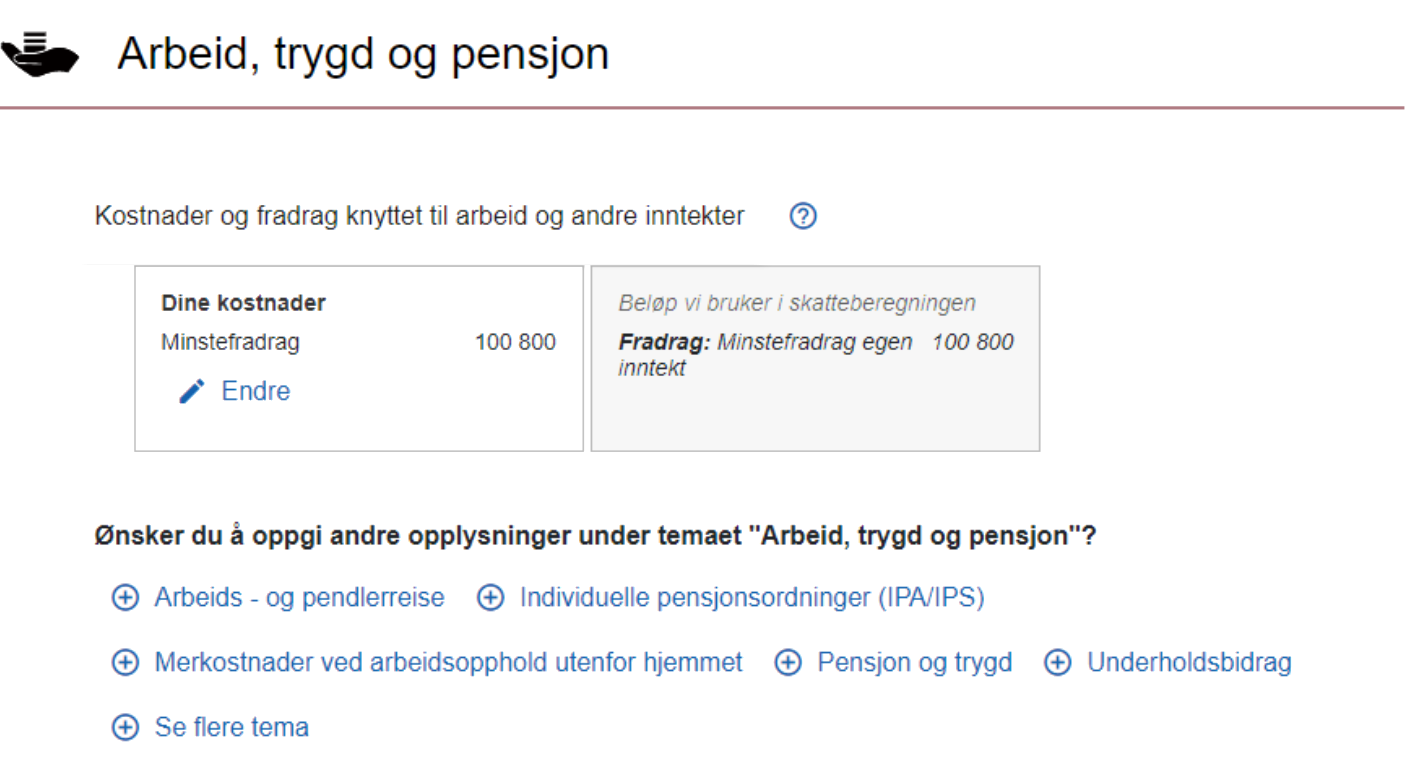

Step 1: Go to skatteetaten.no. Then scroll down to Arbeid, trygd or pension (work, social security, and pension). Look for Kostnader og fradrag knyttet til arbeid og andre inntekter (Costs and deductions related to work and other income). To enter your information click on Endre (change)

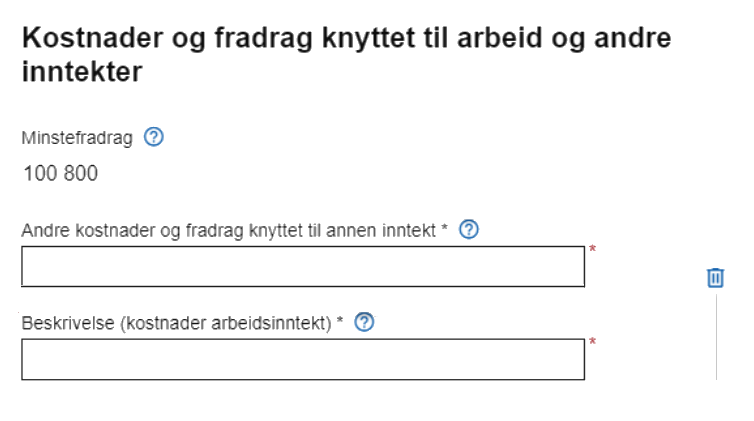

Step 2: Once you've gotten to Kostnader og fradrag knyttet til arbeid og andre inntekter you can click on Legg til flere opplysninger (Add more information. Then look for Andre kostnader og fradrag knyttet til annan inntekt** (Other expenses and deductions related to other income).

Step 3: Fill in your information. You should fill the costs under Andre kostnader og fradrag knyttet til annen inntekt (costs and deductions related to other income). You should write a comment about what the expenses are for under Beskrivelse* (Description). Finalize your addition by clicking OK.

EN

EN